How to Register and Trade Crypto at KuCoin

How to Register in KuCoin

How to Register a KuCoin Account【Web】

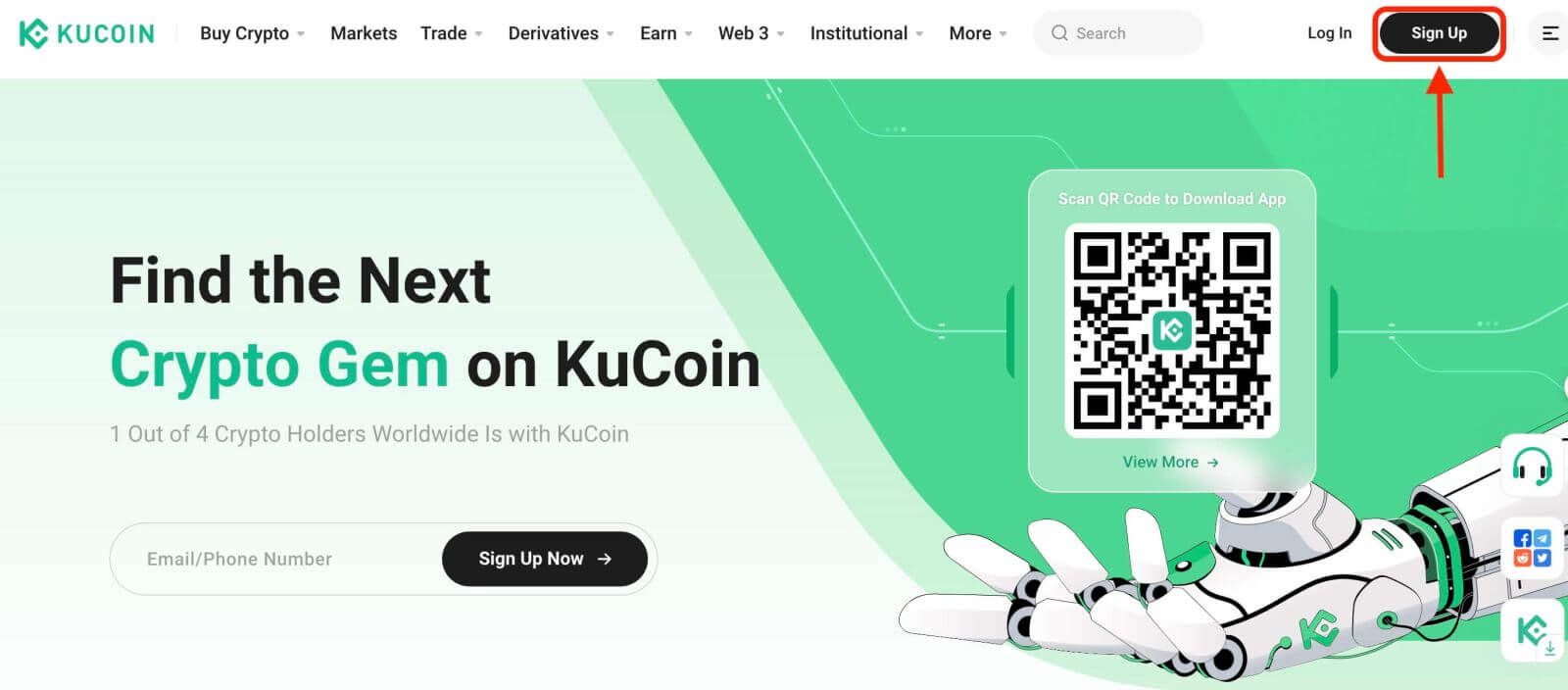

Step 1: Visit the KuCoin website

The first step is to visit the KuCoin website. You will see a black button that says "Sign Up". Click on it and you will be redirected to the registration form.

