How to Trade Crypto and Withdraw on KuCoin

How to Trade Cryptocurrency on KuCoin

How to Open a Trade on KuCoin (Website)

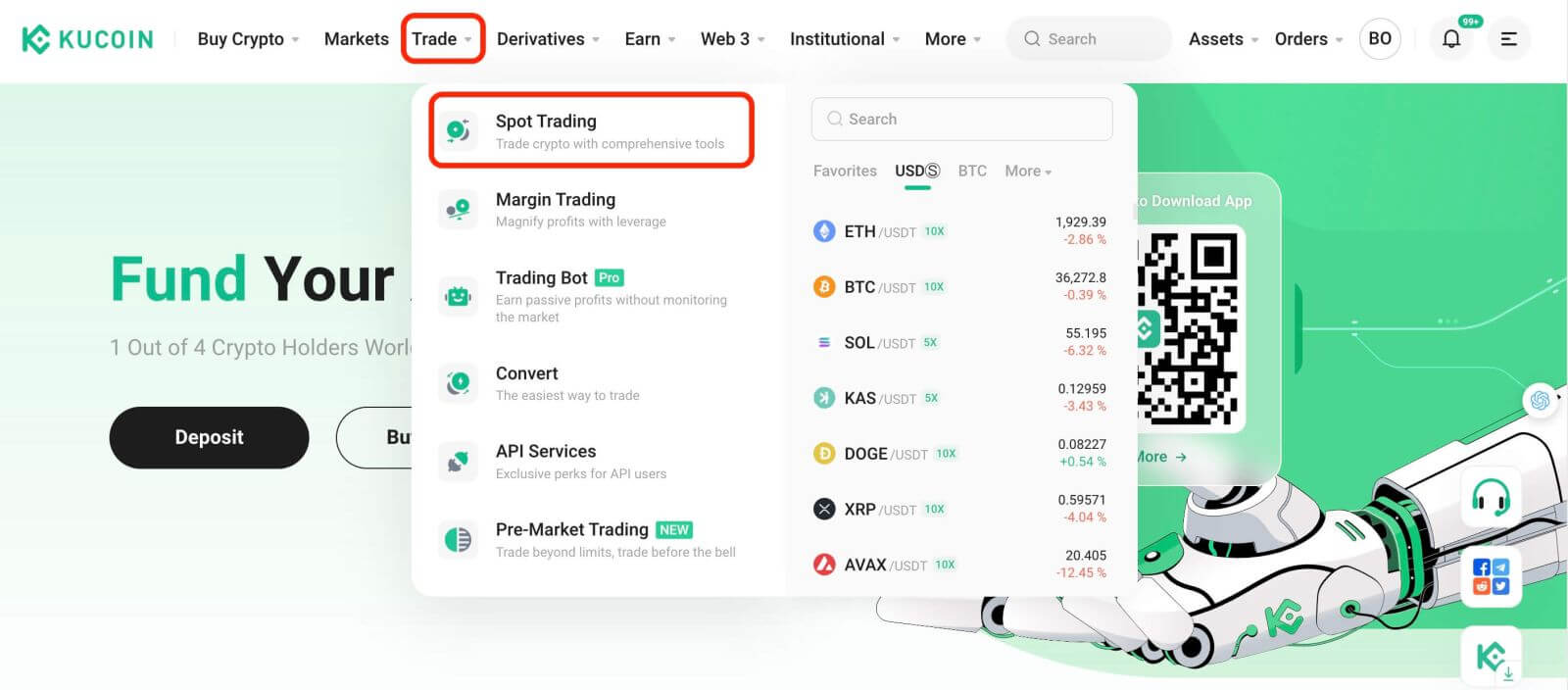

Step 1: Accessing TradingWeb Version: Click on "Trade" in the top navigation bar and choose "Spot Trading" to enter the trading interface.

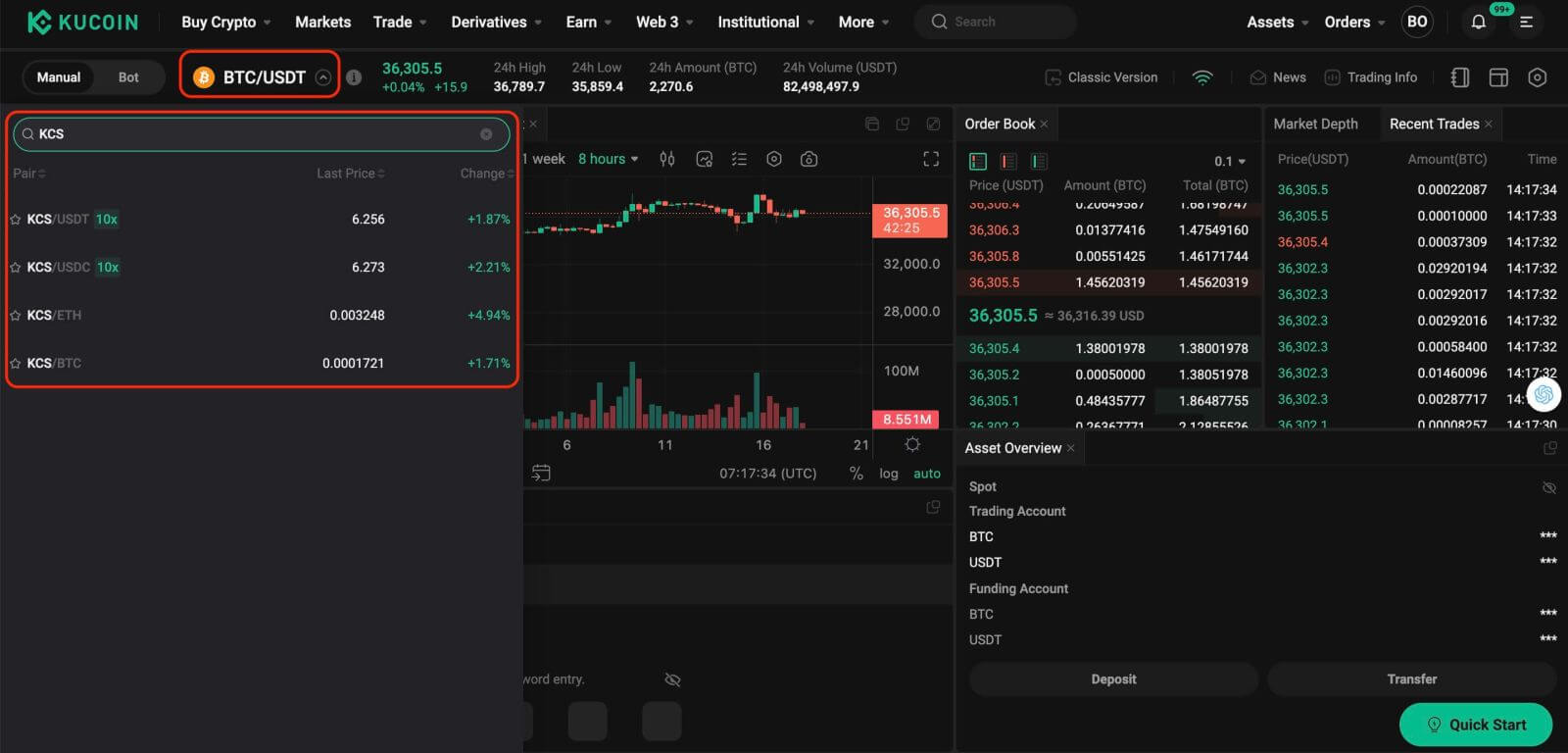

Step 2: Selecting Assets

On the trading page, assuming you wish to buy or sell KCS, you would enter "KCS" into the search bar. Then, you would select your desired trading pair to conduct your trade.

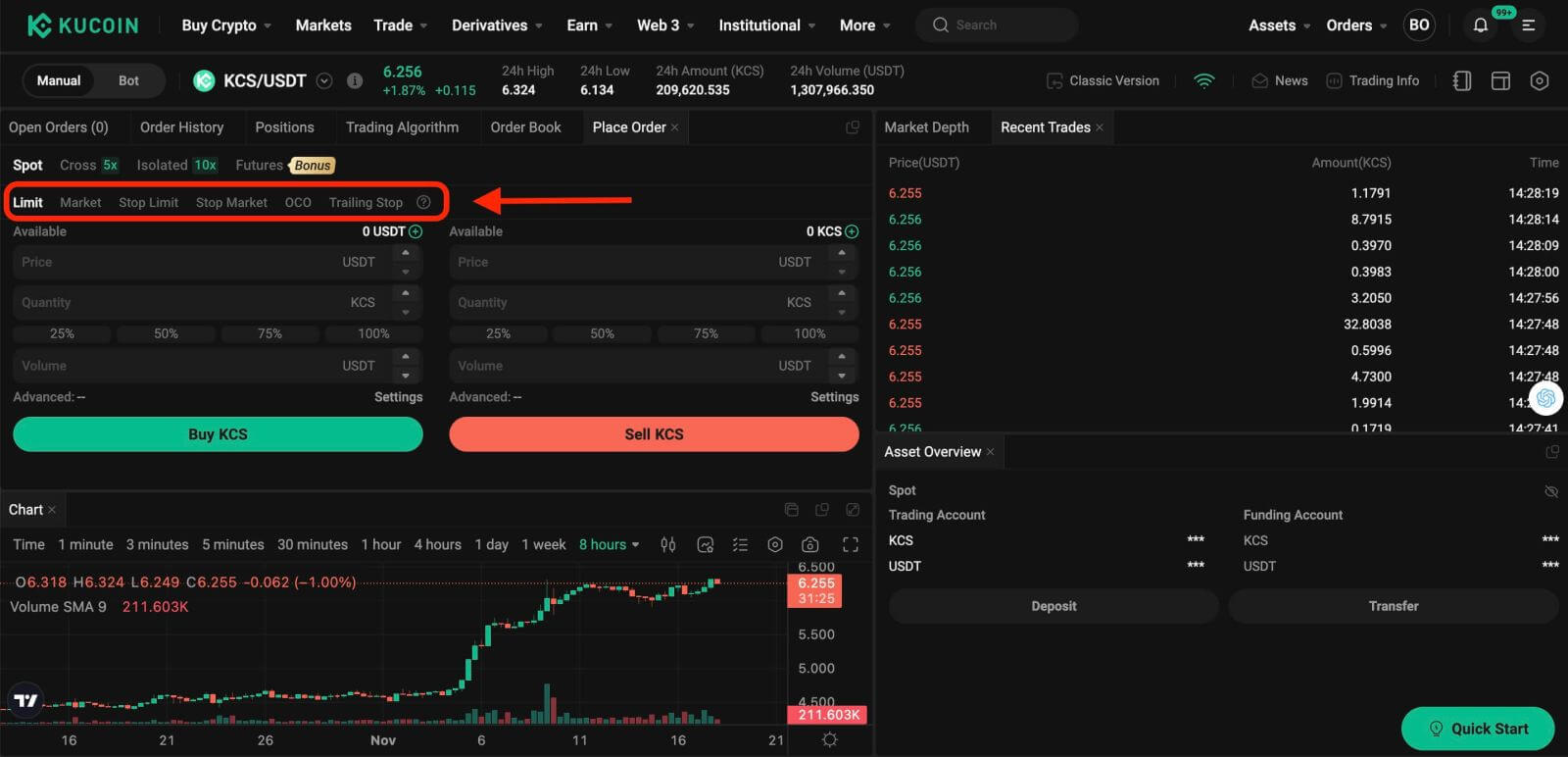

Step 3: Placing Orders

At the bottom of the trading interface is the panel for buying and selling. There are six order types you can choose from:

- Limit orders.

- Market orders.

- Stop-limit orders.

- Stop-market orders.

- One-cancels-the-other (OCO) orders.

- Trailing stop orders.

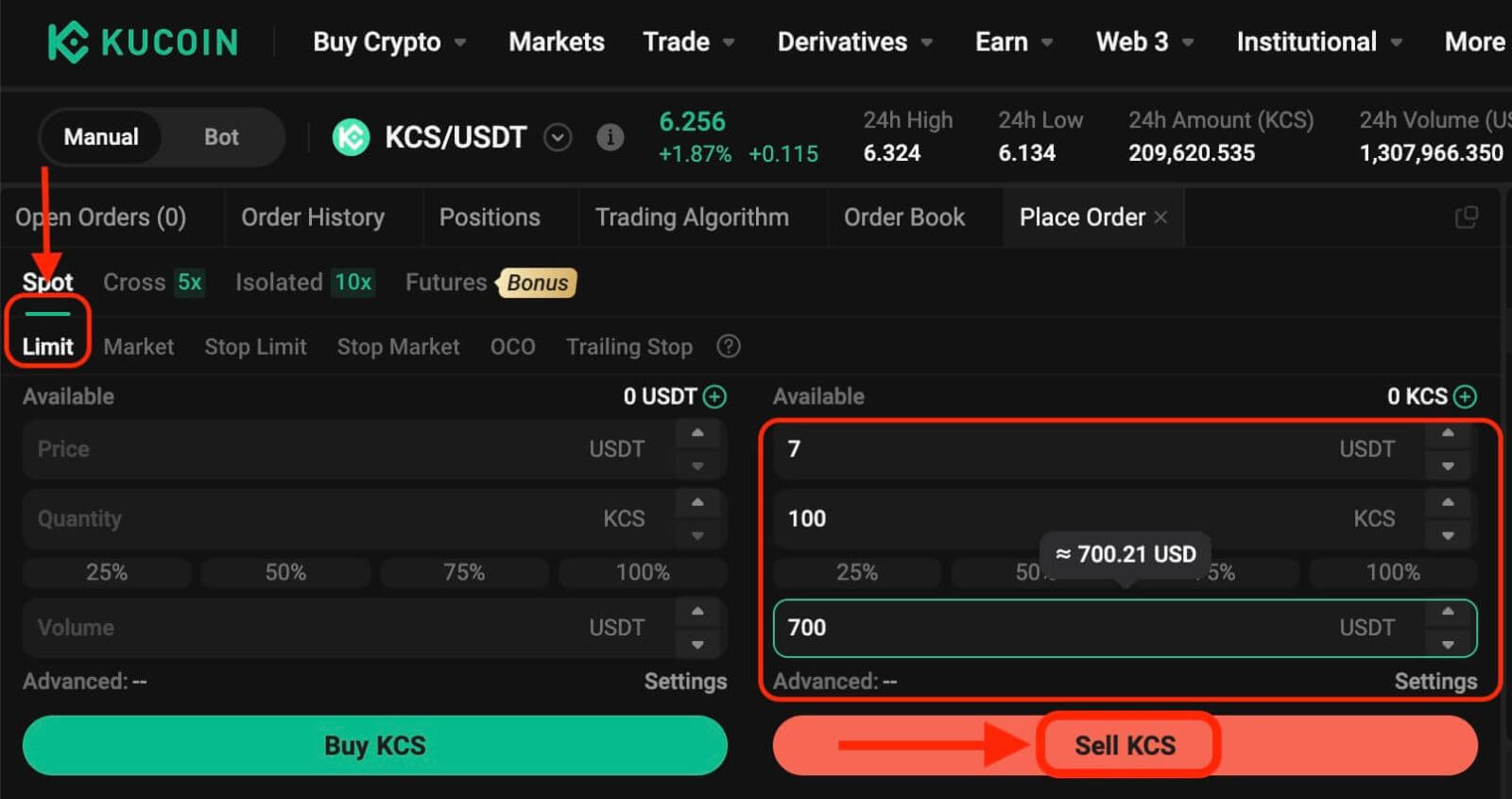

1. Limit Order

A limit order is an order to buy or sell an asset at a specific price or better.

For instance, if the current price of KCS in the KCS/USDT trading pair is 7 USDT, and you wish to sell 100 KCS at a KCS price of 7 USDT, you can place a limit order to do so.

To place such a limit order:

- Select Limit: Choose the "Limit" option.

- Set Price: Enter 7 USDT as the specified price.

- Set Quantity: Define the Quantity as 100 KCS.

- Confirm Order: Click on "Sell KCS" to confirm and finalize the order.

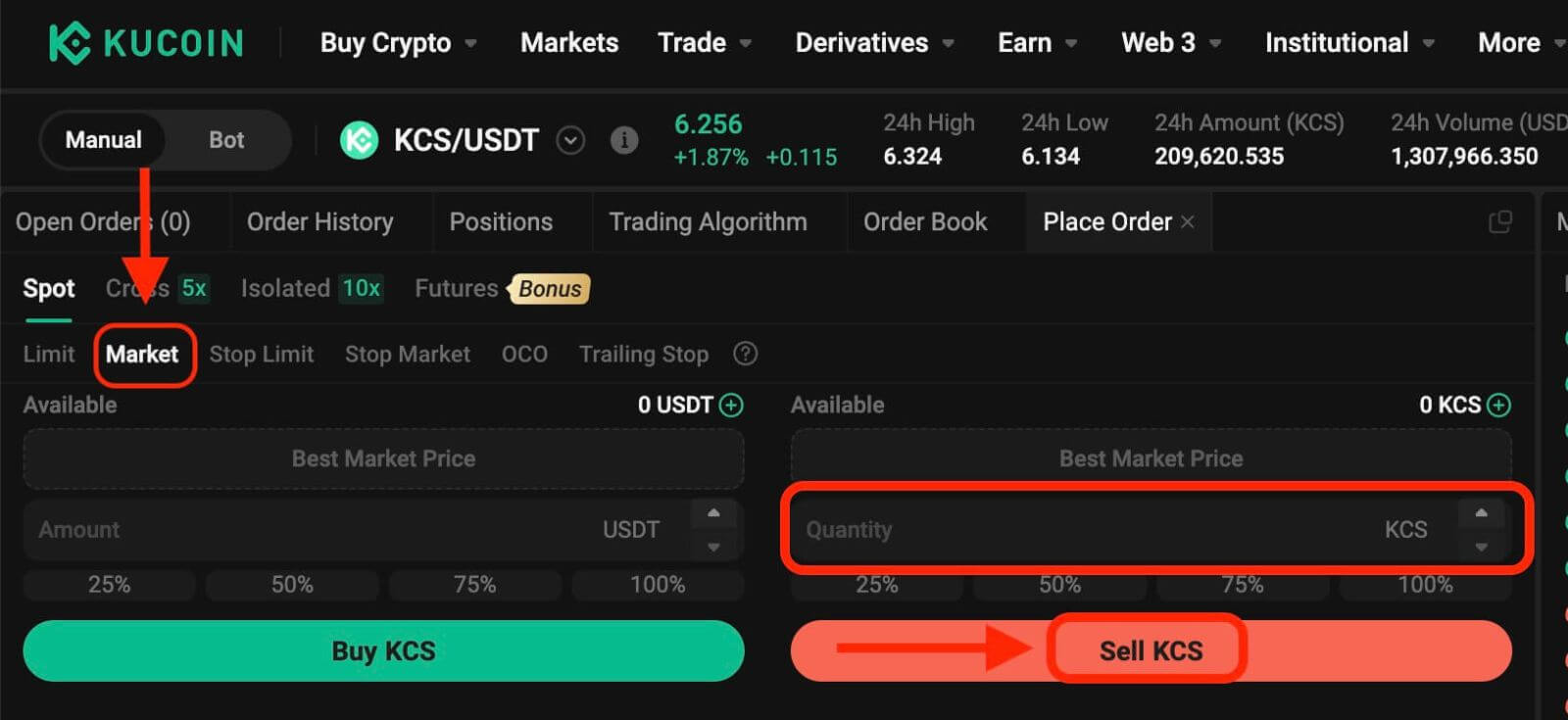

2. Market Order

Execute an order at the current best available market price.

