How to Trade Futures on KuCoin

Futures trading is a dynamic and potentially lucrative endeavor, offering traders the opportunity to profit from price movements in various financial assets. KuCoin, a leading cryptocurrency derivatives exchange, provides a robust platform for traders to engage in futures trading with ease and efficiency. This comprehensive guide aims to equip you with the knowledge and skills necessary to navigate the world of futures trading on KuCoin successfully.

What is Futures Trading on KuCoin

Futures trading lets traders participate in market movements and potentially profit by going long or short on a futures contract. On KuCoin Futures, you may also use different leverage levels to reduce risk or potentially amplify profits in volatile markets.What are long and short in futures trading?

In spot trading, traders can only profit when the value of an asset increases. Futures trading lets traders potentially profit in both directions as the value of an asset rises or falls by going long or short on a futures contract.By going long, a trader buys a futures contract with the expectation that the contract will rise in value in the future.

Conversely, if a trader anticipates that the contract price will drop in the future, they can sell a futures contract to go short.

For example, you anticipate that the BTC price is going to rise. You may go long to buy a BTCUSDT contract:

| Initial Margin | Leverage | Entry Price | Close Price | Profit and Loss (PNL) |

| 100 USDT | 100 | 40000 USDT | 50000 USDT | 2500 USDT |

If you anticipate that the BTC price will fall, you may go short to sell a BTCUSDT contract:

| Initial Margin | Leverage | Entry Price | Close Price | Profit and Loss (PNL) |

| 100 USDT | 100 | 50000 USDT | 40000 USDT | 2000 USDT |

How to Trade on KuCoin Futures?