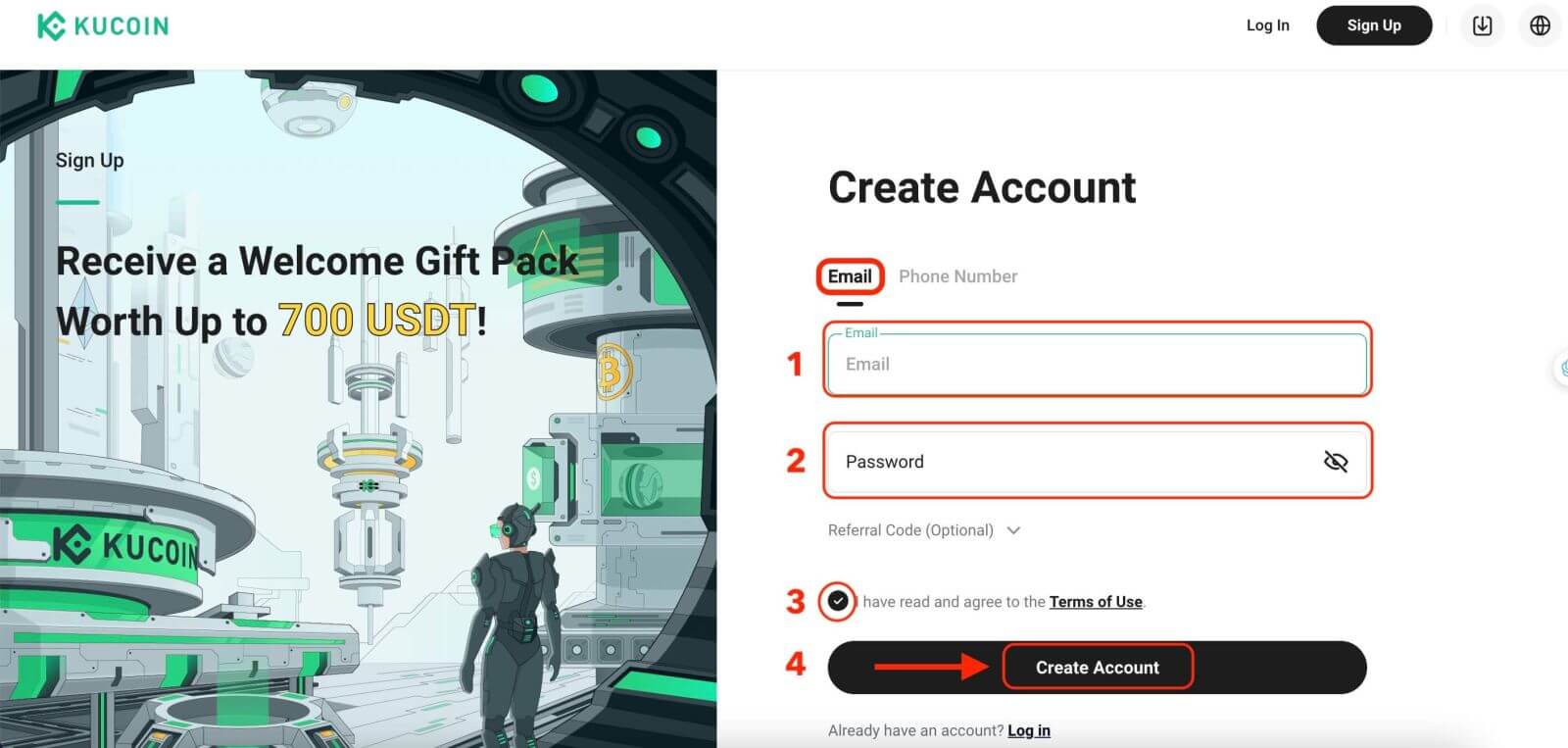

Step 2: Fill in the registration form

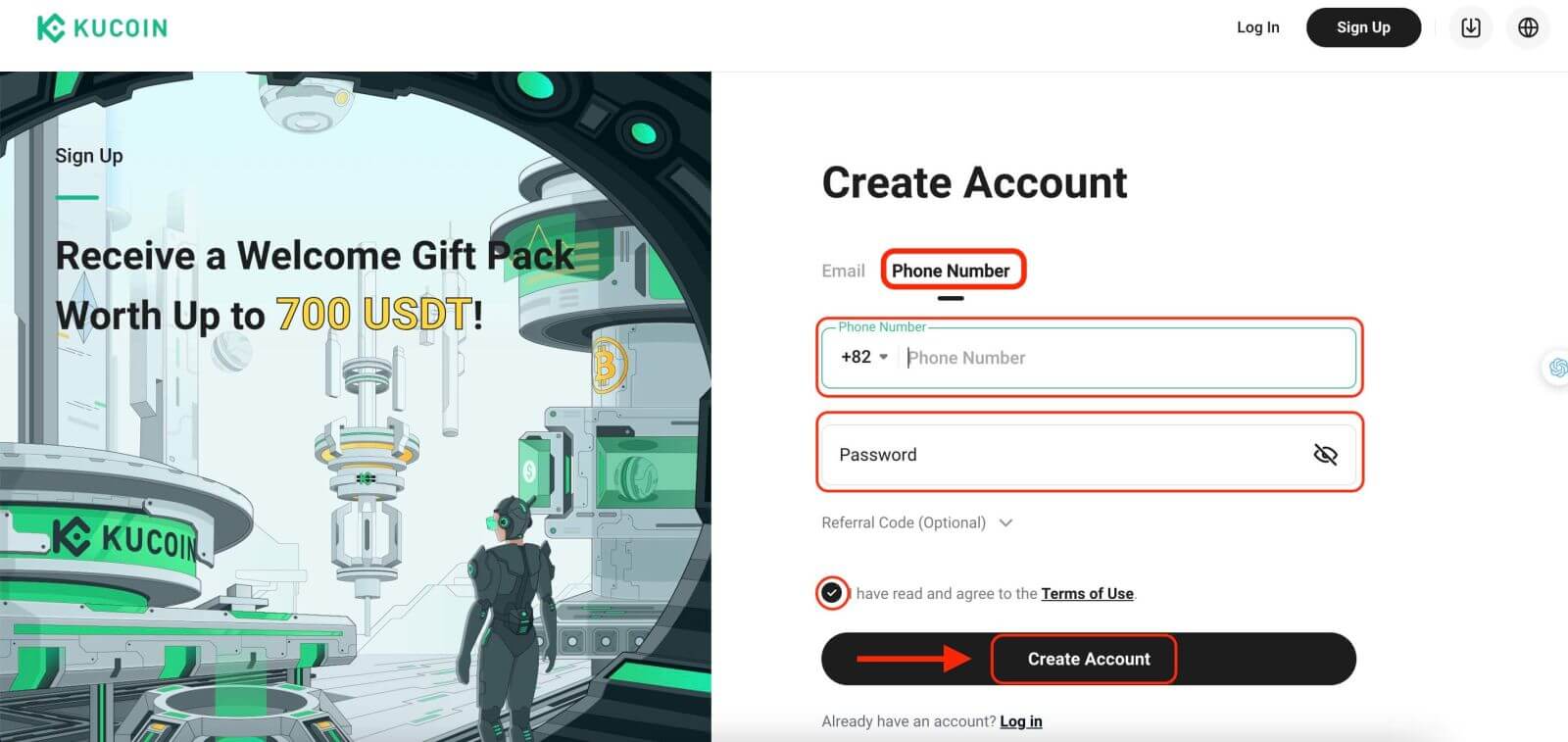

There are two ways to register a KuCoin account: you might choose [Email] or [Phone Number] as your preference. Here are the steps for each method:

With your Email:

- Enter a valid email address.

- Create a strong password. Make sure to use a password that combines letters, numbers, and special characters to enhance security.

- Read and agree to the User Agreement and Privacy Policy of KuCoin.

- After filling in the form, Click the "Create Account" button.

With your Mobile Phone Number:

- Enter your phone number.

- Create a strong password. Make sure to use a password that combines letters, numbers, and special characters to enhance security.

- Read and agree to the User Agreement and Privacy Policy of KuCoin.

- After filling in the form, Click the "Create Account" button.

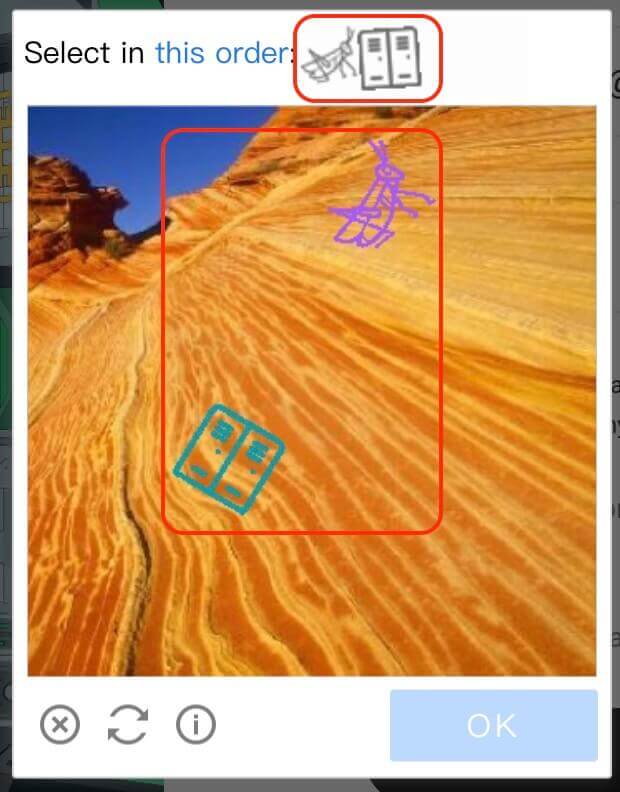

Step 3: Complete the CAPTCHA

Step 3: Complete the CAPTCHA

Complete the CAPTCHA verification to prove you’re not a bot. This step is essential for security purposes.

Step 4: Access your trading account

Congratulations! You have successfully registered a KuCoin account. You can now explore the platform and use the various features and tools of KuCoin.