Take the KCS/USDT trading pair for example. Assuming the current price of KCS is 6.2 USDT, and you wish to quickly sell 100 KCS. To do this, you can use a market order. When you issue a market order, the system matches your sell order with the existing buy orders on the market, which ensures a swift execution of your order. This makes market orders the best way to quickly buy or sell assets.

To place such a market order:

- Select Market: Choose the "Market" option.

- Set Quantity: Specify the Quantity as 100 KCS.

- Confirm Order: Click on "Sell KCS" to confirm and execute the order.

Please note: Market orders, once executed, cannot be canceled. You can track order and transaction specifics in your Order History and Trade History. These orders are matched with the prevailing maker order price in the market and can be impacted by market depth. It’s crucial to be mindful of market depth when initiating market orders.

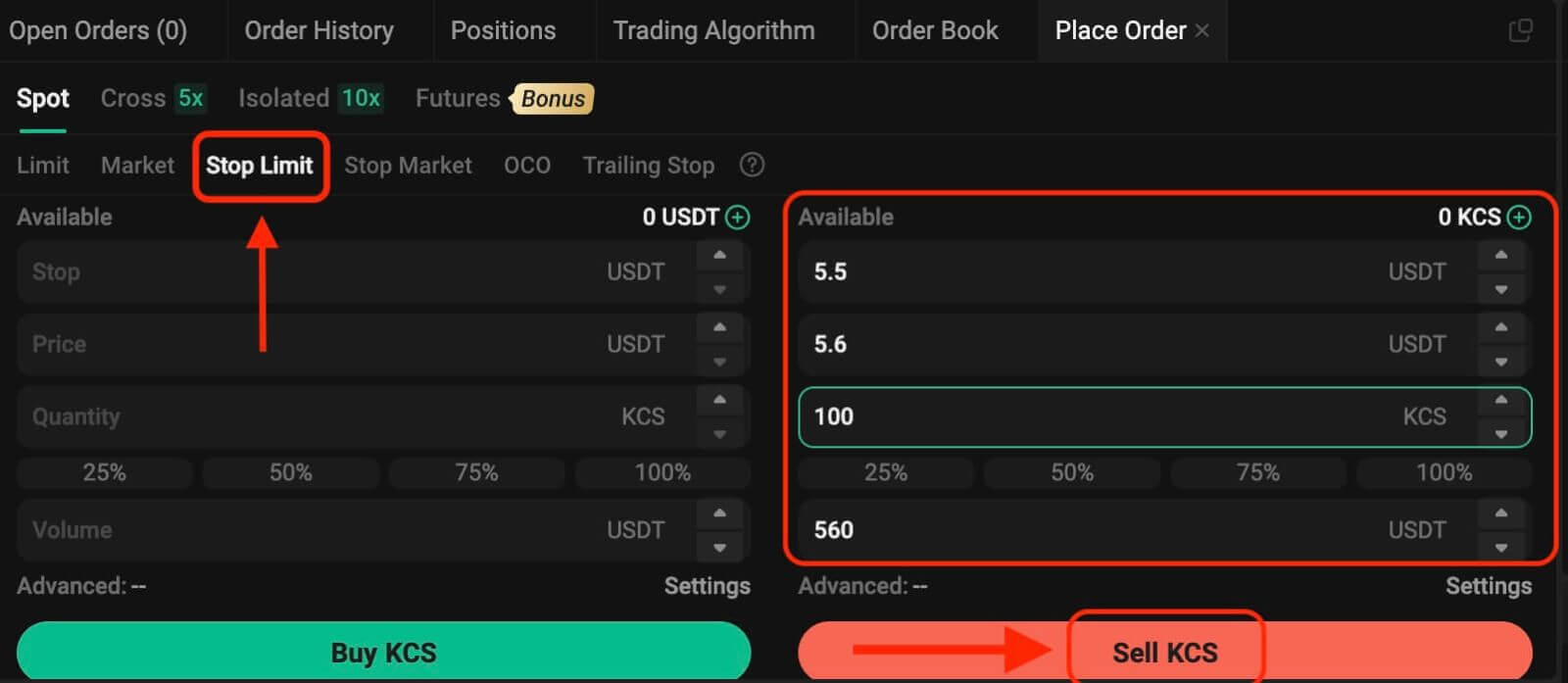

3. Stop-Limit Order

A stop-limit order blends the features of a stop order with a limit order. This type of trade involves setting a "Stop" (stop price), a "Price" (limit price), and a "Quantity." When the market hits the stop price, a limit order is activated based on the specified limit price and quantity.

Take the KCS/USDT trading pair for example. Assuming the current price of KCS is 4 USDT, and you believe that there is resistance around 5.5 USDT, this suggests that once the price of KCS reaches that level, it is unlikely to go any higher in the short term. As such, your ideal selling price would be 5.6 USDT, but you don’t want to have to monitor the market 24/7 just to maximize these profits. In such a scenario, you can opt to place a stop-limit order.

To execute this order:

- Select Stop-Limit: Choose the "Stop-Limit" option.

- Set Stop Price: Enter 5.5 USDT as the stop price.

- Set Limit Price: Specify 5.6 USDT as the limit price.

- Set Quantity: Define the Quantity as 100 KCS.

- Confirm Order: Click on "Sell KCS" to confirm and initiate the order.

Upon reaching or exceeding the stop price of 5.5 USDT, the limit order becomes active. Once the price hits 5.6 USDT, the limit order will be filled as per the set conditions.

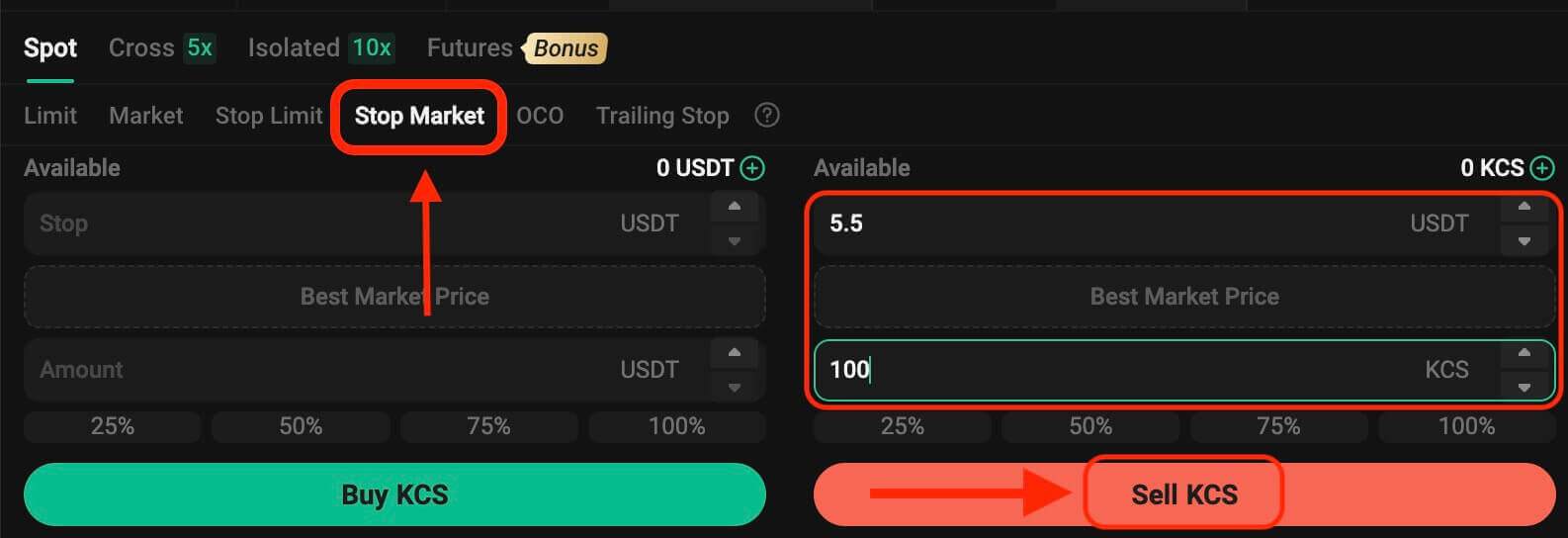

4. Stop Market Order

A stop market order is an order to buy or sell an asset once the price reaches a specific price (the "stop price"). Once the price reaches the stop price, the order becomes a market order and will be filled at the next available market price.

Take the KCS/USDT trading pair for example. Assuming the current price of KCS is 4 USDT, and you believe there is resistance around 5.5 USDT, this suggests that once the price of KCS reaches that level, it is unlikely to go any higher in the short term. However, you don’t want to have to monitor the market 24/7 just to be able to sell at an ideal price. In this situation, you can choose to place a stop-market order.

- Select Stop Market: Choose the "Stop Market" option.

- Set Stop Price: Specify a stop price of 5.5 USDT.

- Set Quantity: Define the Quantity as 100 KCS.

- Confirm Order: Click on "Sell KCS" to place the order.

Once the market price reaches or surpasses 5.5 USDT, the stop market order will be activated and executed at the next available market price.

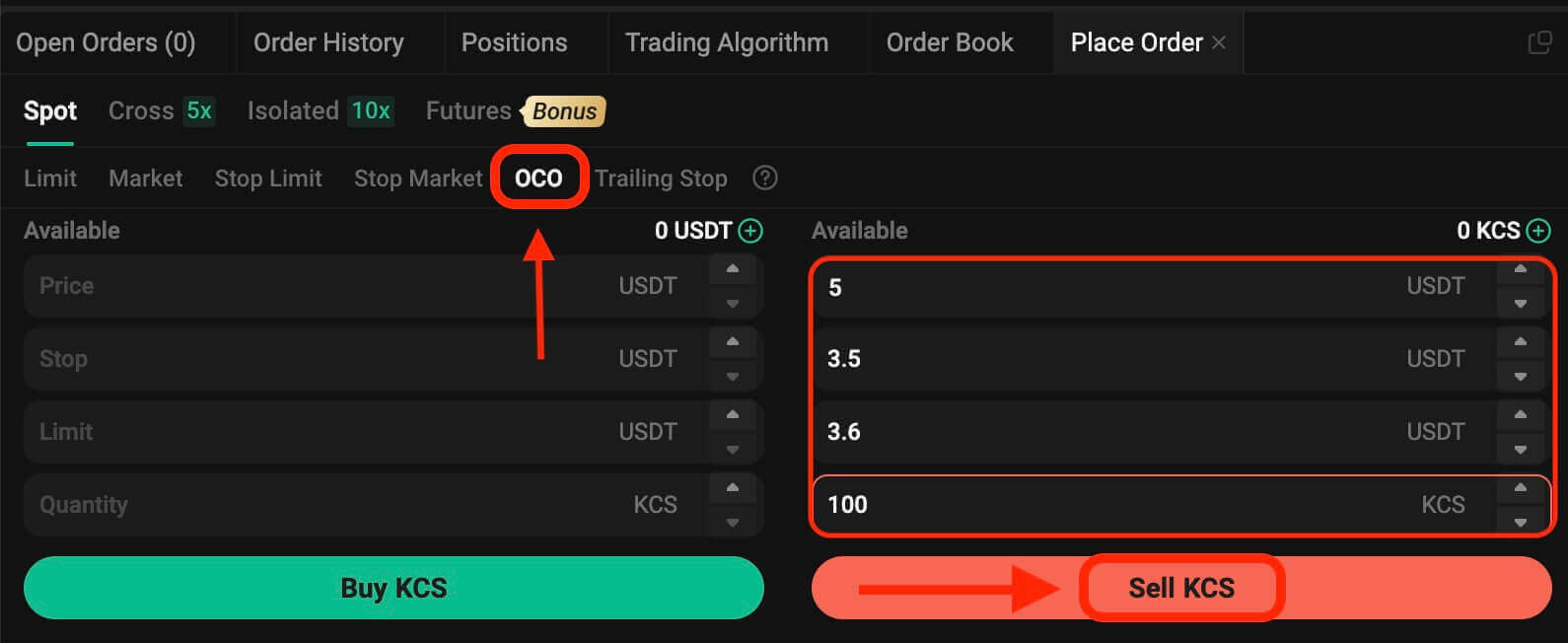

5. One-Cancels-the-Other (OCO) Order

An OCO order executes both a limit order and a stop-limit order concurrently. Depending on market movements, one of these orders will activate, automatically canceling the other.

For instance, consider the KCS/USDT trading pair, assuming the current KCS price is at 4 USDT. If you anticipate a potential decline in the final price—either after rising to 5 USDT and then dropping or directly decreasing—your objective is to sell at 3.6 USDT just before the price falls below the support level of 3.5 USDT.

To place this OCO order:

- Select OCO: Choose the "OCO" option.

- Set Price: Define the Price as 5 USDT.

- Set Stop: Specify the Stop price as 3.5 USDT (this triggers a limit order when the price reaches 3.5 USDT).

- Set Limit: Specify the Limit price as 3.6 USDT.

- Set Quantity: Define the Quantity as 100.

- Confirm Order: Click on "Sell KCS" to execute the OCO order.

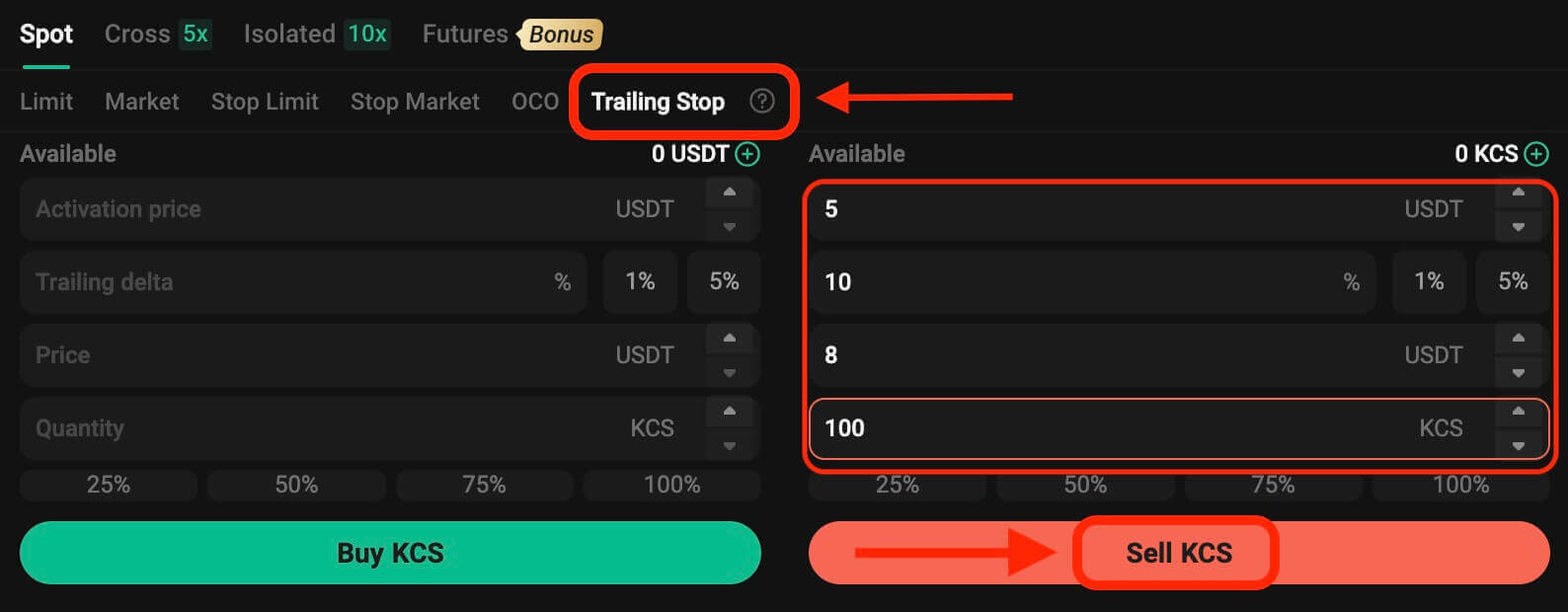

6. Trailing Stop Order

A trailing stop order is a variation of a standard stop order. This type of order allows setting the stop price as a specific percentage away from the current asset price. When both conditions align in the market’s price movement, it activates a limit order.

With a trailing buy order, you can swiftly purchase when the market rises after a decline. Similarly, a trailing sell order enables prompt selling when the market declines after an upward trend. This order type safeguards profits by keeping a trade open and profitable as long as the price moves favorably. It closes the trade if the price shifts by the specified percentage in the opposite direction.

For instance, in the KCS/USDT trading pair with KCS priced at 4 USDT, assuming an anticipated rise in KCS to 5 USDT followed by a subsequent retracement of 10% before considering selling, setting the selling price at 8 USDT becomes the strategy. In this scenario, the plan involves placing a sell order at 8 USDT, but only triggered when the price reaches 5 USDT and then experiences a 10% retracement.

To execute this trailing stop order:

- Select Trailing Stop: Choose the "Trailing Stop" option.

- Set Activation Price: Specify the activation price as 5 USDT.

- Set Trailing Delta: Define the trailing delta as 10%.

- Set Price: Specify the Price as 8 USDT.

- Set Quantity: Define the Quantity as 100.

- Confirm Order: Click on "Sell KCS" to execute the trailing stop order.

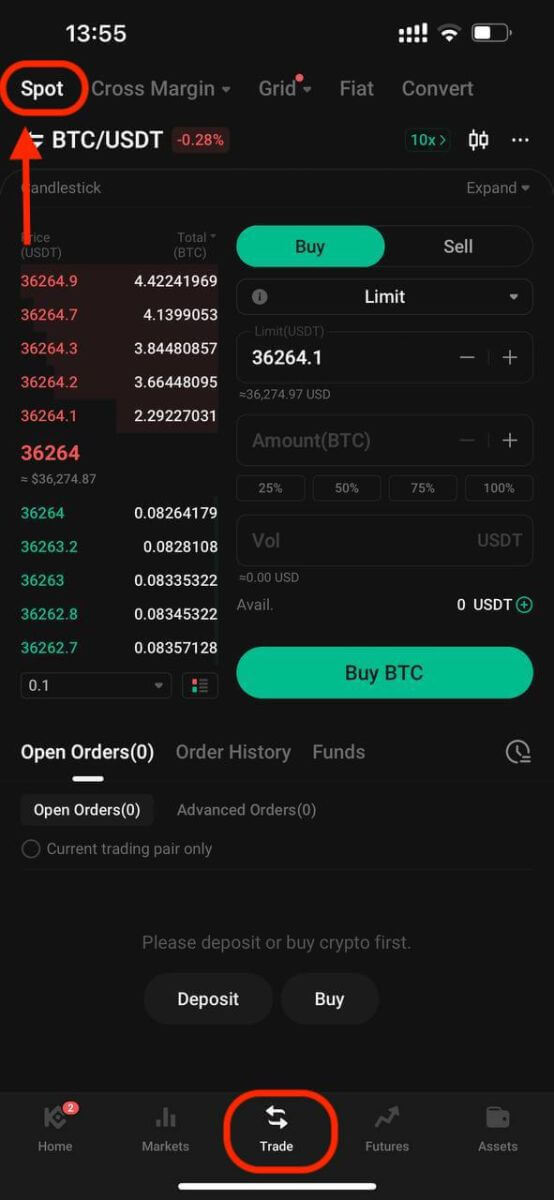

How to Open a Trade on KuCoin (App)

Step 1: Accessing TradingApp Version: Simply tap on "Trade".