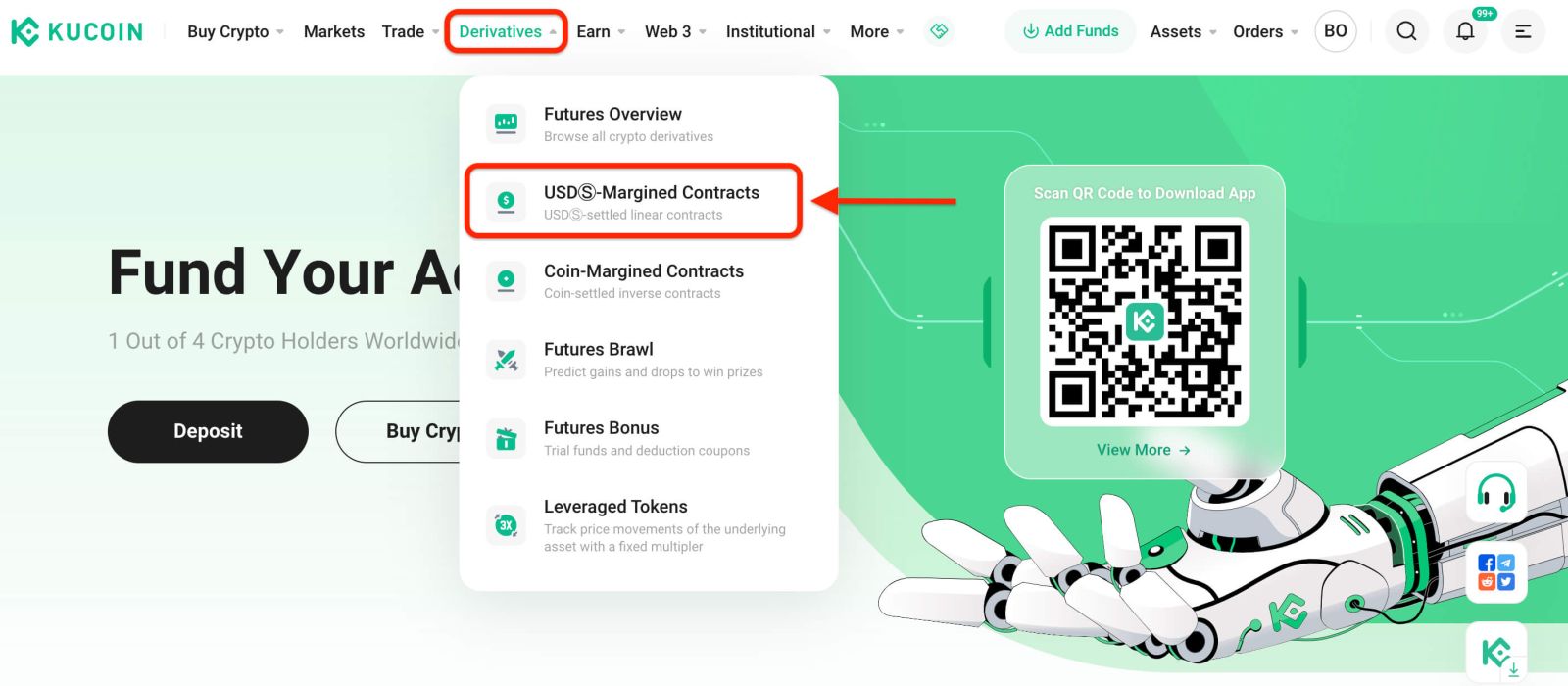

1. Log in to your KuCoin account and go to the USDⓈ-M or COIN-M Futures trading page.

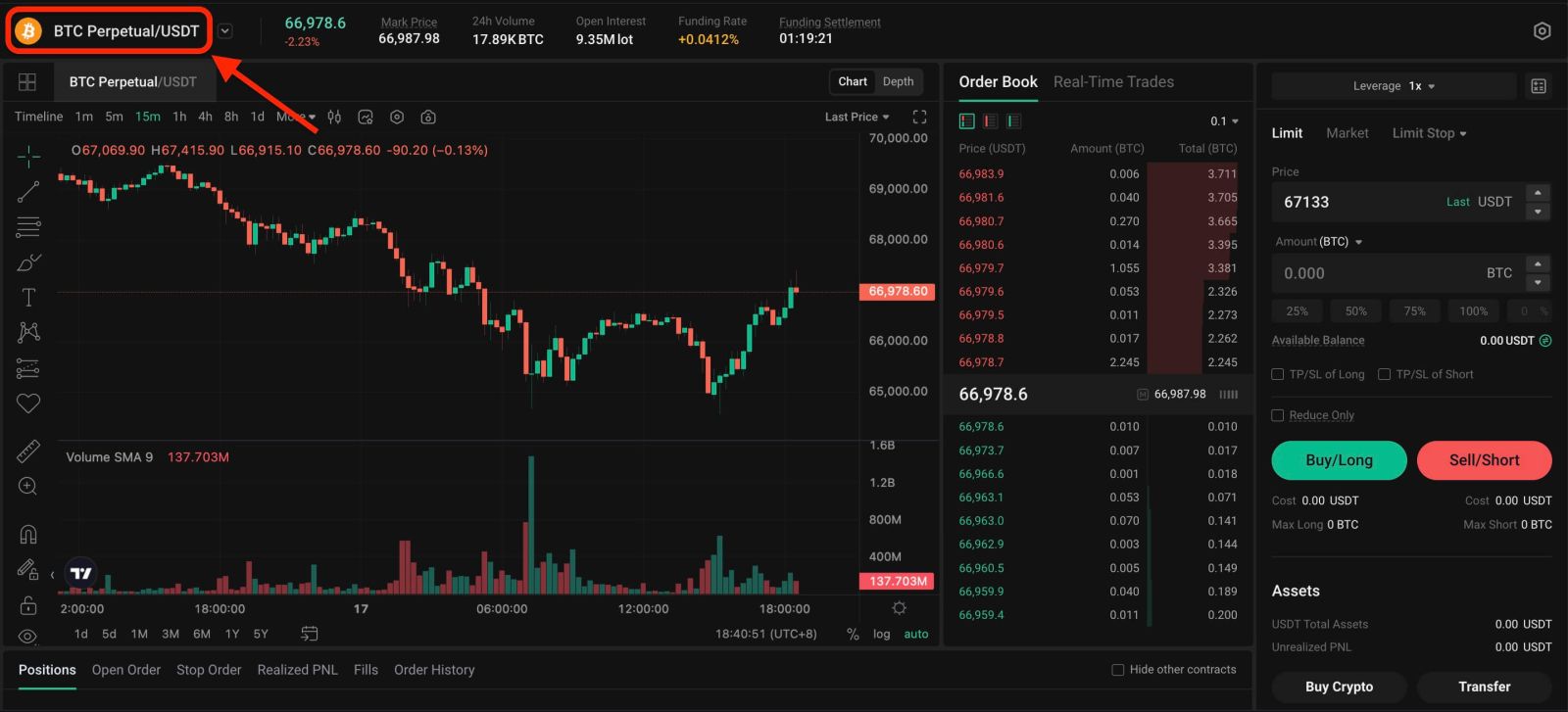

- Trading Pairs: Shows the current contract underlying cryptos. Users can click here to switch to other varieties.