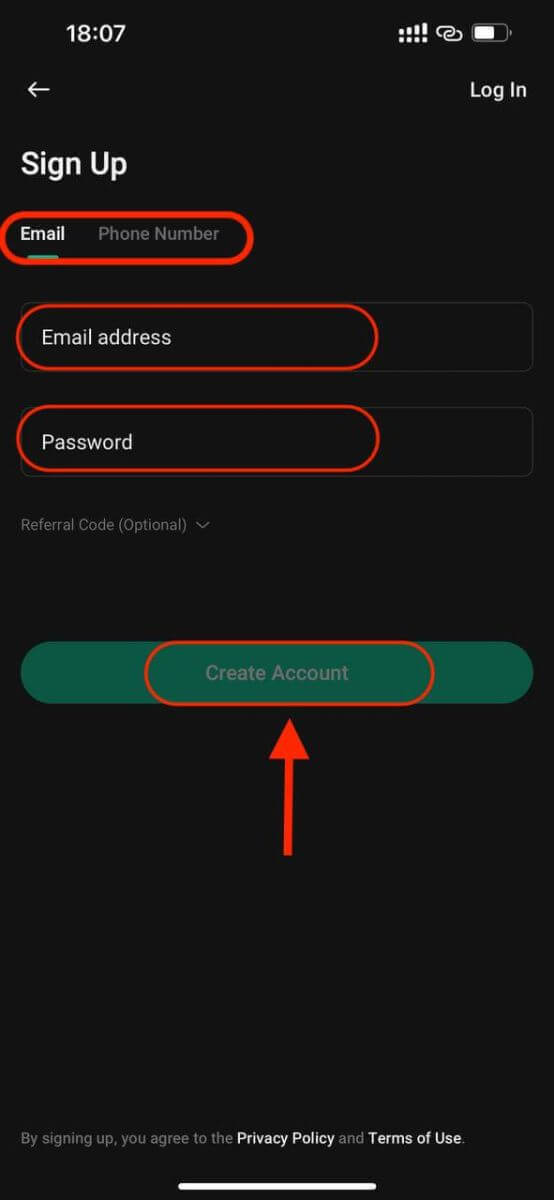

How to Register a KuCoin Account【APP】

Step 1: When you open the KuCoin app for the first time, you will need to set up your account. Tap on the "Sign Up" button.

Step 2: Enter your phone number or email address based on your selection. Then, click the "Create Account" button.

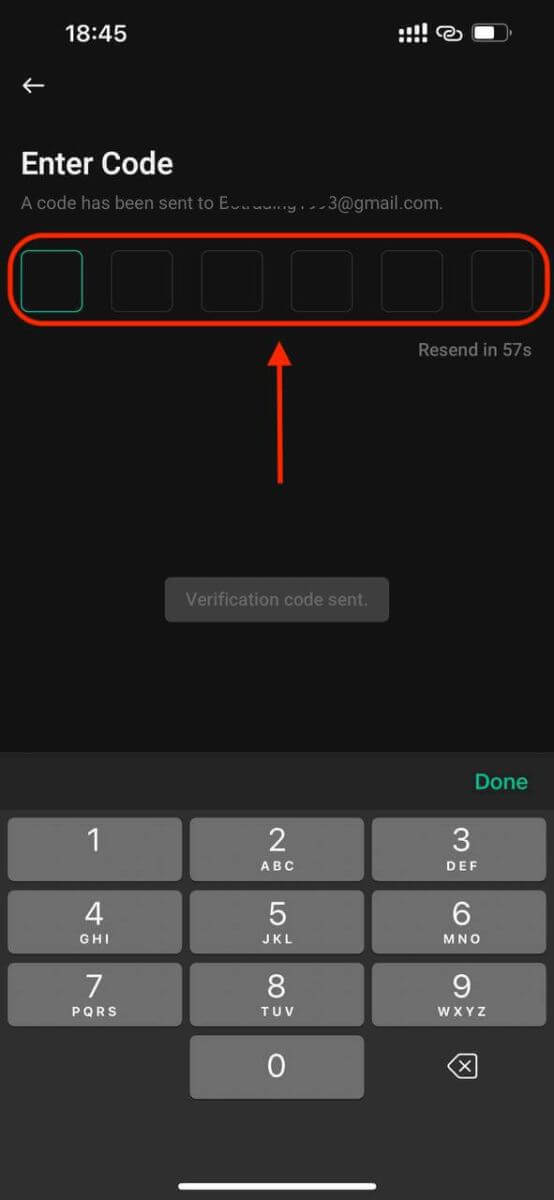

Step 3: KuCoin will send a verification code to the address email or phone number you provided.

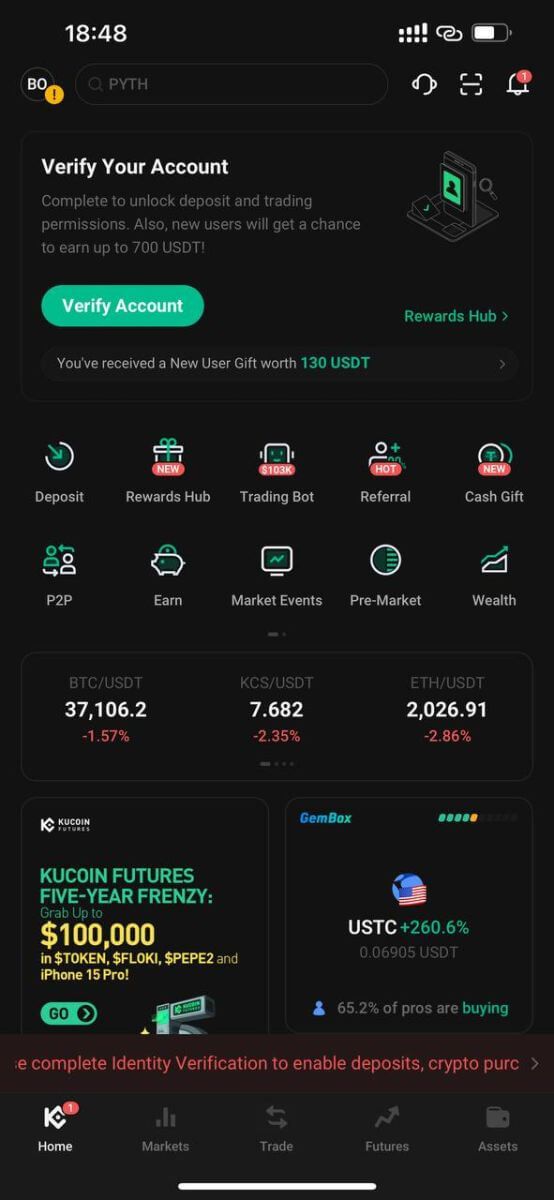

Step 4: Congratulations that you have completed the registration and can use KuCoin now.

Features and Benefits of KuCoin

Features of KuCoin:

1. User-Friendly Interface:

The platform is designed with a clean and intuitive interface, making it accessible for both novice and experienced traders.