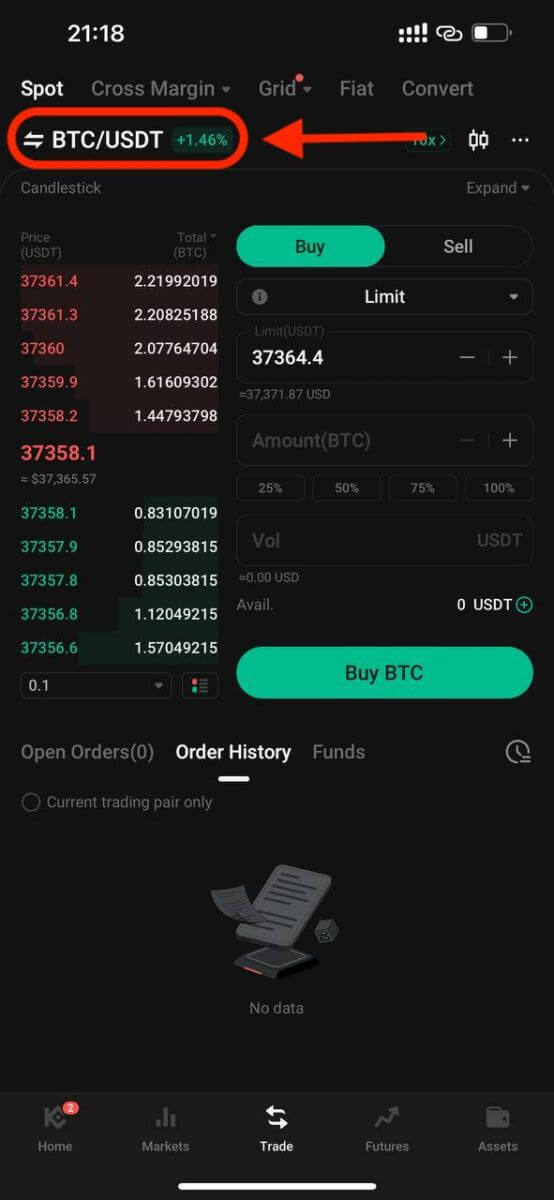

Step 2: Selecting Assets

On the trading page, assuming you wish to buy or sell KCS, you would enter "KCS" into the search bar. Then, you would select your desired trading pair to conduct your trade.

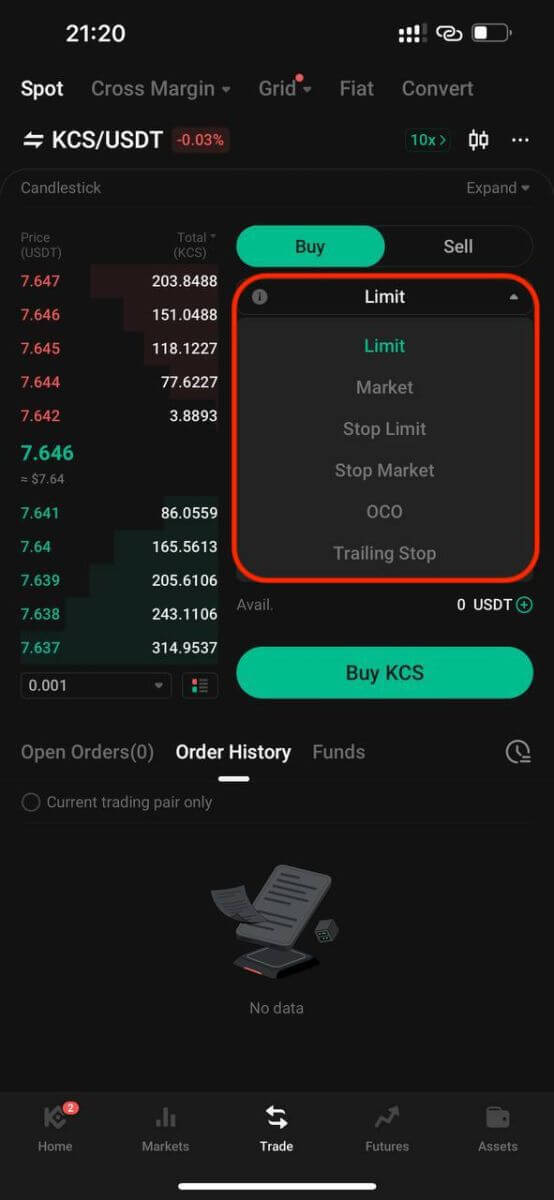

Step 3: Placing Orders

At the trading interface is the panel for buying and selling. There are six order types you can choose from:

- Limit orders.

- Market orders.

- Stop-limit orders.

- Stop-market orders.

- One-cancels-the-other (OCO) orders.

- Trailing stop orders.

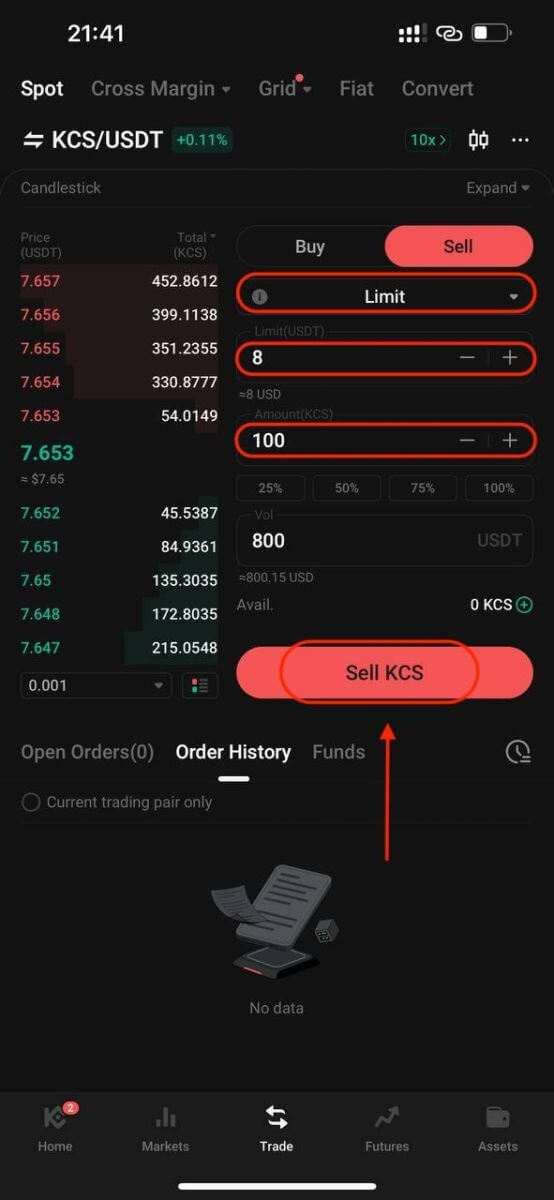

1. Limit Order

A limit order is an order to buy or sell an asset at a specific price or better.

For instance, if the current price of KCS in the KCS/USDT trading pair is 8 USDT, and you wish to sell 100 KCS at a KCS price of 8 USDT, you can place a limit order to do so.

To place such a limit order:

- Select Limit: Choose the "Limit" option.

- Set Price: Enter 8 USDT as the specified price.

- Set Quantity: Define the Quantity as 100 KCS.

- Confirm Order: Click on "Sell KCS" to confirm and finalize the order.

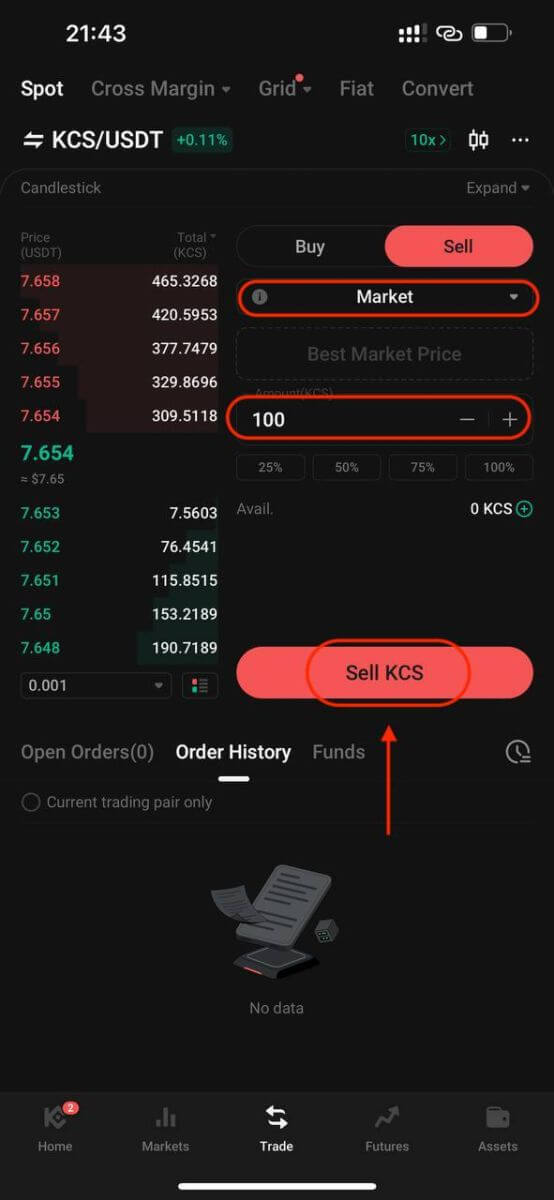

2. Market Order

Execute an order at the current best available market price.

Take the KCS/USDT trading pair for example. Assuming the current price of KCS is 7.8 USDT, and you wish to quickly sell 100 KCS. To do this, you can use a market order. When you issue a market order, the system matches your sell order with the existing buy orders on the market, which ensures a swift execution of your order. This makes market orders the best way to quickly buy or sell assets.

To place such a market order:

- Select Market: Choose the "Market" option.

- Set Quantity: Specify the Quantity as 100 KCS.

- Confirm Order: Click on "Sell KCS" to confirm and execute the order.

Please note: Market orders, once executed, cannot be canceled. You can track order and transaction specifics in your Order History and Trade History. These orders are matched with the prevailing maker order price in the market and can be impacted by market depth. It’s crucial to be mindful of market depth when initiating market orders.

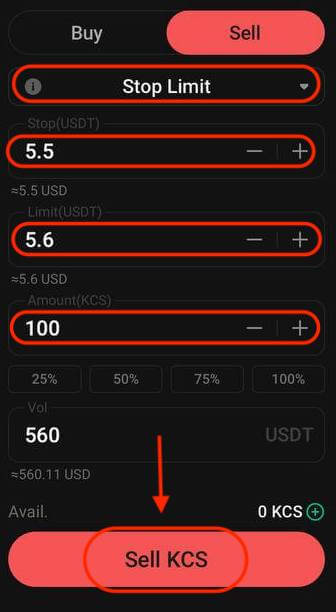

3. Stop-Limit Order

A stop-limit order blends the features of a stop order with a limit order. This type of trade involves setting a "Stop" (stop price), a "Price" (limit price), and a "Quantity." When the market hits the stop price, a limit order is activated based on the specified limit price and quantity.

Take the KCS/USDT trading pair for example. Assuming the current price of KCS is 4 USDT, and you believe that there is resistance around 5.5 USDT, this suggests that once the price of KCS reaches that level, it is unlikely to go any higher in the short term. As such, your ideal selling price would be 5.6 USDT, but you don’t want to have to monitor the market 24/7 just to maximize these profits. In such a scenario, you can opt to place a stop-limit order.

To execute this order:

- Select Stop-Limit: Choose the "Stop-Limit" option.

- Set Stop Price: Enter 5.5 USDT as the stop price.

- Set Limit Price: Specify 5.6 USDT as the limit price.

- Set Quantity: Define the Quantity as 100 KCS.

- Confirm Order: Click on "Sell KCS" to confirm and initiate the order.

Upon reaching or exceeding the stop price of 5.5 USDT, the limit order becomes active. Once the price hits 5.6 USDT, the limit order will be filled as per the set conditions.

4. Stop Market Order

A stop market order is an order to buy or sell an asset once the price reaches a specific price (the "stop price"). Once the price reaches the stop price, the order becomes a market order and will be filled at the next available market price.

Take the KCS/USDT trading pair for example. Assuming the current price of KCS is 4 USDT, and you believe there is resistance around 5.5 USDT, this suggests that once the price of KCS reaches that level, it is unlikely to go any higher in the short term. However, you don’t want to have to monitor the market 24/7 just to be able to sell at an ideal price. In this situation, you can choose to place a stop-market order.

- Select Stop Market: Choose the "Stop Market" option.

- Set Stop Price: Specify a stop price of 5.5 USDT.

- Set Quantity: Define the Quantity as 100 KCS.

- Confirm Order: Click on "Sell KCS" to place the order.

Once the market price reaches or surpasses 5.5 USDT, the stop market order will be activated and executed at the next available market price.

5. One-Cancels-the-Other (OCO) Order

An OCO order executes both a limit order and a stop-limit order concurrently. Depending on market movements, one of these orders will activate, automatically canceling the other.

For instance, consider the KCS/USDT trading pair, assuming the current KCS price is at 4 USDT. If you anticipate a potential decline in the final price—either after rising to 5 USDT and then dropping or directly decreasing—your objective is to sell at 3.6 USDT just before the price falls below the support level of 3.5 USDT.

To place this OCO order:

- Select OCO: Choose the "OCO" option.

- Set Price: Define the Price as 5 USDT.

- Set Stop: Specify the Stop price as 3.5 USDT (this triggers a limit order when the price reaches 3.5 USDT).

- Set Limit: Specify the Limit price as 3.6 USDT.

- Set Quantity: Define the Quantity as 100.

- Confirm Order: Click on "Sell KCS" to execute the OCO order.

6. Trailing Stop Order

A trailing stop order is a variation of a standard stop order. This type of order allows setting the stop price as a specific percentage away from the current asset price. When both conditions align in the market’s price movement, it activates a limit order.

With a trailing buy order, you can swiftly purchase when the market rises after a decline. Similarly, a trailing sell order enables prompt selling when the market declines after an upward trend. This order type safeguards profits by keeping a trade open and profitable as long as the price moves favorably. It closes the trade if the price shifts by the specified percentage in the opposite direction.

For instance, in the KCS/USDT trading pair with KCS priced at 4 USDT, assuming an anticipated rise in KCS to 5 USDT followed by a subsequent retracement of 10% before considering selling, setting the selling price at 8 USDT becomes the strategy. In this scenario, the plan involves placing a sell order at 8 USDT, but only triggered when the price reaches 5 USDT and then experiences a 10% retracement.

To execute this trailing stop order:

- Select Trailing Stop: Choose the "Trailing Stop" option.

- Set Activation Price: Specify the activation price as 5 USDT.

- Set Trailing Delta: Define the trailing delta as 10%.

- Set Price: Specify the Price as 8 USDT.

- Set Quantity: Define the Quantity as 100.

- Confirm Order: Click on "Sell KCS" to execute the trailing stop order.

How to Withdraw from KuCoin

How to Withdraw Crypto from KuCoin?

Making a withdrawal on KuCoin is as easy as making a deposit.