- Trading Data and Funding Rate: Current price, highest price, lowest price, increase/decrease rate, and trading volume information within 24 hours. Display the current and next funding rate.

- TradingView Price Trend: K-line chart of the price change of the current trading pair. On the left side, users can click to select drawing tools and indicators for technical analysis.

- Orderbook and Transaction Data: Display the current order book and real-time transaction order information.

- Position and Leverage: Switching of position mode and leverage multiplier.

- Order type: Users can choose from a limit order, market order, and limit stop.

- Operation panel: Allow users to make fund transfers and place orders.

- Position and Order information: Current position, current orders, historical orders and transaction history.

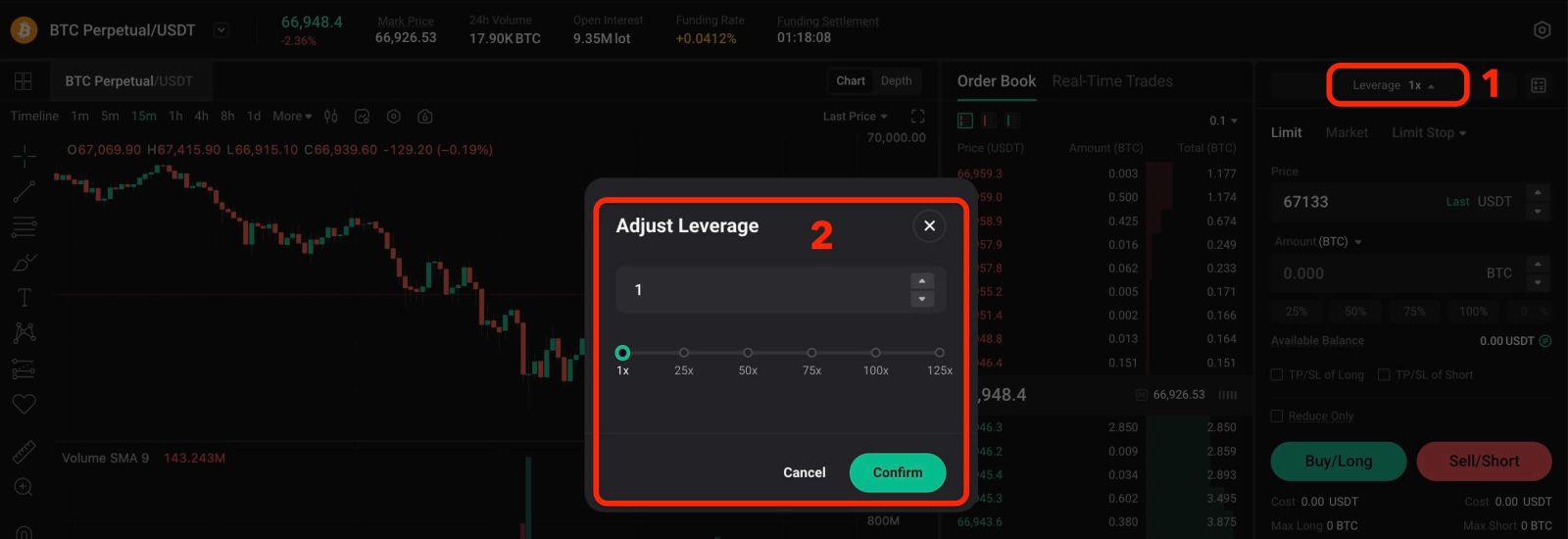

3. Choose "Position by Position" on the right to switch position modes. Adjust the leverage multiplier by clicking on the number. Different products support varying leverage multiples.