2. Wide Range of Cryptocurrencies:

KuCoin supports an extensive selection of cryptocurrencies, offering users access to a diverse portfolio of digital assets beyond mainstream options.

3. Advanced Trading Tools:

KuCoin provides advanced trading tools such as charting indicators, real-time market data, and various order types, catering to the needs of professional traders.

4. Security Measures:

With a strong emphasis on security, KuCoin implements industry-standard security protocols, cold storage for funds, and two-factor authentication (2FA) options to safeguard user accounts.

5. KuCoin Shares (KCS):

KuCoin has its native token, KCS, which offers benefits like reduced trading fees, bonuses, and rewards to users holding and trading the token.

6. Staking and Lending:

The platform supports staking and lending services, allowing users to earn passive income by participating in these programs.

7. Fiat Gateway:

KuCoin offers fiat-to-crypto and crypto-to-fiat trading pairs, facilitating easy access for users to buy or sell cryptocurrencies using fiat currencies.

Benefits of Using KuCoin:

1. Global Accessibility:

KuCoin caters to a global user base, offering its services to users from various countries around the world.

2. Liquidity and Volume:

The platform boasts high liquidity and trading volumes across various cryptocurrency pairs, ensuring better price discovery and trade execution.

3. Community Engagement:

KuCoin actively engages with its community through initiatives like KuCoin Community Chain (KCC) and regular events, fostering a vibrant ecosystem.

4. Low Fees:

KuCoin generally charges competitive trading fees, with potential discounts available for users holding KCS tokens and frequent traders.

5. Responsive Customer Support:

The platform provides customer support via multiple channels, aiming to address user queries and issues promptly.

6. Constant Innovation:

KuCoin continually introduces new features, tokens, and services, staying at the forefront of innovation within the cryptocurrency space

How to Trade Crypto at KuCoin

How to Open a Trade on KuCoin【Web】

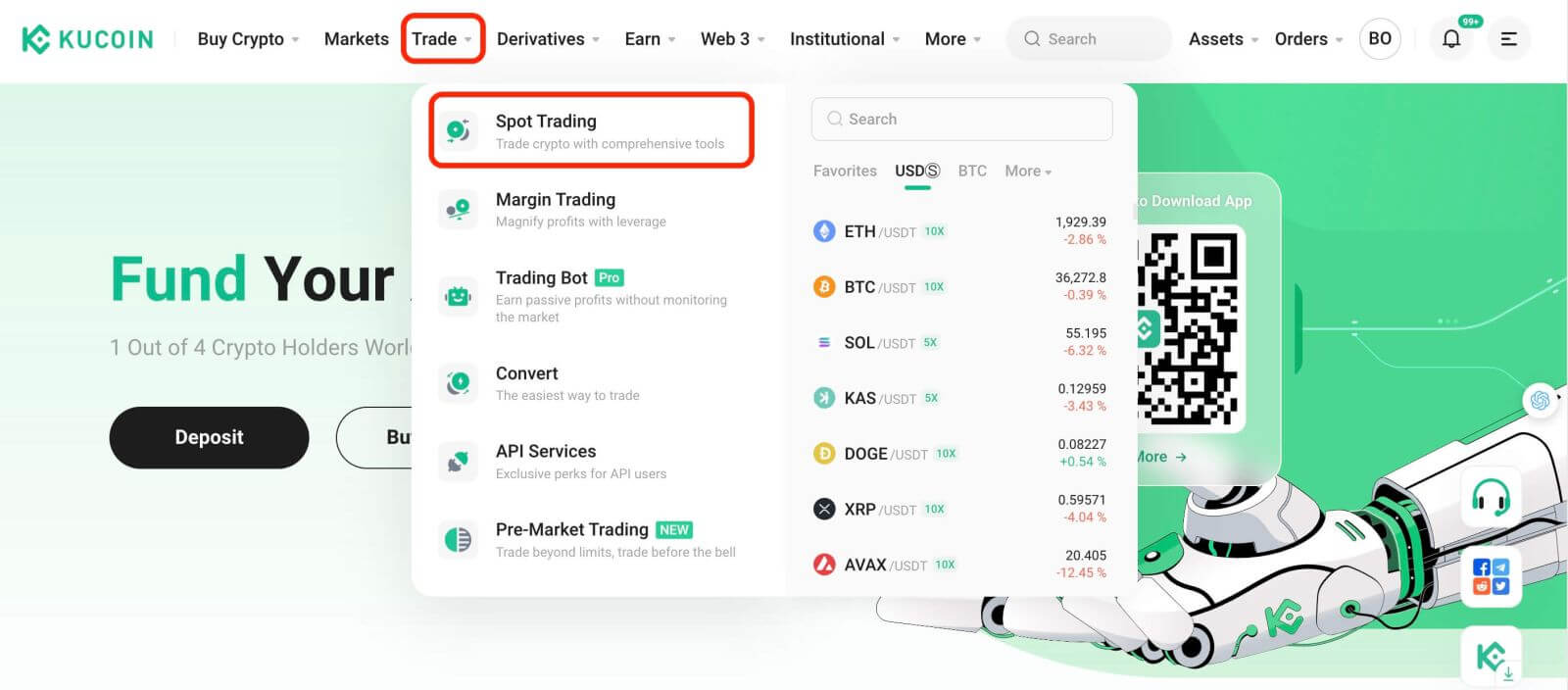

Step 1: Accessing TradingWeb Version: Click on "Trade" in the top navigation bar and choose "Spot Trading" to enter the trading interface.