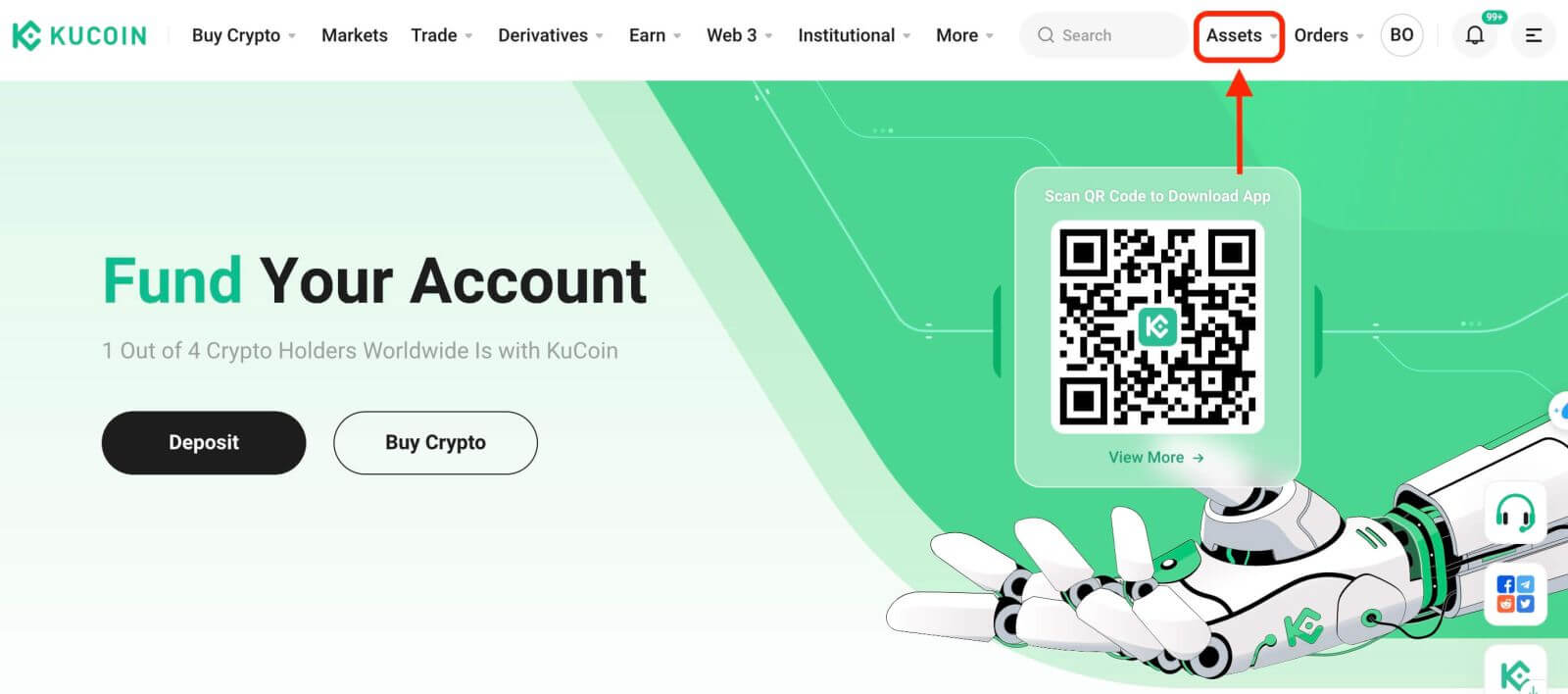

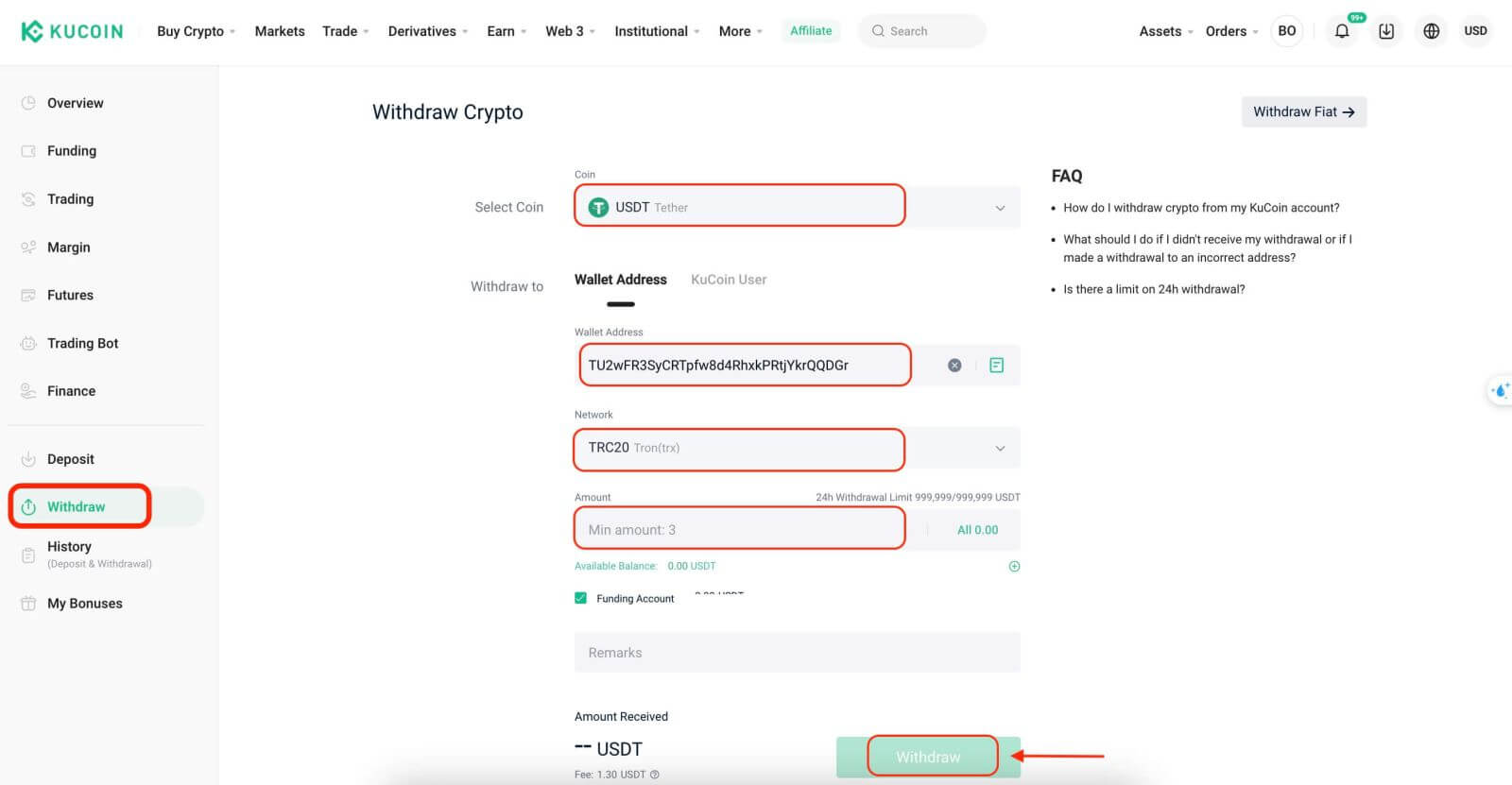

Withdraw Crypto from KuCoin (Website)

Step 1: Go to KuCoin, then click Assets in the upper right corner of the header.

Step 2: Click Withdraw and select a crypto. Fill in the wallet address and choose a corresponding network. Input the amount you wish to withdraw, then click "Withdraw" to proceed.

Note that you can only withdraw from your KuCoin Funding Account or Trading Account, so make sure to transfer your funds to the Funding Account or Trading Account before attempting withdrawal.

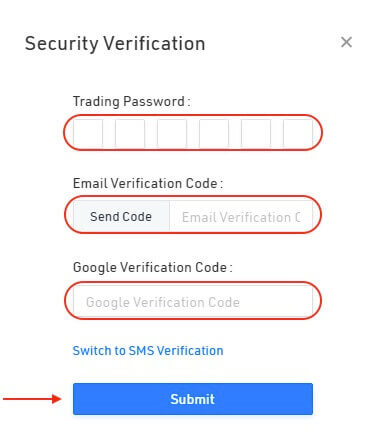

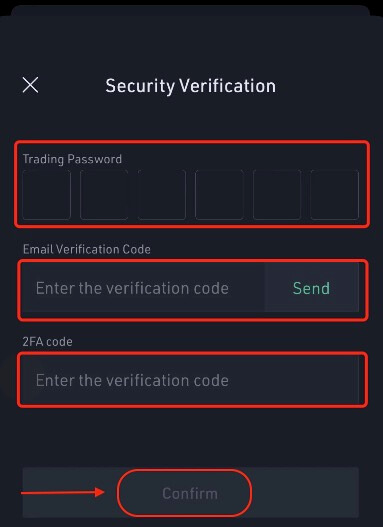

Step 3: The security verification window will pop up. Fill in the trading password, verification code, and 2FA code to submit the withdrawal request.

Warning: If you input the wrong information or select the wrong network when making a transfer, your assets will be permanently lost. Please, make sure that the information is correct before making a transfer.

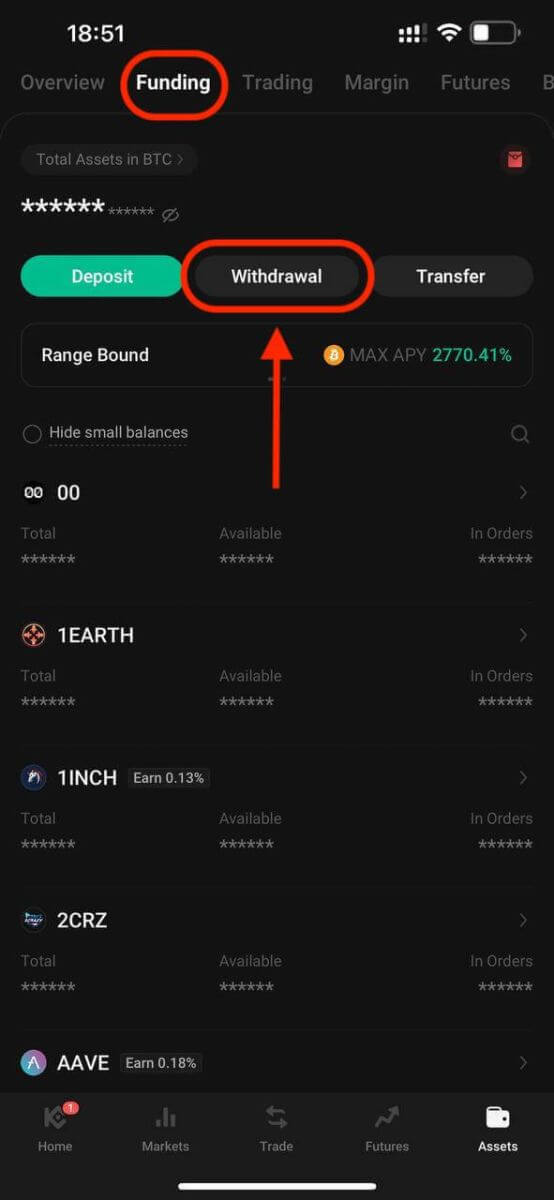

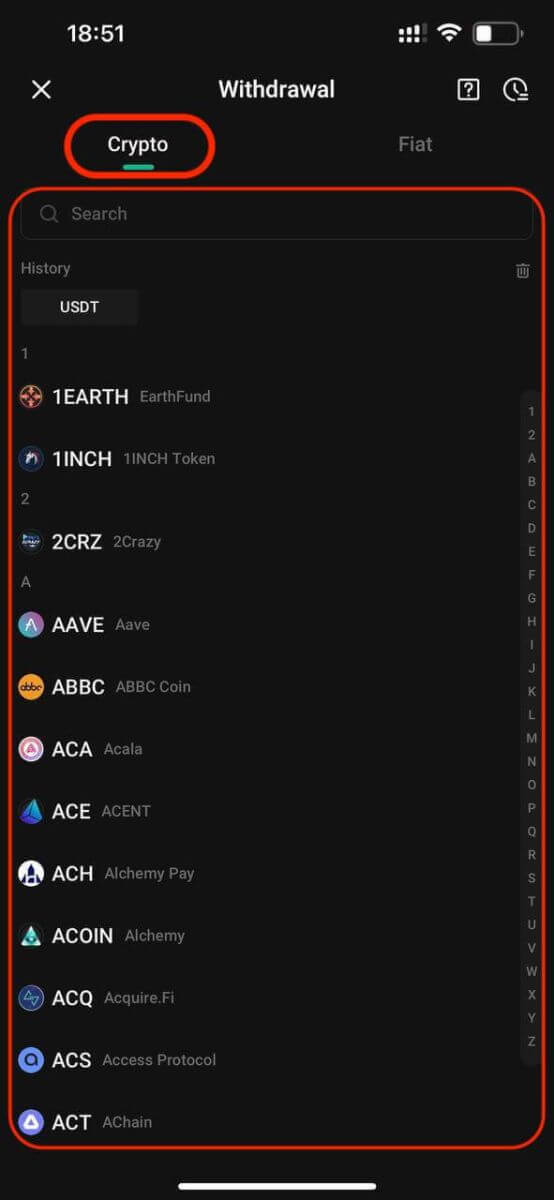

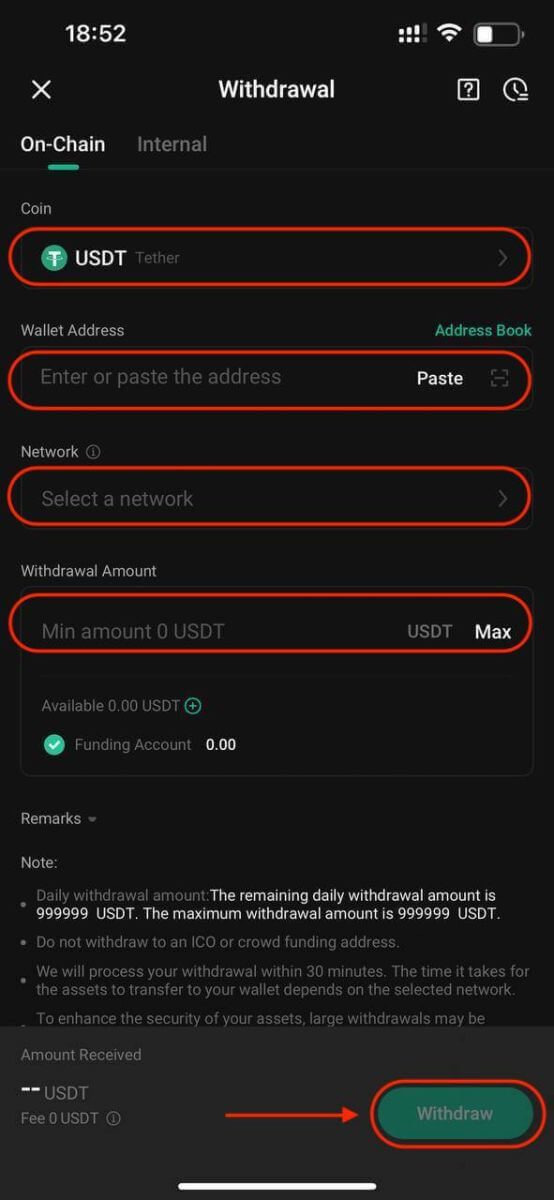

Withdraw Crypto from KuCoin (App)

Step 1: Log in to your KuCoin account, then tap ’Assets’ - ’Withdrawal’ to enter the withdrawal page.

Step 2: Select a crypto, fill in the wallet address, and choose the corresponding network. Input the amount, then tap Confirm to proceed.

Step 3: Confirm your withdrawal information on the next page, then fill in your trading password, verification code, and Google 2FA to submit the withdrawal request.

Warning: If you input the wrong information or select the wrong network when making a transfer, your assets will be permanently lost. Please, make sure that the information is correct before making a transfer.

How long does a withdrawal take to process?

Withdrawal processing times can vary from a few minutes to several hours, depending on the crypto.

Why is it taking so long to receive my withdrawal?

Normally, KuCoin processes withdrawals within 30 minutes; however, delays might arise due to network congestion or security measures. Larger withdrawals could undergo manual processing, taking a bit more time to ensure asset security.

What is the fee for crypto withdrawals?

KuCoin charges a small fee based on the cryptocurrency and blockchain network you choose. For example, TRC-20 tokens usually have lower transaction fees compared to ERC-20 tokens.

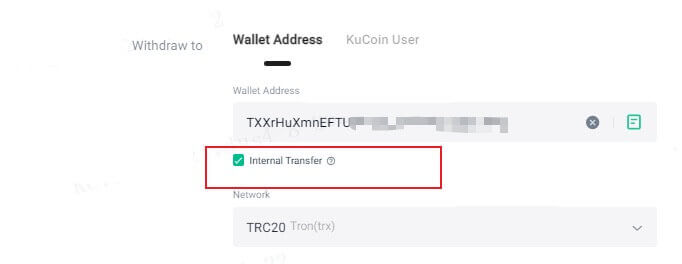

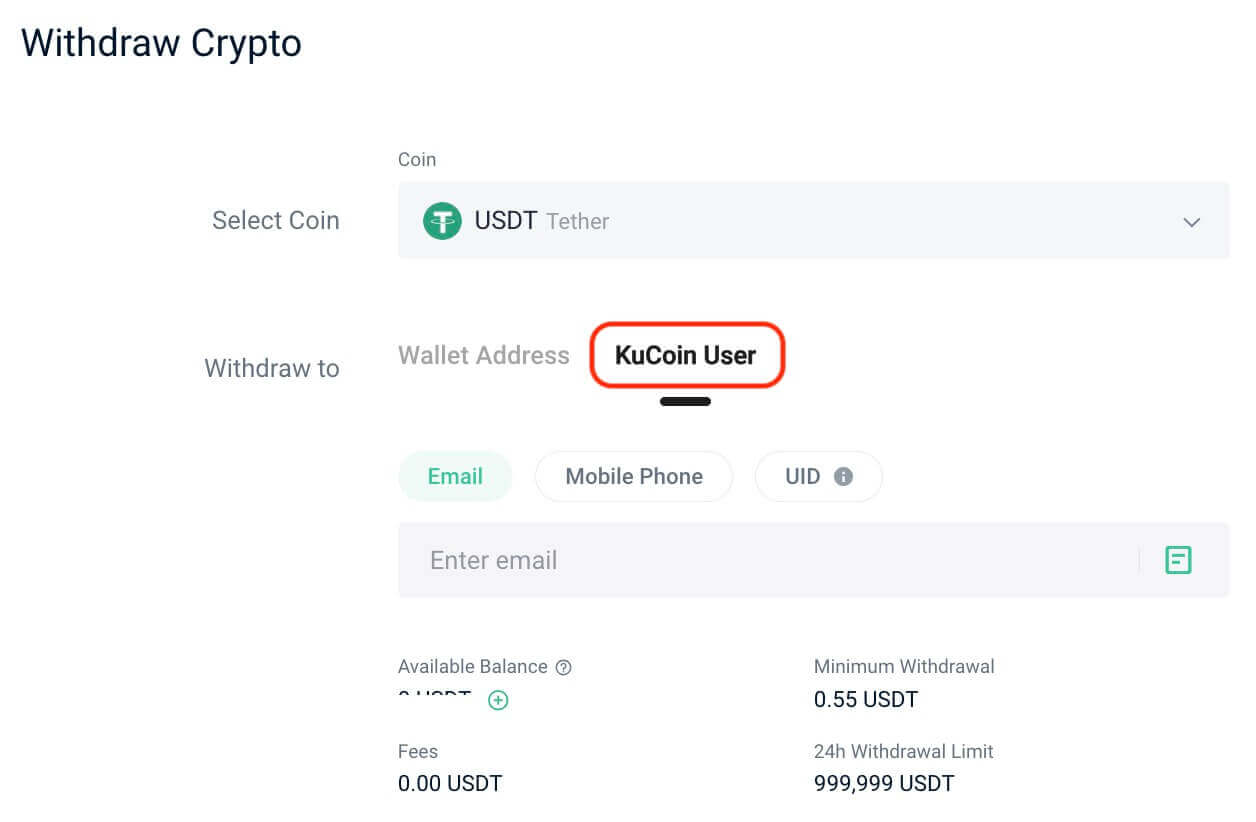

To transfer funds to another KuCoin account without fees and almost instantly, select the Internal Transfer option on the withdrawal page.

Also, we support withdrawing to KuCoin users with no fee. You can directly enter the Email/Mobile Phone/ UID for the internal withdrawal.

What is the minimum withdrawal amount?

The minimum withdrawal amount differs for each cryptocurrency.

What if I withdraw a token to the wrong address?

Once funds leave KuCoin, they might not be recoverable. Please reach out to the recipient platform for assistance.

Why have my withdrawals been suspended?

Your withdrawals are temporarily on hold for 24 hours after making important security changes like updating your trading password or Google 2FA. This delay is to boost the security of your account and assets.

How to Sell Crypto via P2P trading on KuCoin?