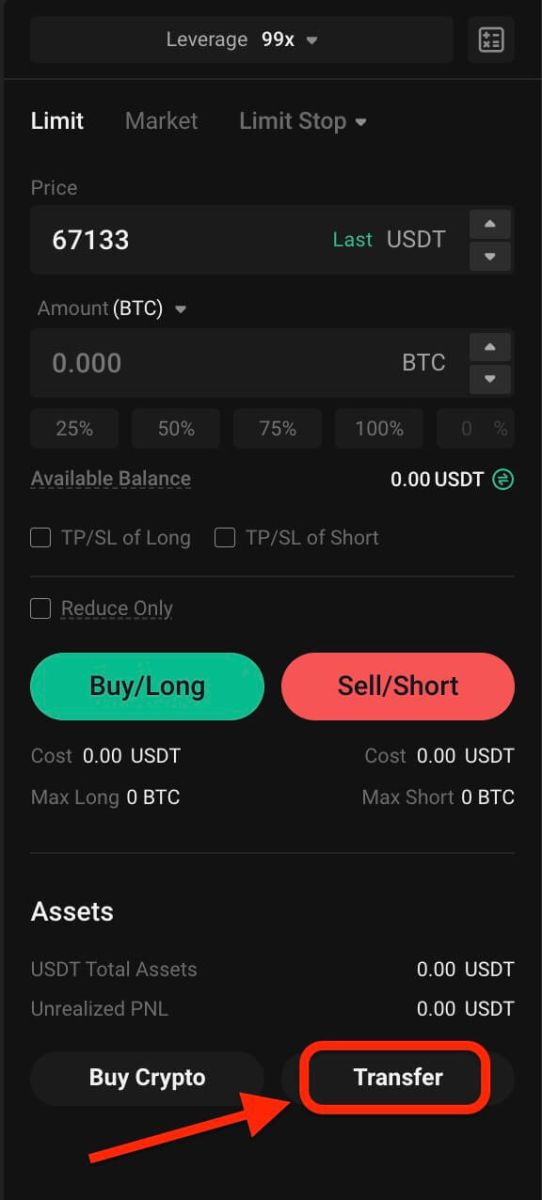

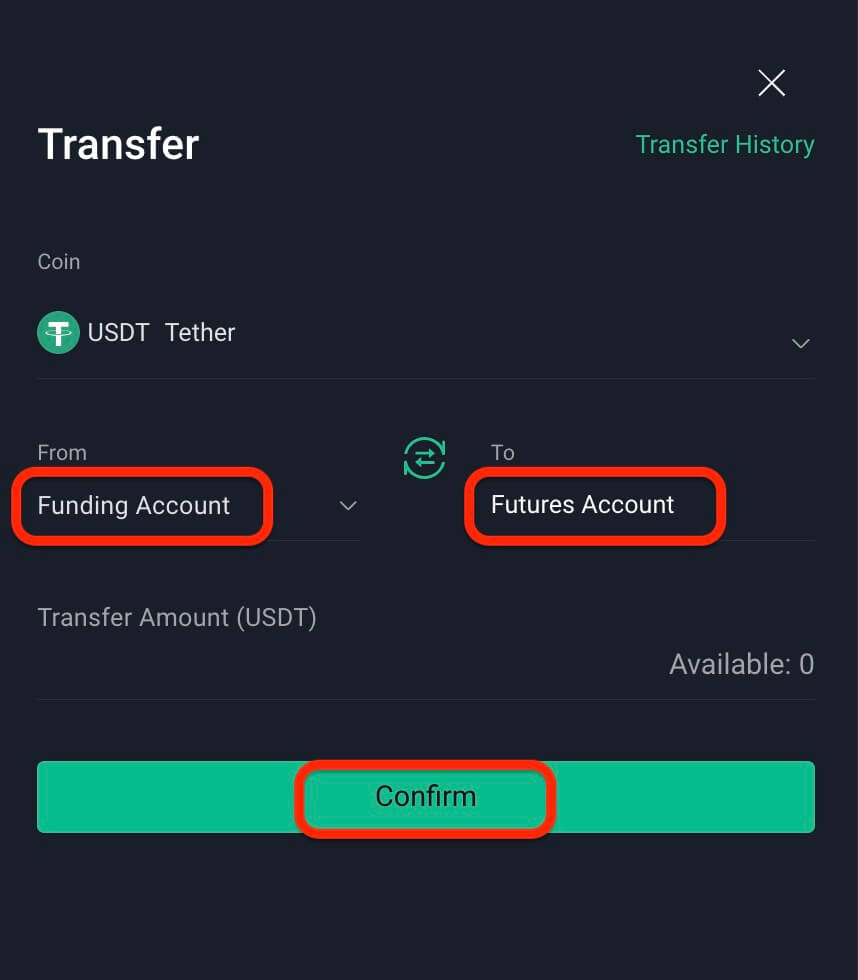

4. Click the Transfer button on the right to access the transfer menu. Enter the desired amount for transferring funds from the Funding to Futures account and confirm.

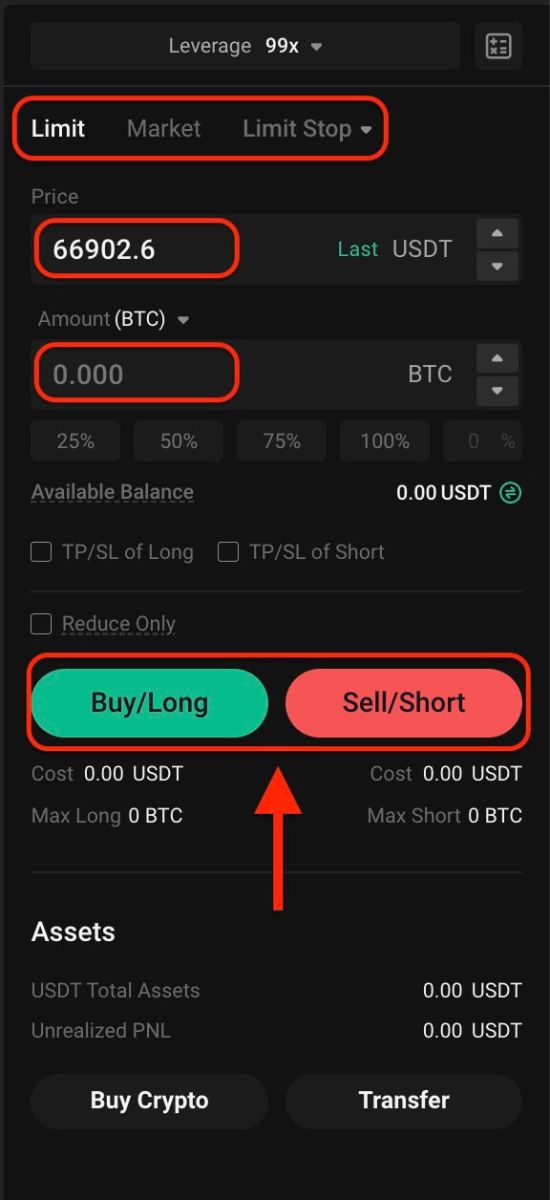

5. To open a position, users can choose an order type: Limit Order, Market Order, and Limit Stop. Enter the order price and quantity and click Click [Buy/Long] or [Sell/Short] to place your order.

- Limit Order: Users set the buying or selling price by themselves. The order will only be executed when the market price reaches the set price. If the market price does not reach the set price, the limit order will continue to wait for the transaction in the order book.

- Market Order: Market order refers to the transaction without setting the buying price or selling price. The system will complete the transaction according to the latest market price when placing the order, and the user only needs to enter the amount of the order to be placed.

6. After placing your order, view it at the bottom of the page. You can cancel orders before they’re filled. Once filled, find them under "Position".

7. To close your position, click "Close".

How to calculate unrealized PNL and ROE%?

USDⓈ-M FuturesUnrealized PNL = Position amount * Futures Multiplier * (Current Mark Price – Entry Price)

ROE% = Unrealized PNL / Initial Margin = Unrealized PNL /(Position amount * Futures Multiplier * Entry Price * Initial Margin Rate)

* Initial Margin Rate = 1 / Leverage

COIN-M Futures

Unrealized PNL = Position amount * Futures Multiplier * (1 / Entry Price - 1 / Current Mark Price)

ROE% = Unrealized PNL / Initial Margin = Unrealized PNL /(Position amount * Futures Multiplier / Entry Price * Initial Margin Rate)

* Initial Margin Rate = 1 / Leverage