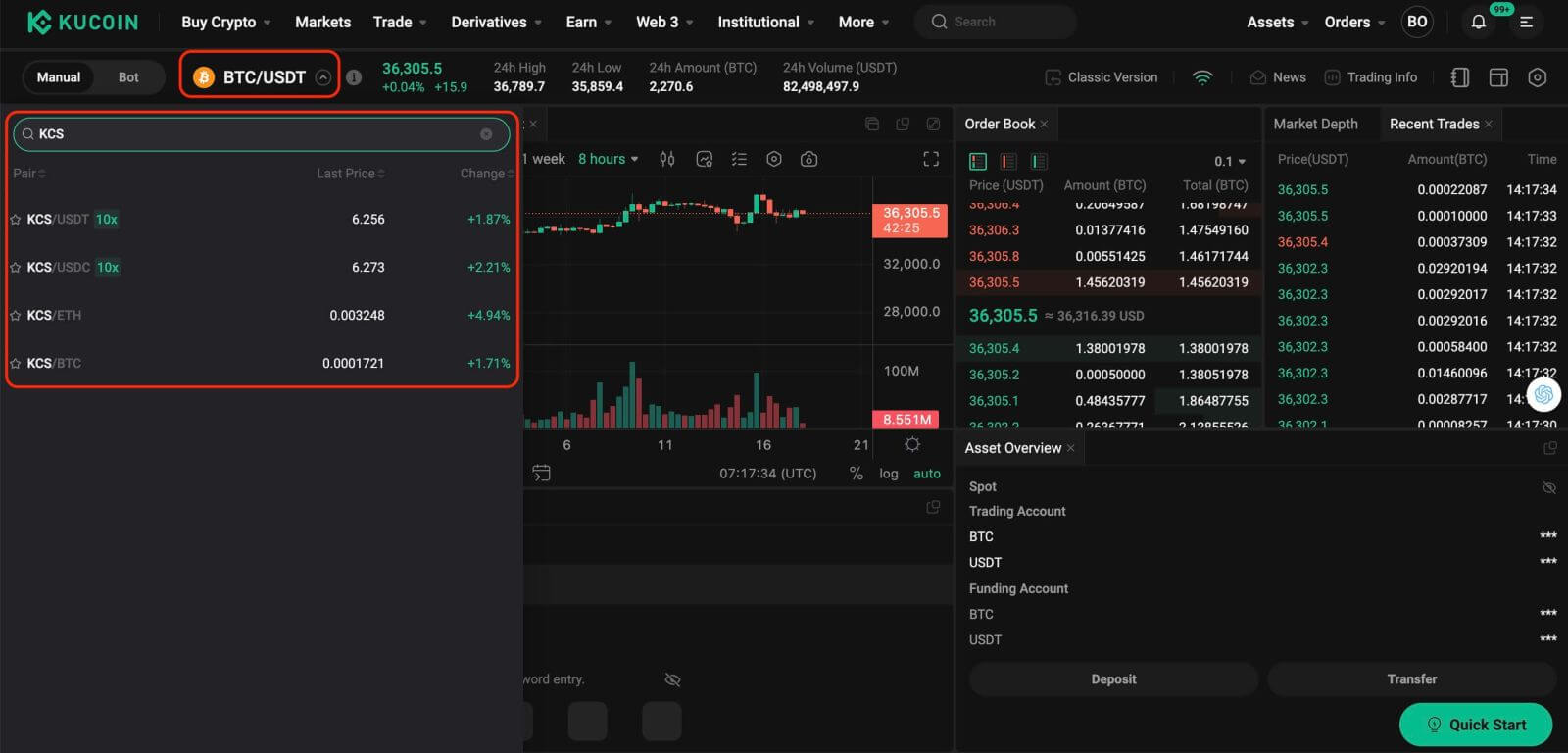

Step 2: Selecting Assets

On the trading page, assuming you wish to buy or sell KCS, you would enter "KCS" into the search bar. Then, you would select your desired trading pair to conduct your trade.

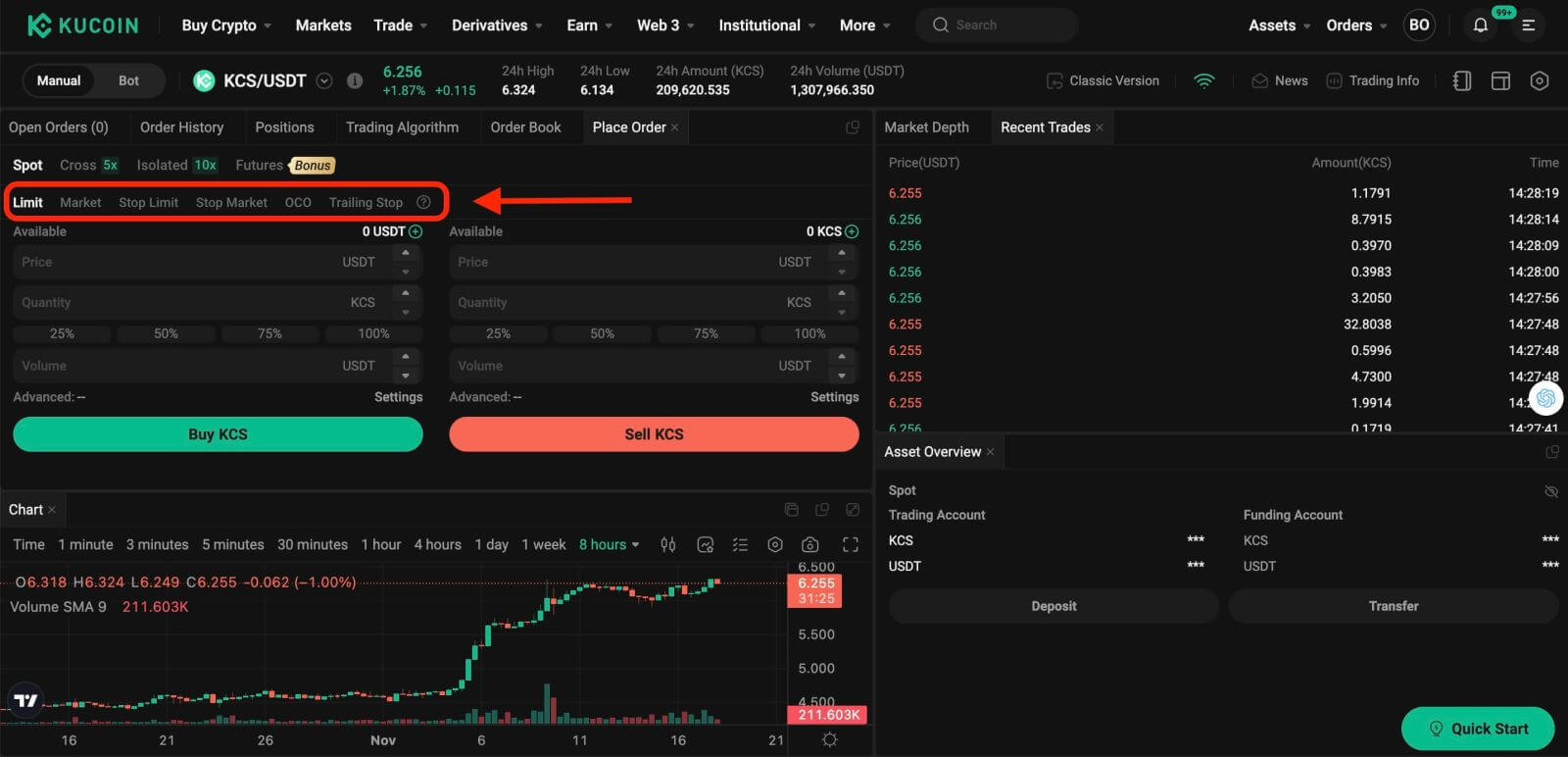

Step 3: Placing Orders

At the bottom of the trading interface is the panel for buying and selling. There are six order types you can choose from:

- Limit orders.

- Market orders.

- Stop-limit orders.

- Stop-market orders.

- One-cancels-the-other (OCO) orders.

- Trailing stop orders.