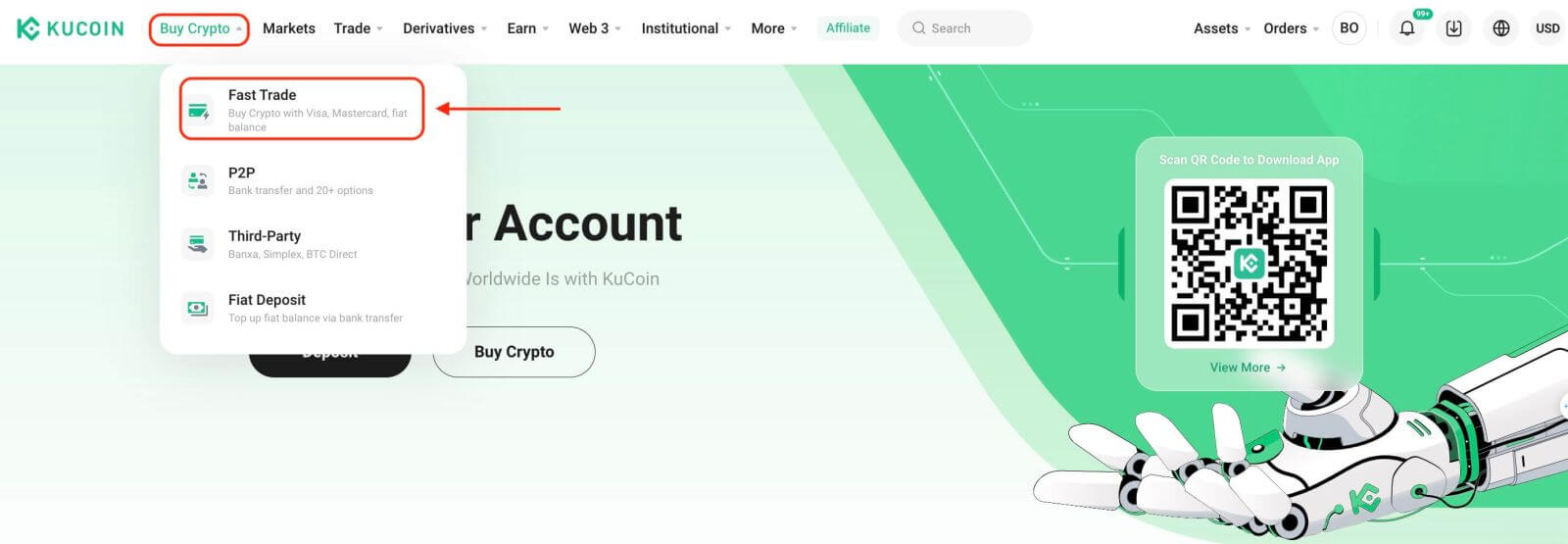

Sell Crypto via P2P trading on KuCoin (Website)

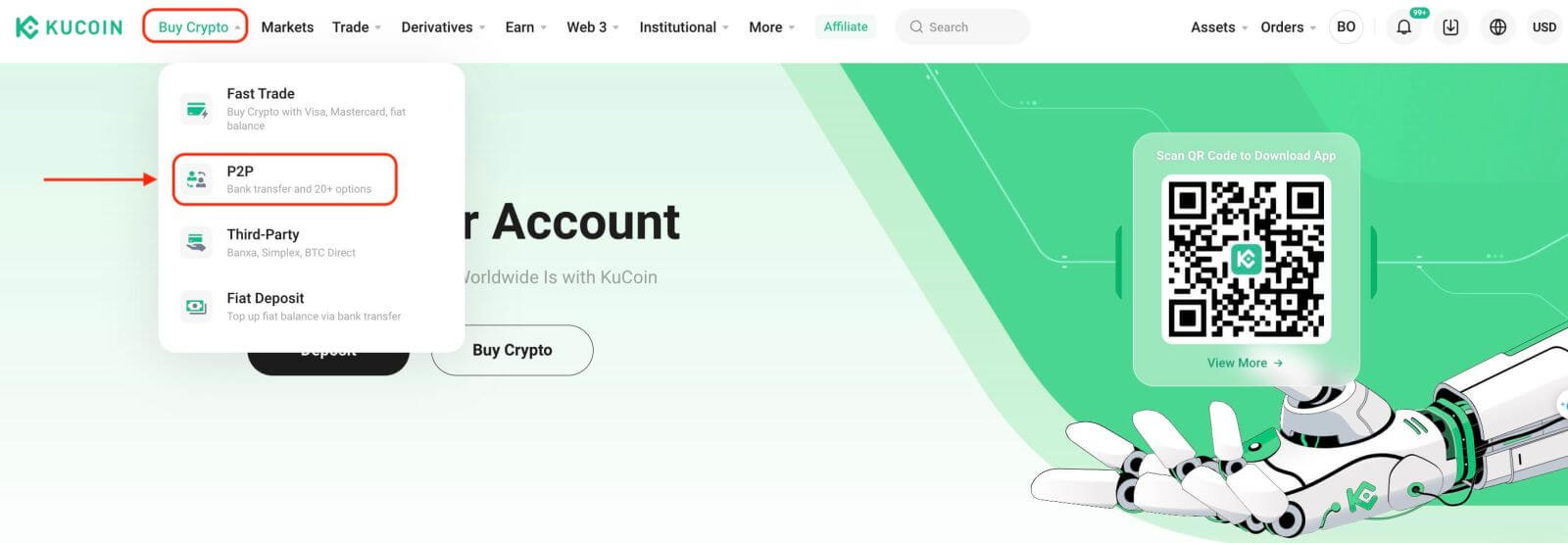

You can sell cryptocurrency from the KuCoin P2P website in just a few clicks.Step 1: Log in to your KuCoin account and go to [Buy Crypto] - [P2P].

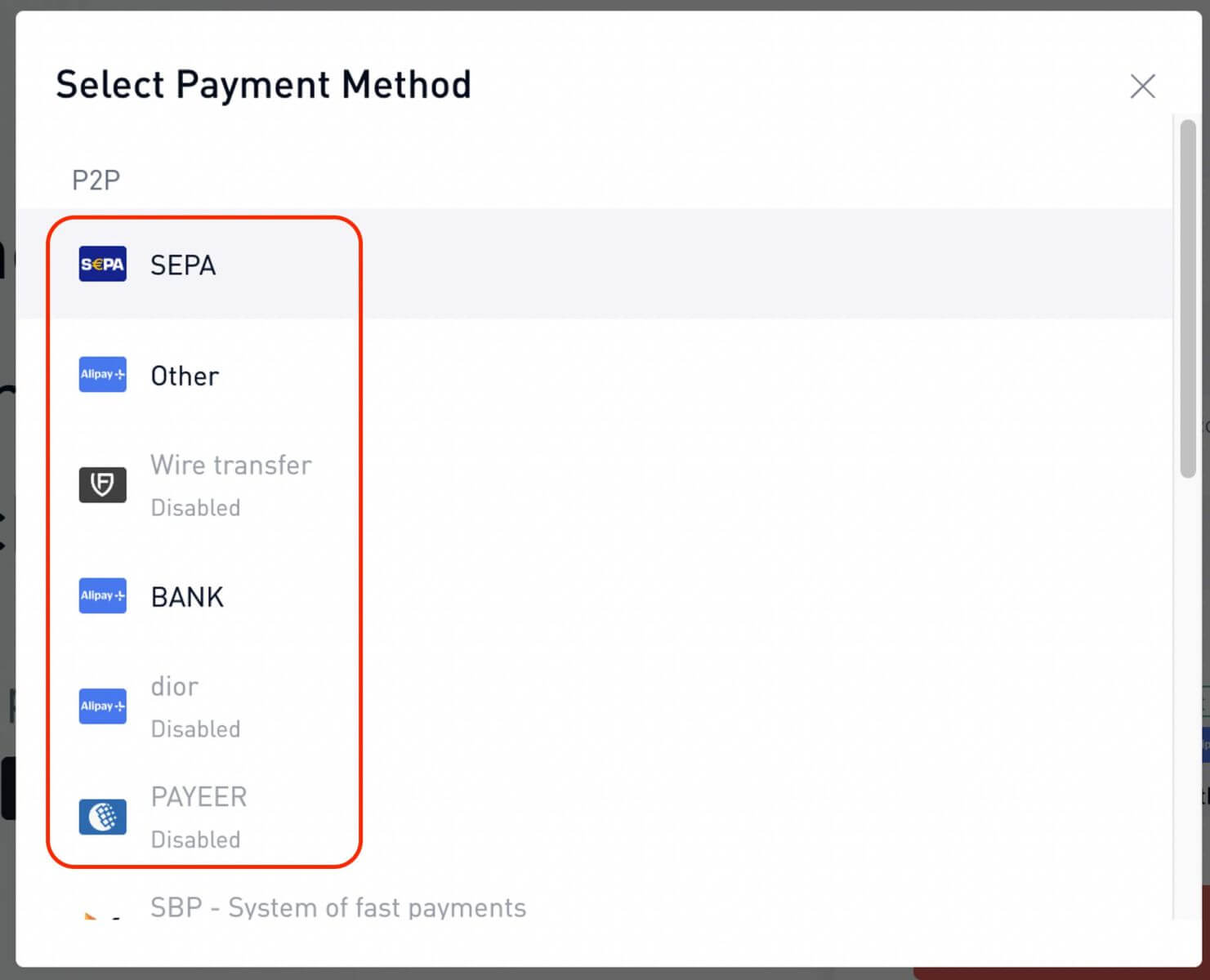

Before trading on the P2P market, you need to add your preferred payment methods first.

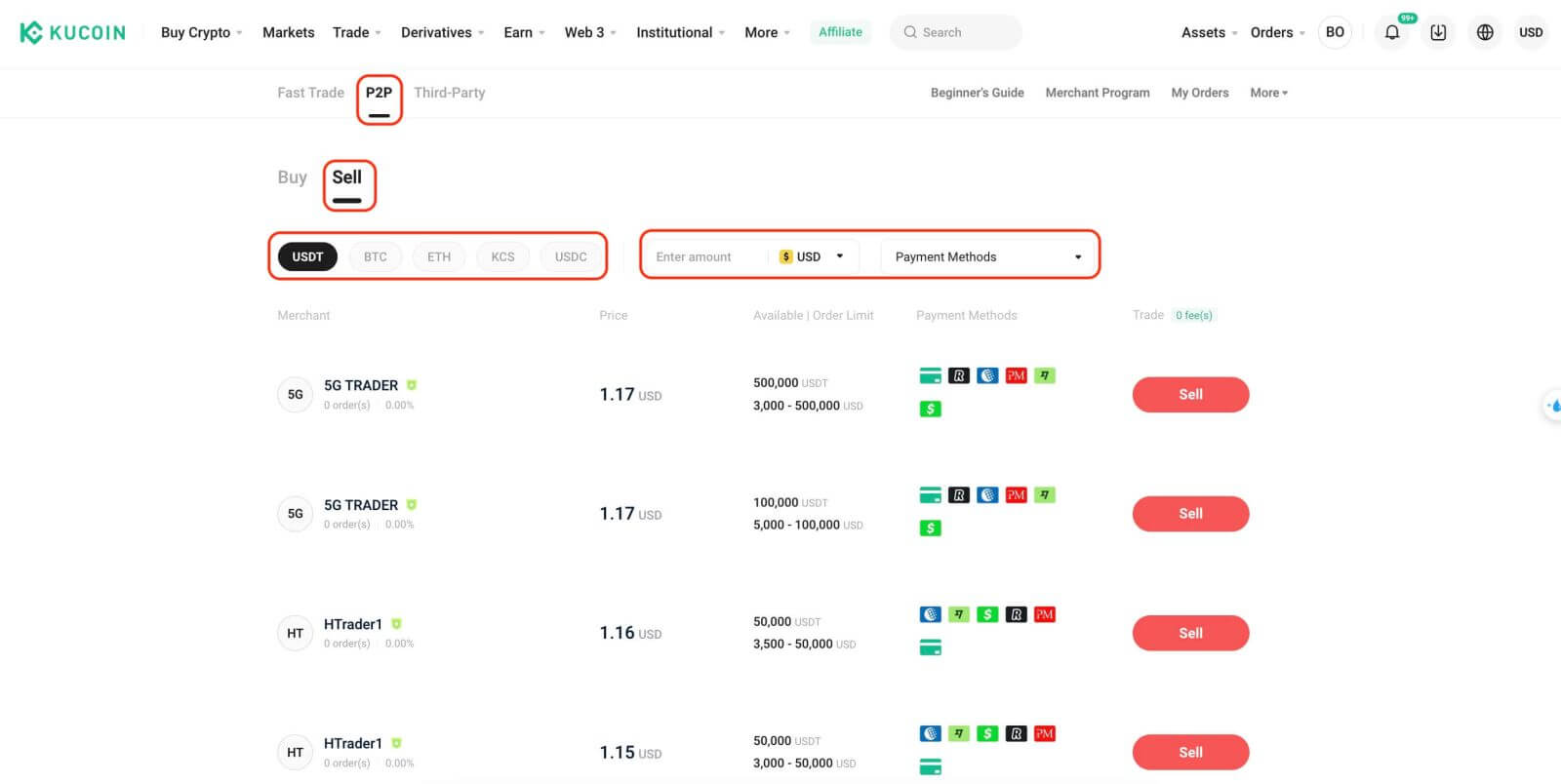

Step 2: Select the crypto you want to sell. You can filter all P2P advertisements using the filters. Click [Sell] next to the preferred ad.

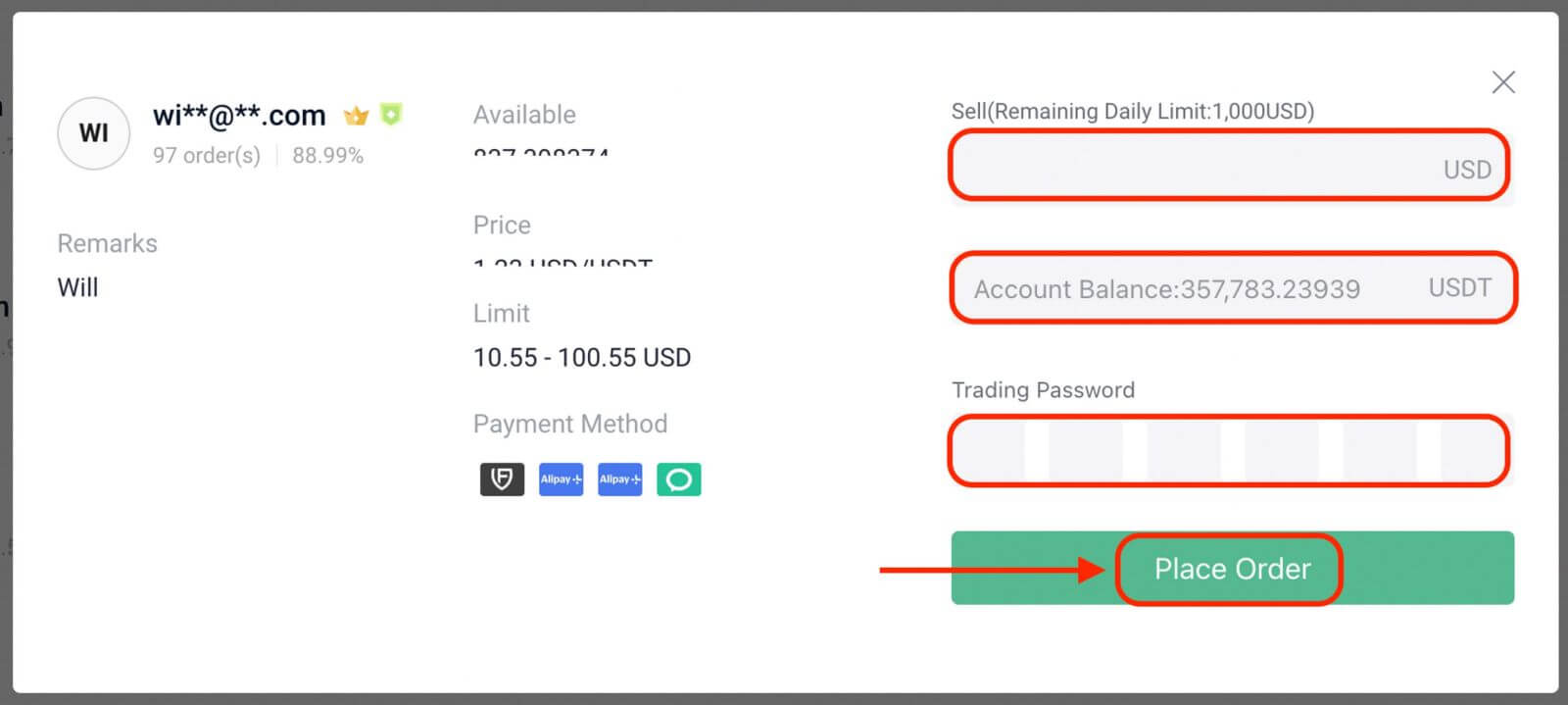

Confirm the order details. Enter the amount of crypto to sell, and the system will automatically calculate the amount of fiat you can get. Click [Place Order].

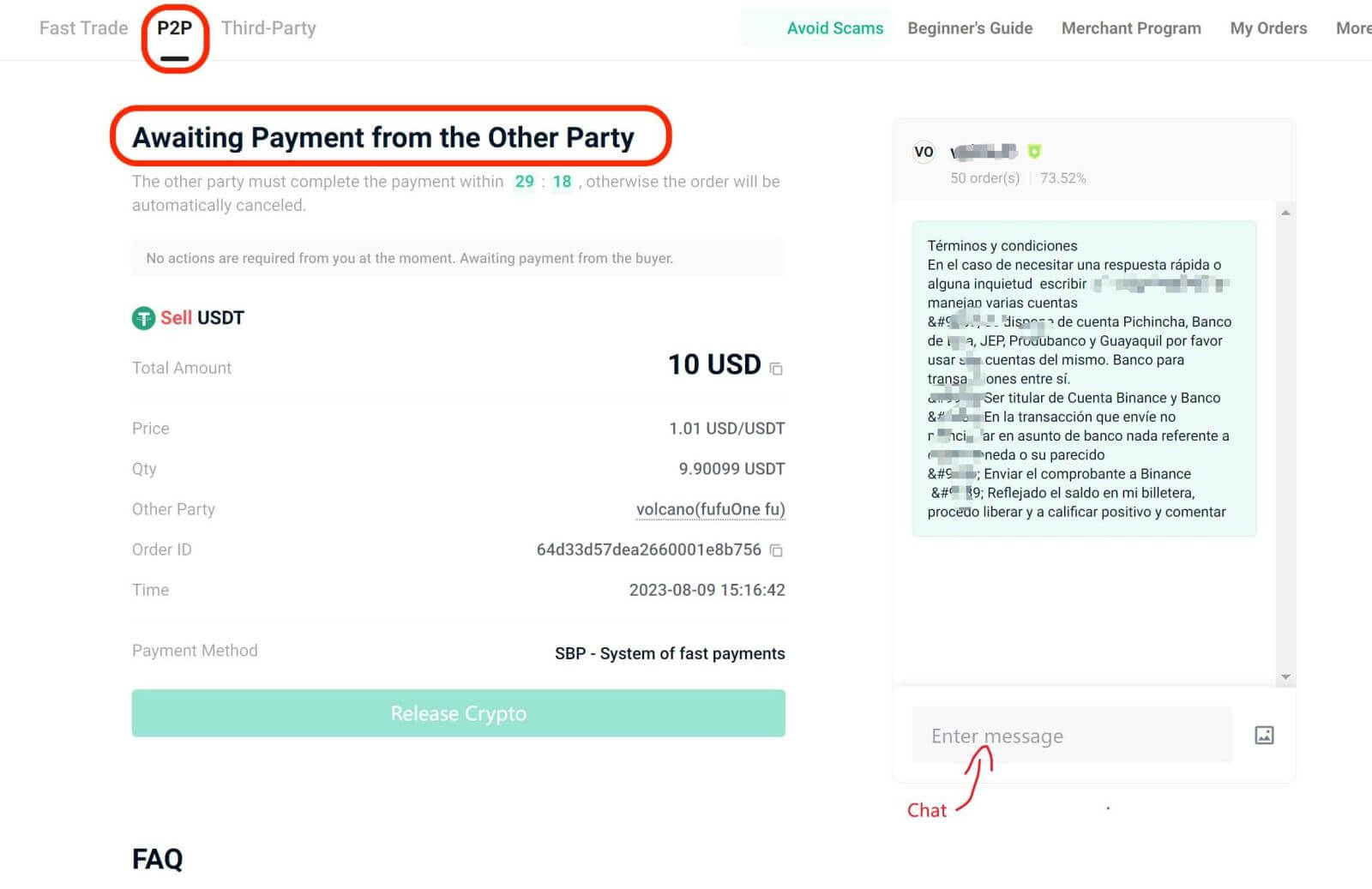

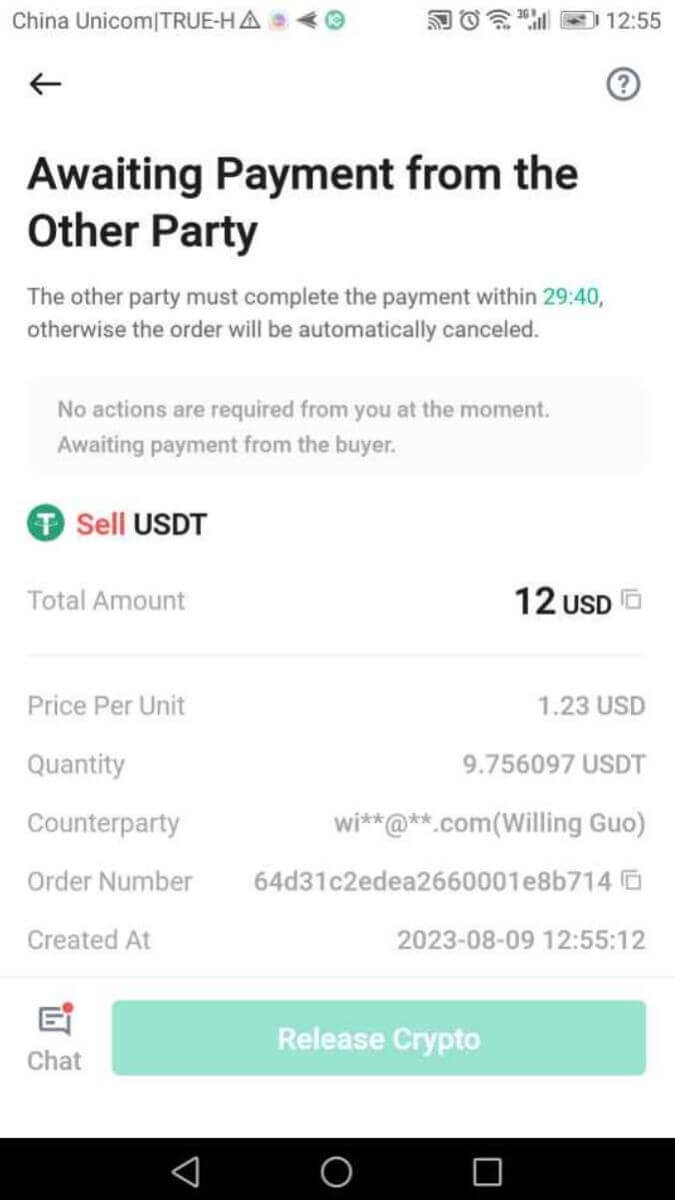

Step 3: The order status will be shown as [Awaiting Payment from the Other Party]. The buyer should transfer the funds to you via your preferred payment method within the time limit. You may use the [Chat] function on the right to contact the buyer.