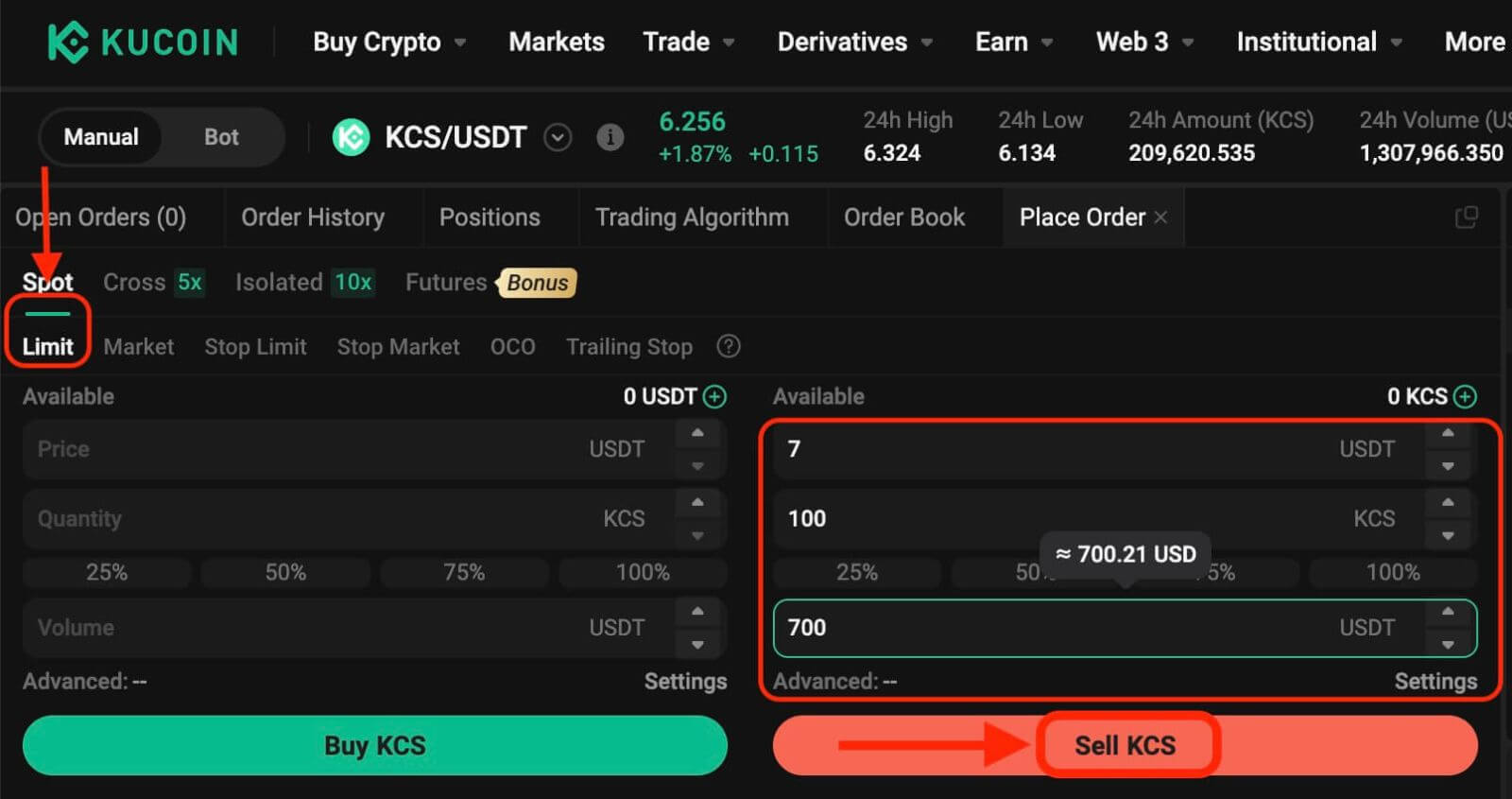

1. Limit Order

A limit order is an order to buy or sell an asset at a specific price or better.

For instance, if the current price of KCS in the KCS/USDT trading pair is 7 USDT, and you wish to sell 100 KCS at a KCS price of 7 USDT, you can place a limit order to do so.

To place such a limit order:

- Select Limit: Choose the "Limit" option.

- Set Price: Enter 7 USDT as the specified price.

- Set Quantity: Define the Quantity as 100 KCS.

- Confirm Order: Click on "Sell KCS" to confirm and finalize the order.

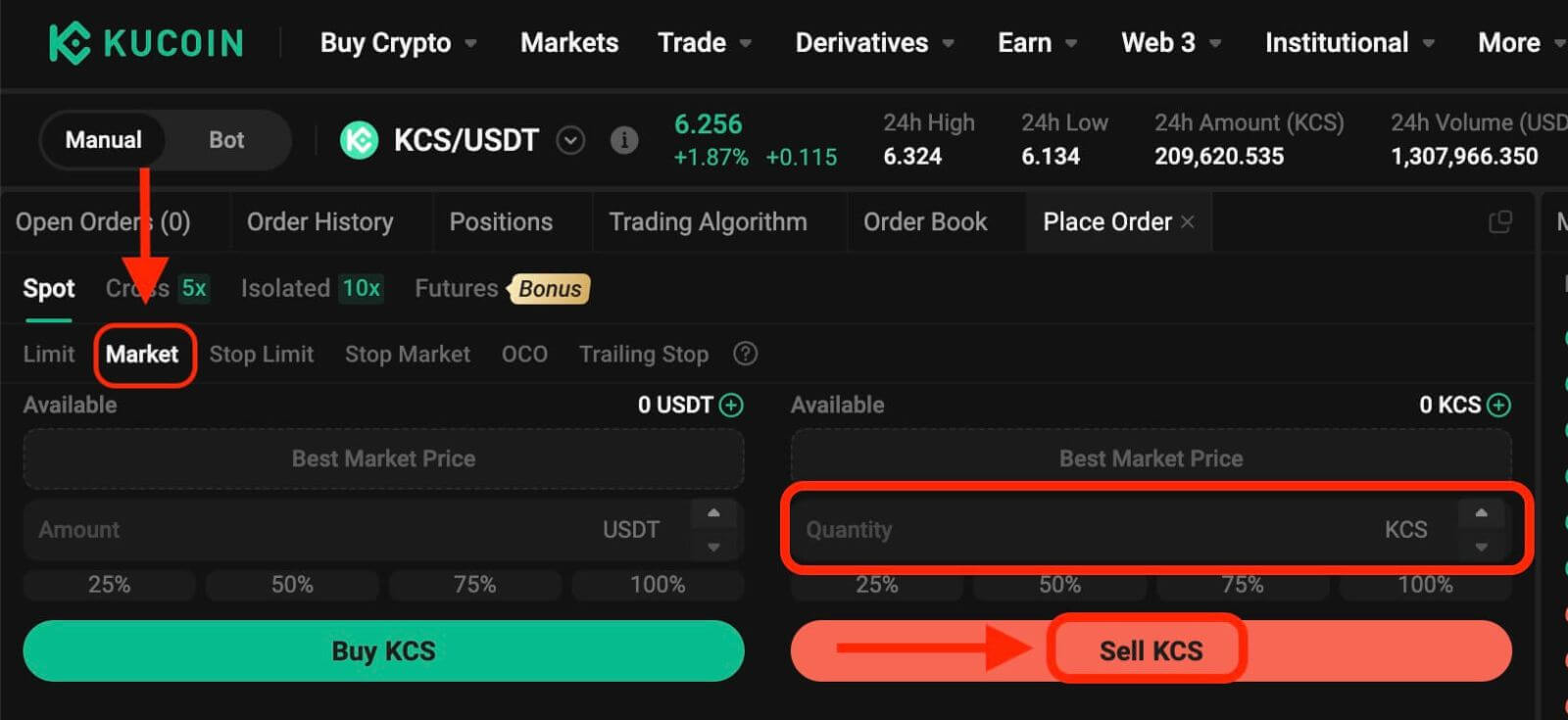

2. Market Order

Execute an order at the current best available market price.

Take the KCS/USDT trading pair for example. Assuming the current price of KCS is 6.2 USDT, and you wish to quickly sell 100 KCS. To do this, you can use a market order. When you issue a market order, the system matches your sell order with the existing buy orders on the market, which ensures a swift execution of your order. This makes market orders the best way to quickly buy or sell assets.

To place such a market order:

- Select Market: Choose the "Market" option.

- Set Quantity: Specify the Quantity as 100 KCS.

- Confirm Order: Click on "Sell KCS" to confirm and execute the order.

Please note: Market orders, once executed, cannot be canceled. You can track order and transaction specifics in your Order History and Trade History. These orders are matched with the prevailing maker order price in the market and can be impacted by market depth. It’s crucial to be mindful of market depth when initiating market orders.

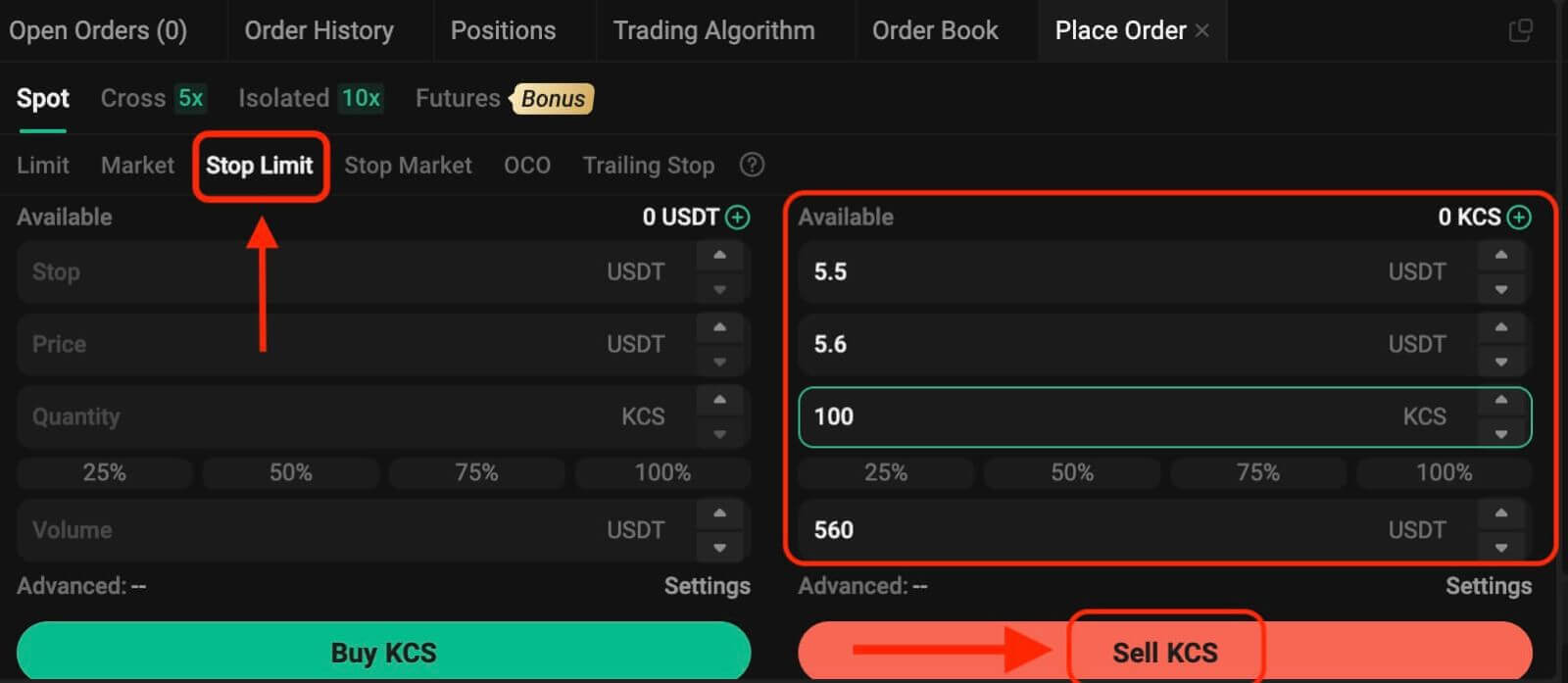

3. Stop-Limit Order

A stop-limit order blends the features of a stop order with a limit order. This type of trade involves setting a "Stop" (stop price), a "Price" (limit price), and a "Quantity." When the market hits the stop price, a limit order is activated based on the specified limit price and quantity.

Take the KCS/USDT trading pair for example. Assuming the current price of KCS is 4 USDT, and you believe that there is resistance around 5.5 USDT, this suggests that once the price of KCS reaches that level, it is unlikely to go any higher in the short term. As such, your ideal selling price would be 5.6 USDT, but you don’t want to have to monitor the market 24/7 just to maximize these profits. In such a scenario, you can opt to place a stop-limit order.

To execute this order:

- Select Stop-Limit: Choose the "Stop-Limit" option.

- Set Stop Price: Enter 5.5 USDT as the stop price.

- Set Limit Price: Specify 5.6 USDT as the limit price.

- Set Quantity: Define the Quantity as 100 KCS.

- Confirm Order: Click on "Sell KCS" to confirm and initiate the order.

Upon reaching or exceeding the stop price of 5.5 USDT, the limit order becomes active. Once the price hits 5.6 USDT, the limit order will be filled as per the set conditions.