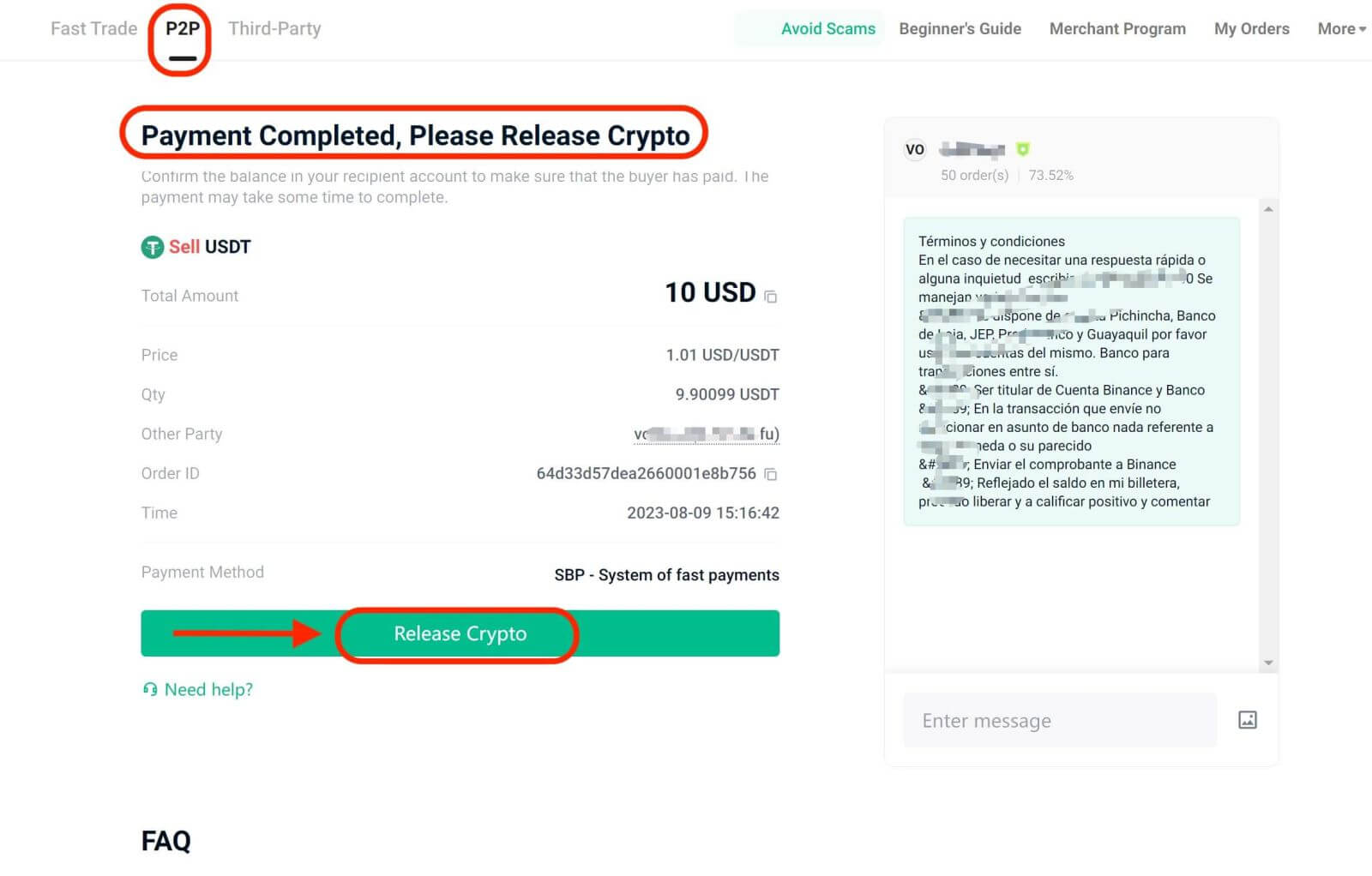

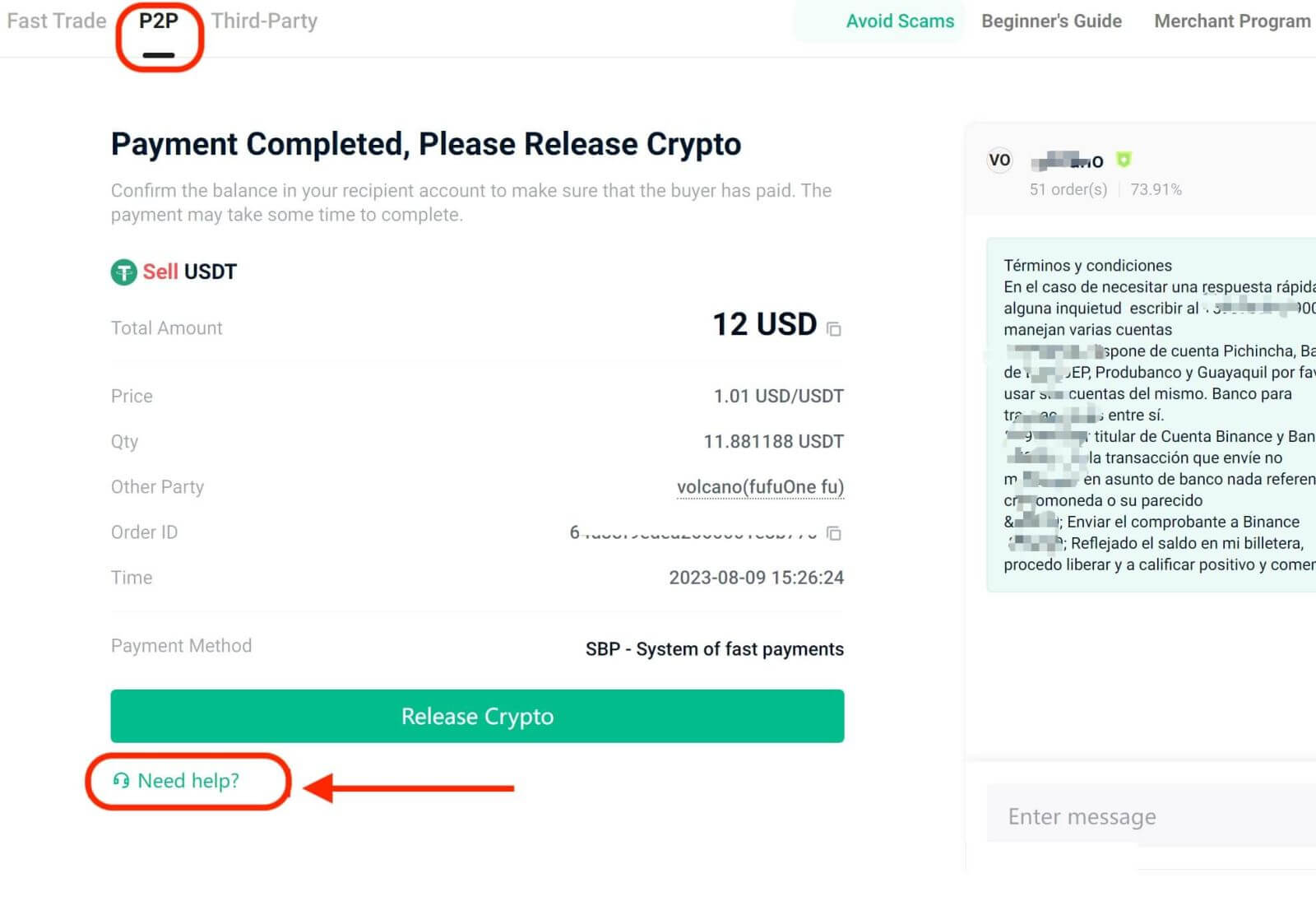

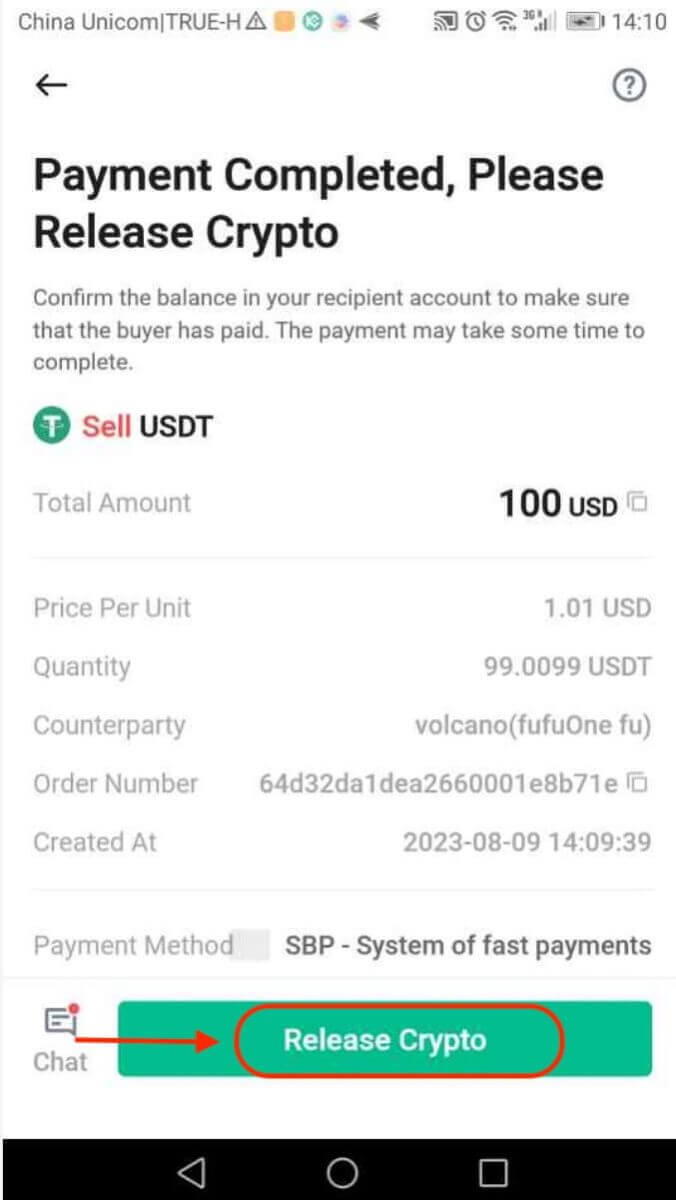

Step 4: After the buyer makes the payment, the order status will change to [Payment Completed, Please Release Crypto].

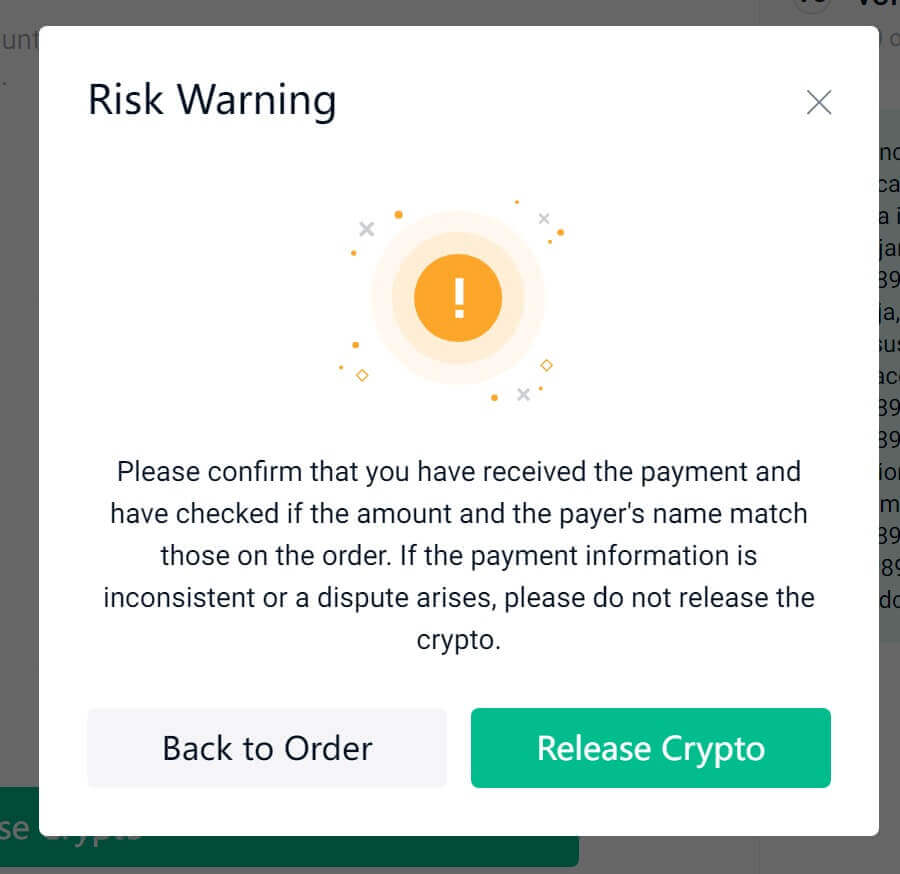

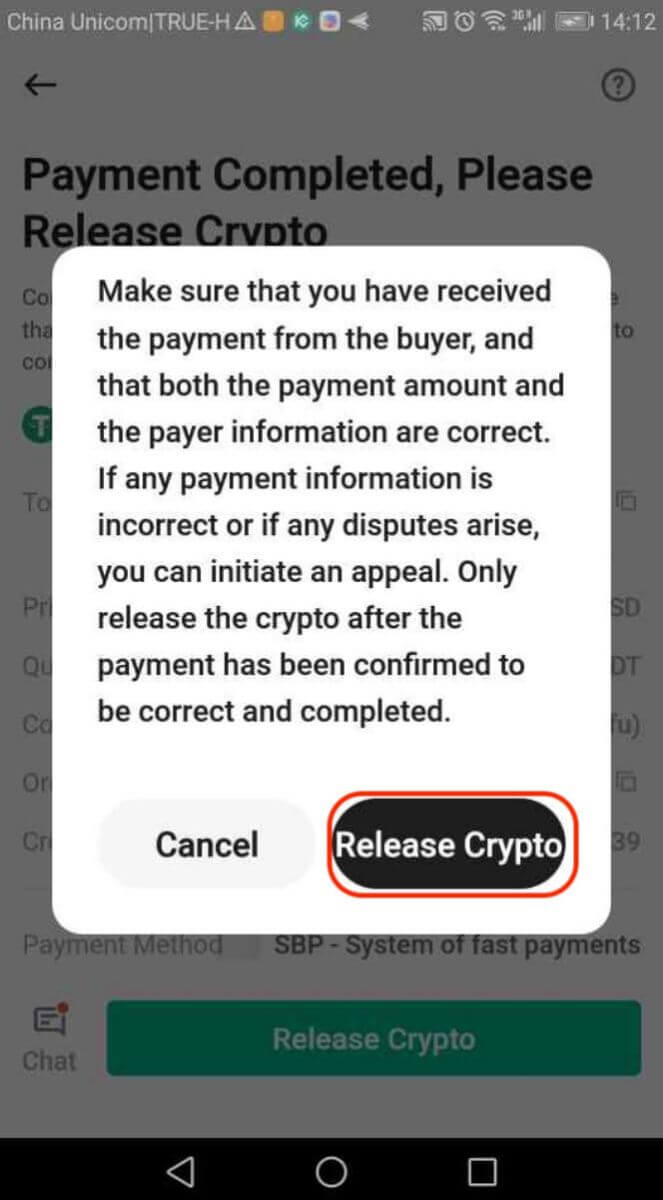

Always confirm that you have received the buyer’s payment in your bank account or wallet before clicking [Release Crypto]. DO NOT release crypto to the buyer if you haven’t received their payment.

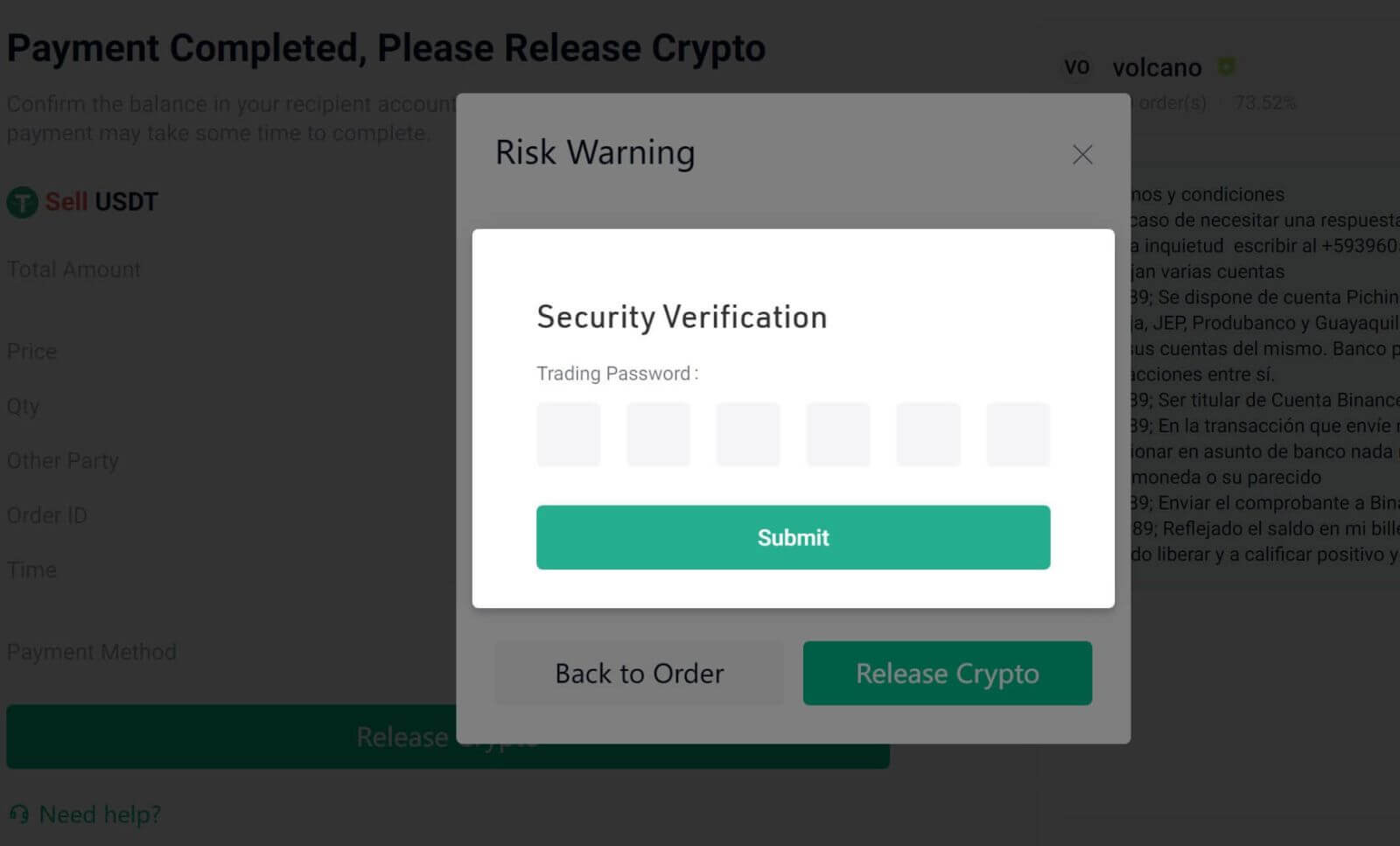

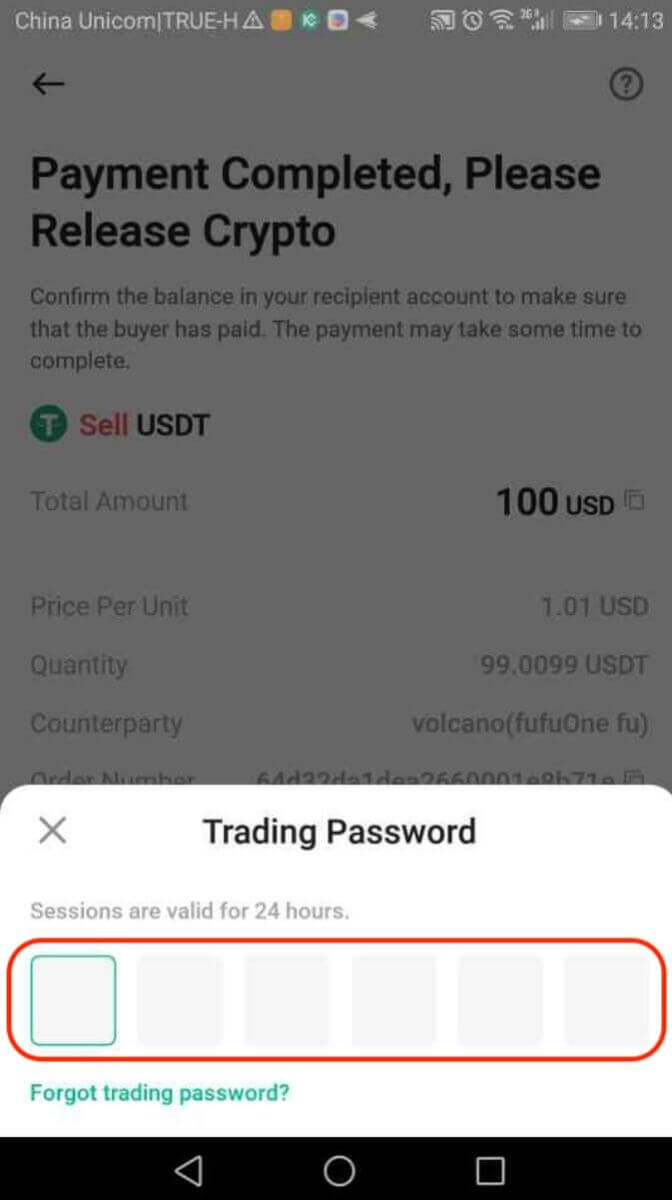

Step 5: You will be prompted to confirm the release of crypto with your Trading Password.

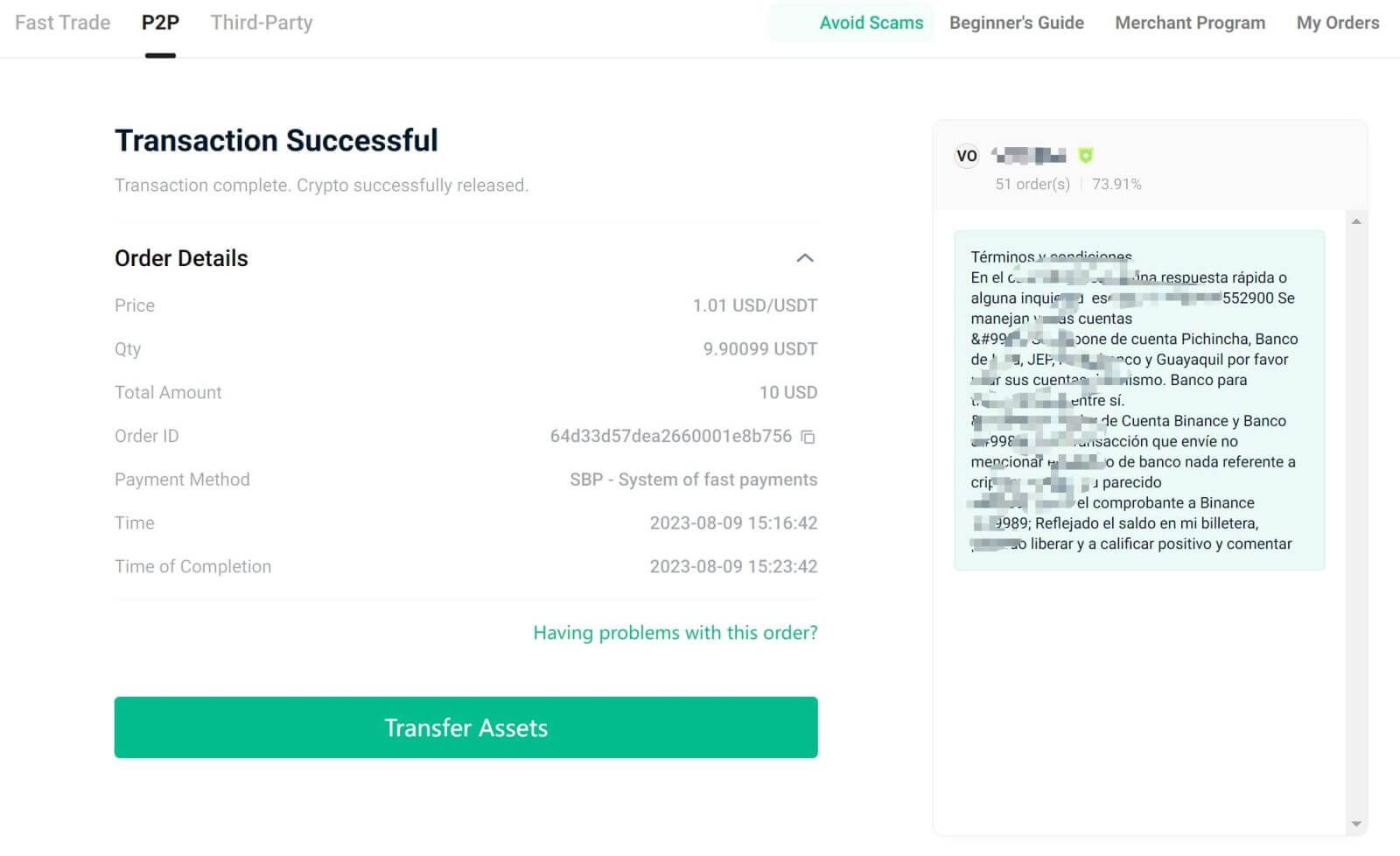

Step 6: The order is now complete. You can click [Transfer Assets] to check the remaining balance of your Funding Account.

Notes:

If you encounter any issues during the transaction process, you can contact the buyer directly using the [Chat] window on the right. You may also click [Need Help?] to contact our Customer Support agents for assistance.

Always confirm that you have received the buyer’s payment in your bank account or wallet before releasing crypto. We recommend logging in to your bank/wallet account to check whether the payment has already been credited. Do not rely solely on SMS or email notifications.

Note:

The crypto assets you sell will be frozen by the platform during the transaction process. Click [Release Crypto] only after confirming you got the buyer’s payment. Also, you can’t have more than two orders going at once. Finish one order before starting another.

Sell Crypto via P2P trading on KuCoin (App)

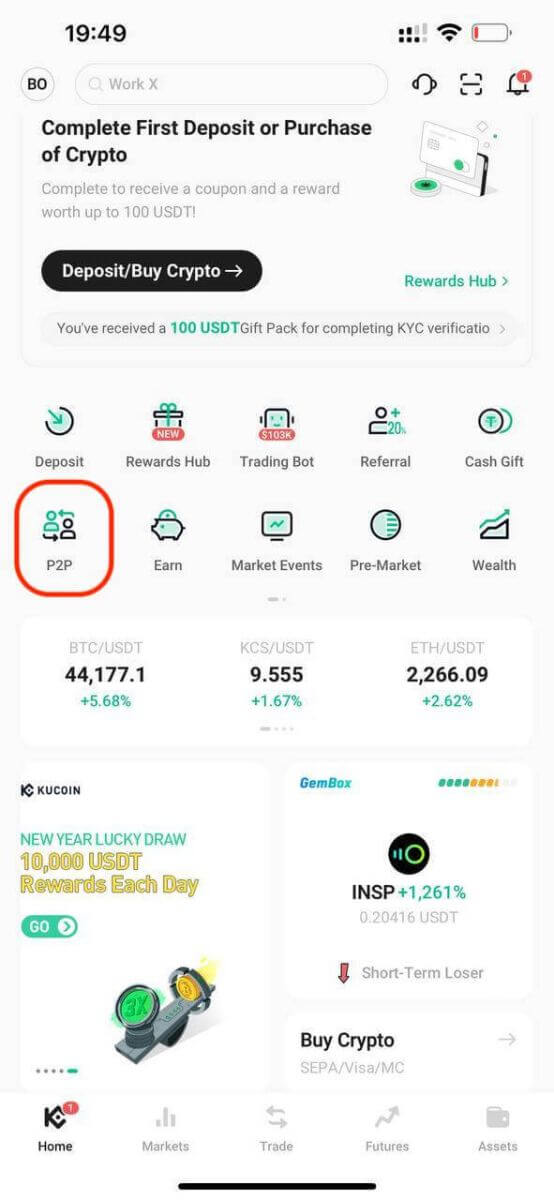

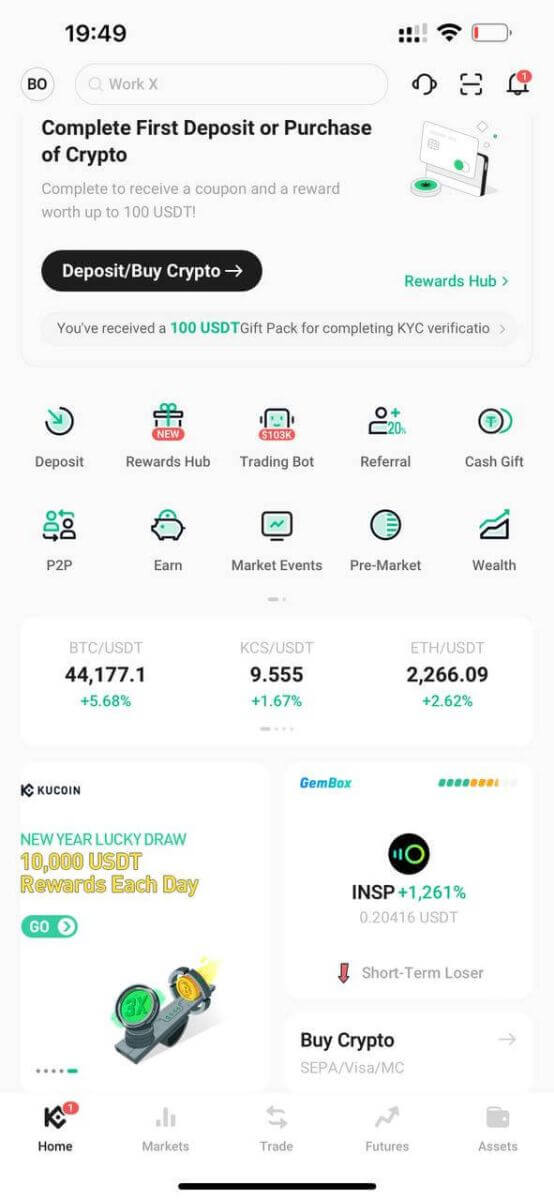

Step 1: Log in to your KuCoin App and Tap [P2P] from the App homepage.

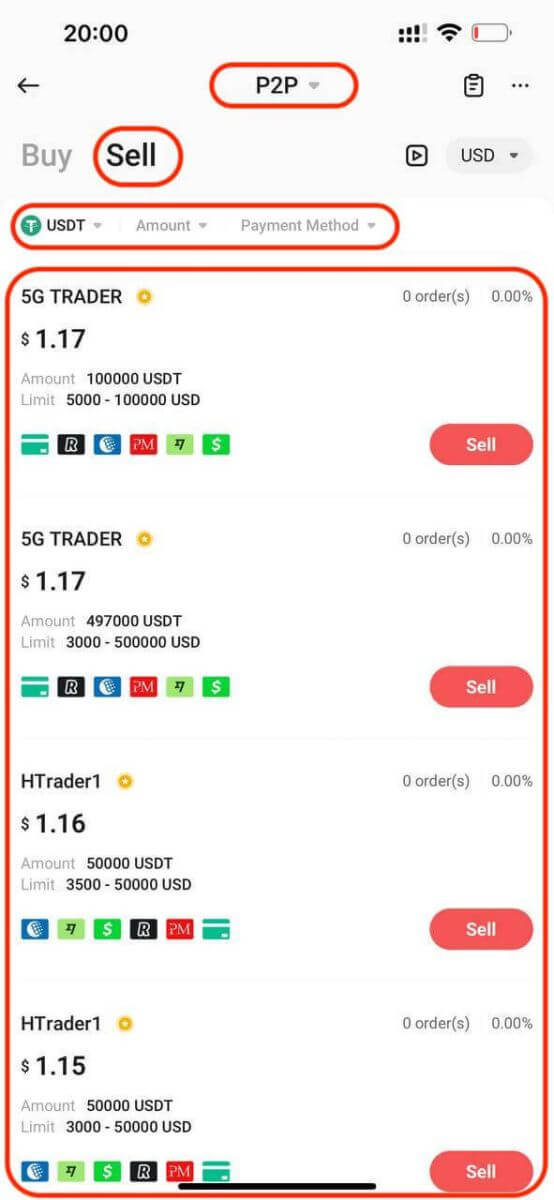

Step 2: Tap [Sell] and select the crypto you want to sell. You will see the available offers on the market. Tap [Sell] next to the preferred offer.

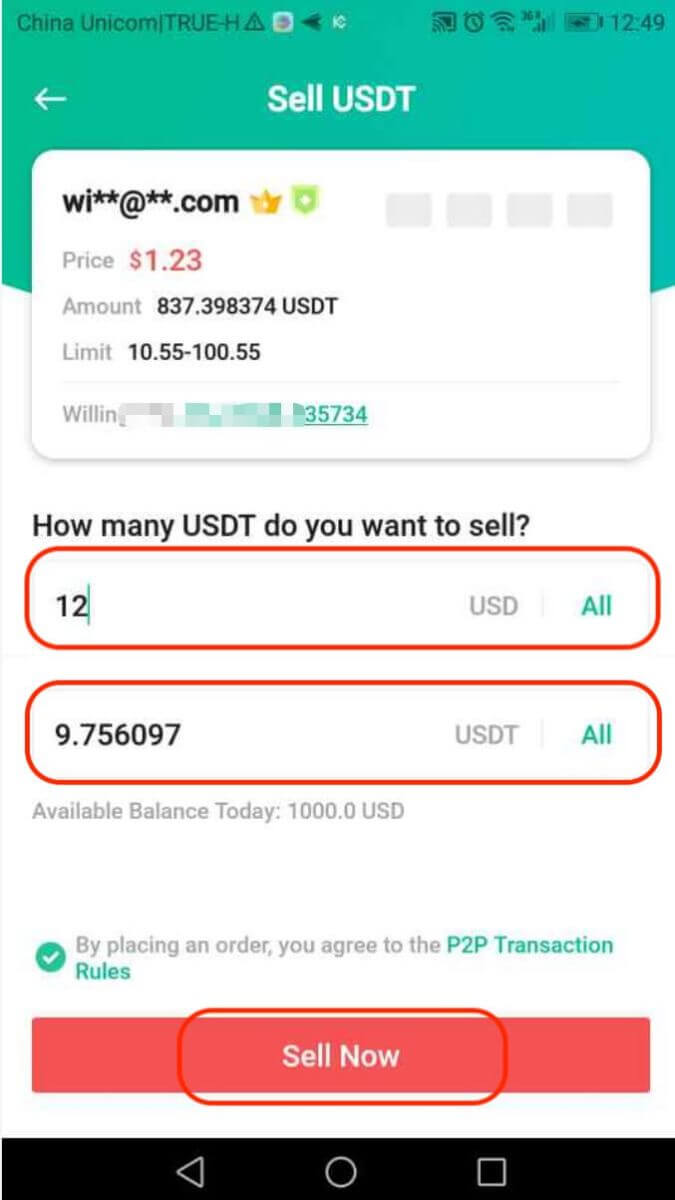

You will see the seller’s payment information and terms (if any). Enter the crypto amount you want to sell, or enter the fiat amount you want to receive, Tap [Sell Now] to confirm the order.

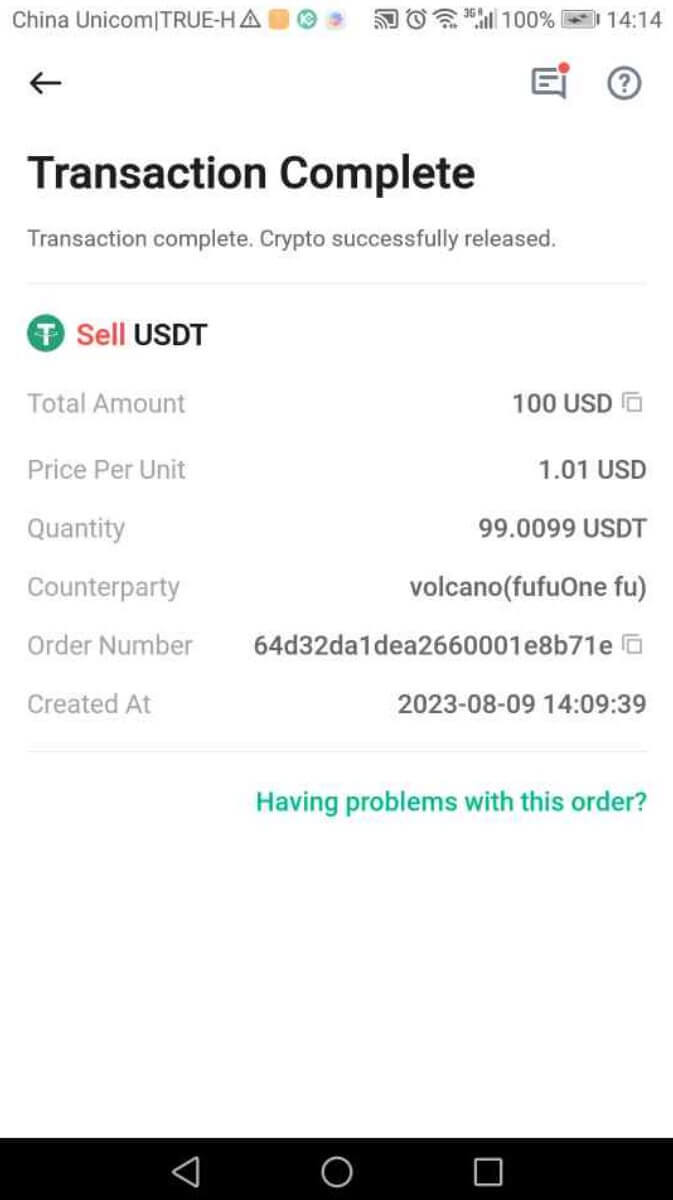

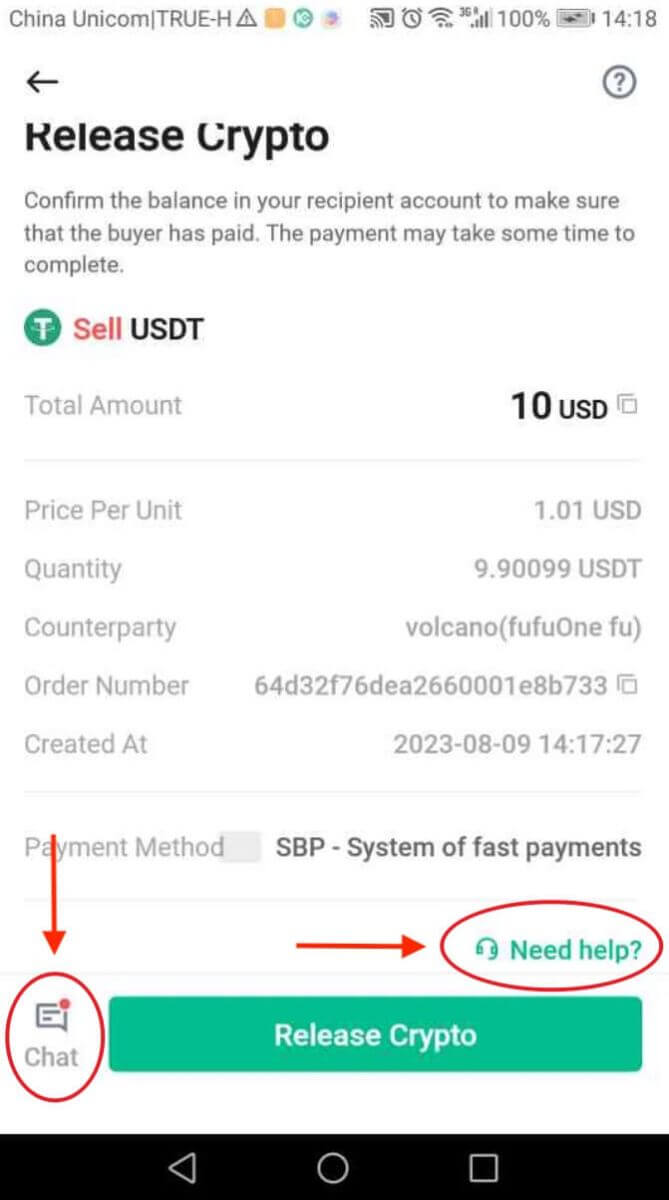

Step 3: Your sell order will be generated. Please wait for the buyer to make a payment to your selected payment method. You may tap [Chat] to contact the buyer directly.

Step 4: You will be notified once the buyer completes the payment.

Always confirm that you have received the buyer’s payment in your bank account or wallet before tapping [Release Crypto]. DO NOT release crypto to the buyer if you haven’t received their payment.

After confirming you have received the payment, tap [Payment received] and [Confirm] to release the crypto to the buyer’s account.

Step 5: You will be prompted to confirm the release of crypto with your Trading Password.

Step 6: You have successfully sold your assets.

Note:

If you encounter any issues during the transaction process, you can contact the buyer directly by tapping [Chat]. You may also tap [Need Help?] to contact our Customer Support agents for assistance.

Please note that you cannot place more than two ongoing orders at the same time. You must complete the existing order before placing a new order.

How to Withdraw Fiat Balance on KuCoin

Withdraw Fiat Balance on KuCoin (Website)

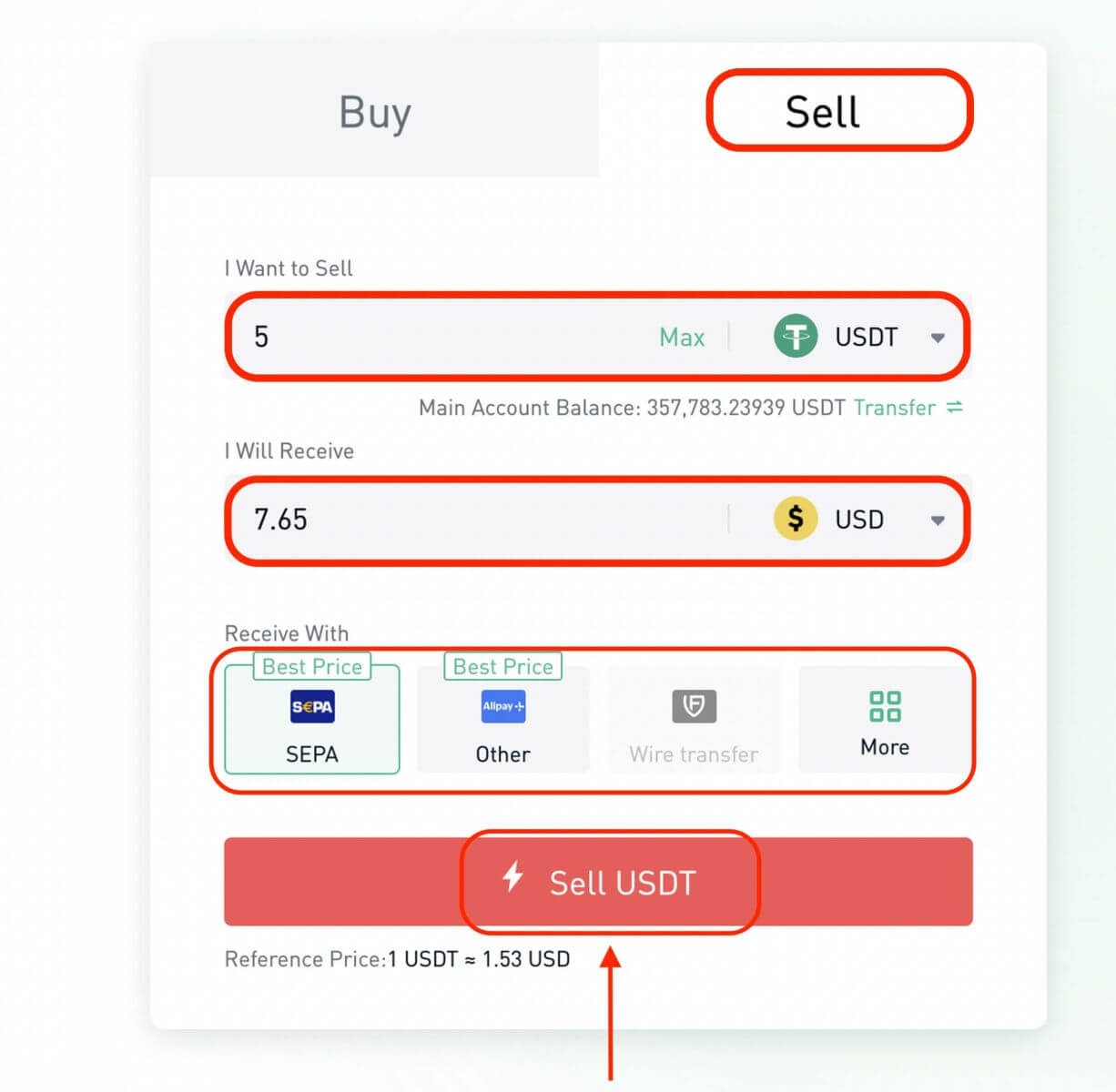

Step 1: Log into your KuCoin account and go to [Buy Crypto] - [Fast Trade].

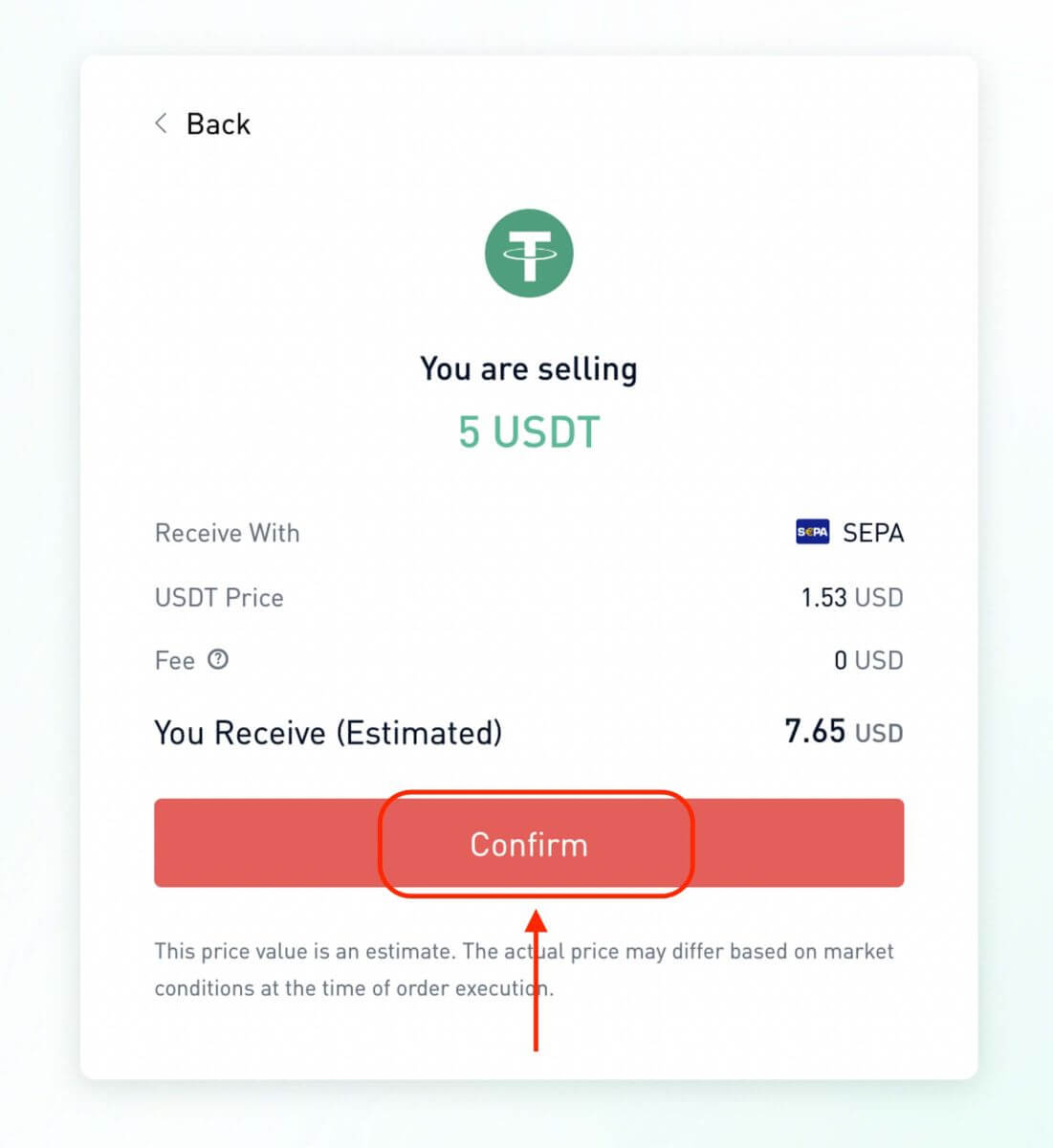

Step 2: Select the crypto you want to sell and the fiat currency you want to receive. Enter the amount of crypto to sell, and the system will automatically calculate the amount of fiat you can receive. Click [Sell USDT].

Step 3: Select the preferred payment method

Step 4: Confirm order information and click [Confirm].

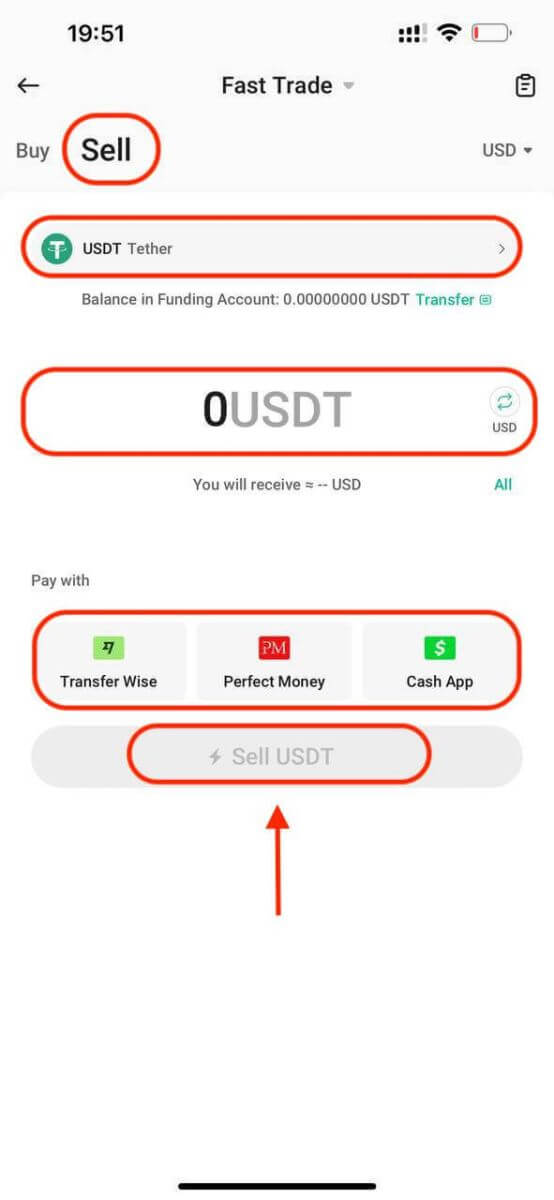

Withdraw Fiat Balance on KuCoin (App)

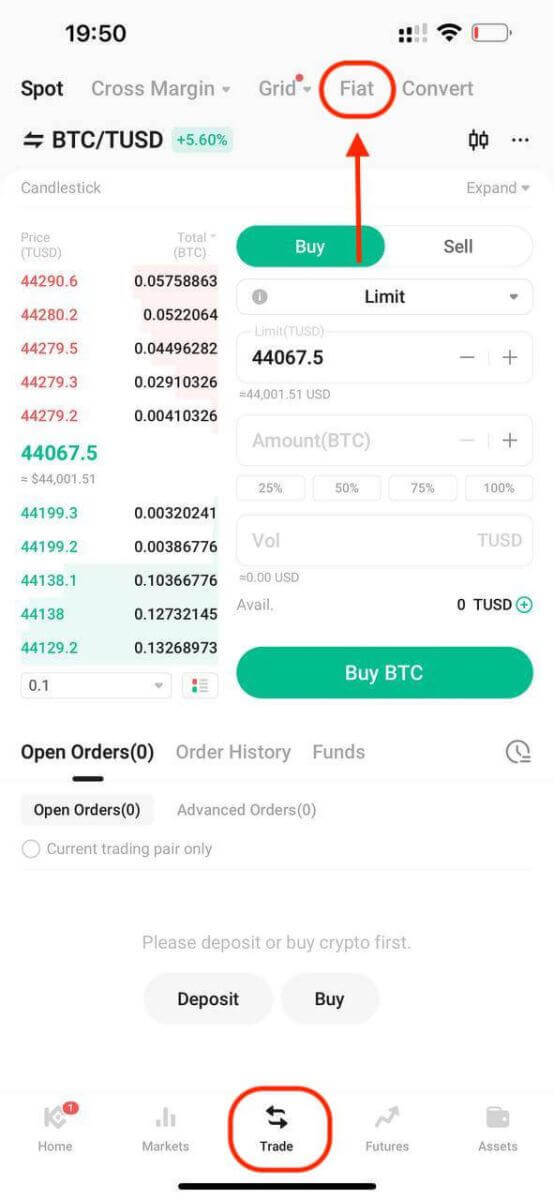

Step 1: Log into your KuCoin App and tap [Trade] - [Fiat].

Alternatively, tap [Buy Crypto] from the App homepage.

Step 2: Tap [Sell] and select the crypto you want to sell. Enter the amount of crypto to sell, and the system will automatically calculate the amount of fiat you can receive, and select the preferred payment method. Then, click [Sell USDT].

Note:

1. Use only bank accounts under your name for receiving funds. Make sure that the name on the bank account you use for the withdrawal (transfer) is the same as the name on your KuCoin account.

2. If a transfer is returned, we will deduct any incurred fees from the funds we receive from your recipient bank or intermediary bank, and then return the remaining funds into your KuCoin account.

How long will it take to receive a withdrawal (transfer) to a bank account

How long it takes to get money in your bank account from a withdrawal relies on the currency and network used. Look for estimated times in the payment method’s description. Typically, withdrawals arrive within specific time frames, but these are estimates and might not match the actual time it takes.

| Currency | Settlement Network | Time |

| EUR | SEPA | 1-2 Business Days |

| EUR | SEPA Instant | Instantly |

| GBP | FPS | Instantly |

| GBP | CHAPS | 1 Day |

| USD | SWIFT | 3-5 Business Days |