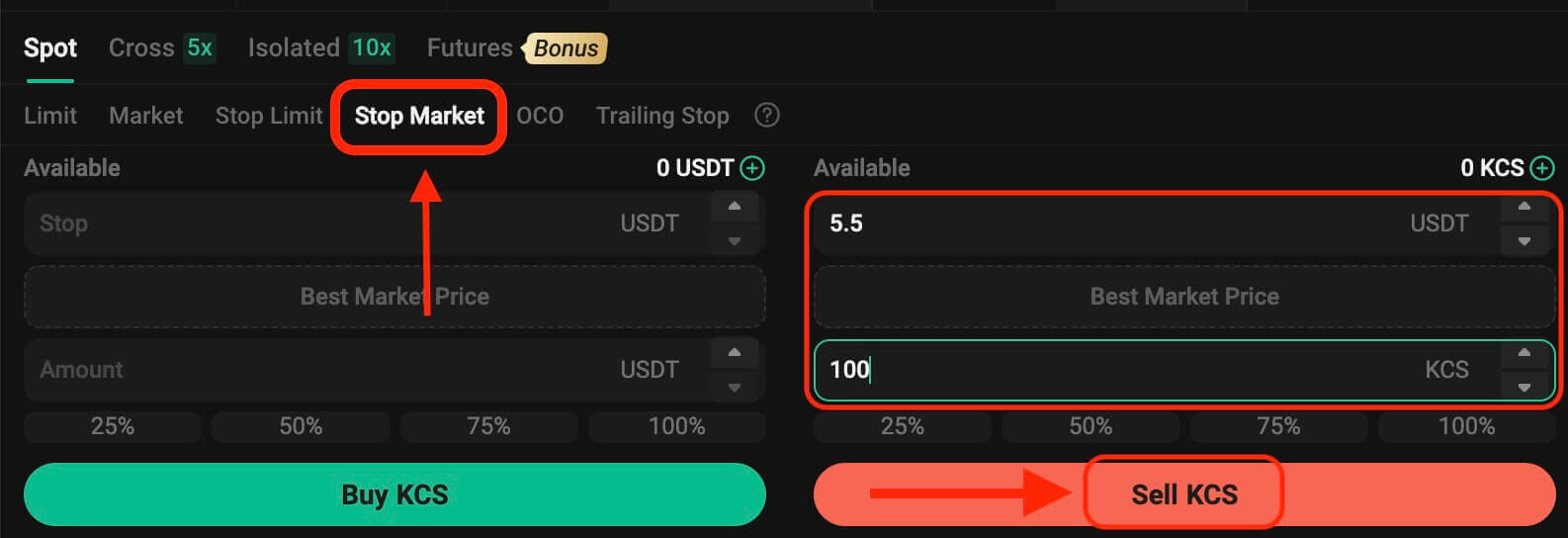

4. Stop Market Order

A stop market order is an order to buy or sell an asset once the price reaches a specific price (the "stop price"). Once the price reaches the stop price, the order becomes a market order and will be filled at the next available market price.

Take the KCS/USDT trading pair for example. Assuming the current price of KCS is 4 USDT, and you believe there is resistance around 5.5 USDT, this suggests that once the price of KCS reaches that level, it is unlikely to go any higher in the short term. However, you don’t want to have to monitor the market 24/7 just to be able to sell at an ideal price. In this situation, you can choose to place a stop-market order.

- Select Stop Market: Choose the "Stop Market" option.

- Set Stop Price: Specify a stop price of 5.5 USDT.

- Set Quantity: Define the Quantity as 100 KCS.

- Confirm Order: Click on "Sell KCS" to place the order.

Once the market price reaches or surpasses 5.5 USDT, the stop market order will be activated and executed at the next available market price.

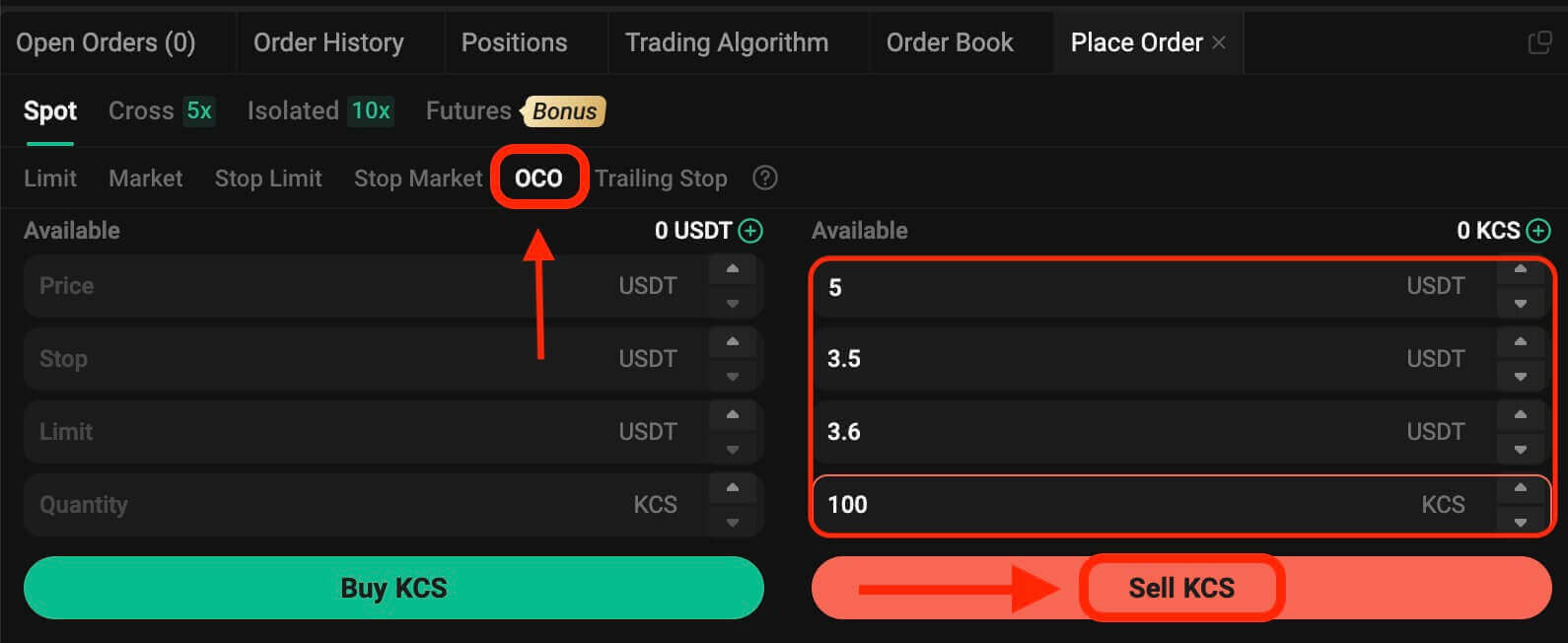

5. One-Cancels-the-Other (OCO) Order

An OCO order executes both a limit order and a stop-limit order concurrently. Depending on market movements, one of these orders will activate, automatically canceling the other.

For instance, consider the KCS/USDT trading pair, assuming the current KCS price is at 4 USDT. If you anticipate a potential decline in the final price—either after rising to 5 USDT and then dropping or directly decreasing—your objective is to sell at 3.6 USDT just before the price falls below the support level of 3.5 USDT.

To place this OCO order:

- Select OCO: Choose the "OCO" option.

- Set Price: Define the Price as 5 USDT.

- Set Stop: Specify the Stop price as 3.5 USDT (this triggers a limit order when the price reaches 3.5 USDT).

- Set Limit: Specify the Limit price as 3.6 USDT.

- Set Quantity: Define the Quantity as 100.

- Confirm Order: Click on "Sell KCS" to execute the OCO order.

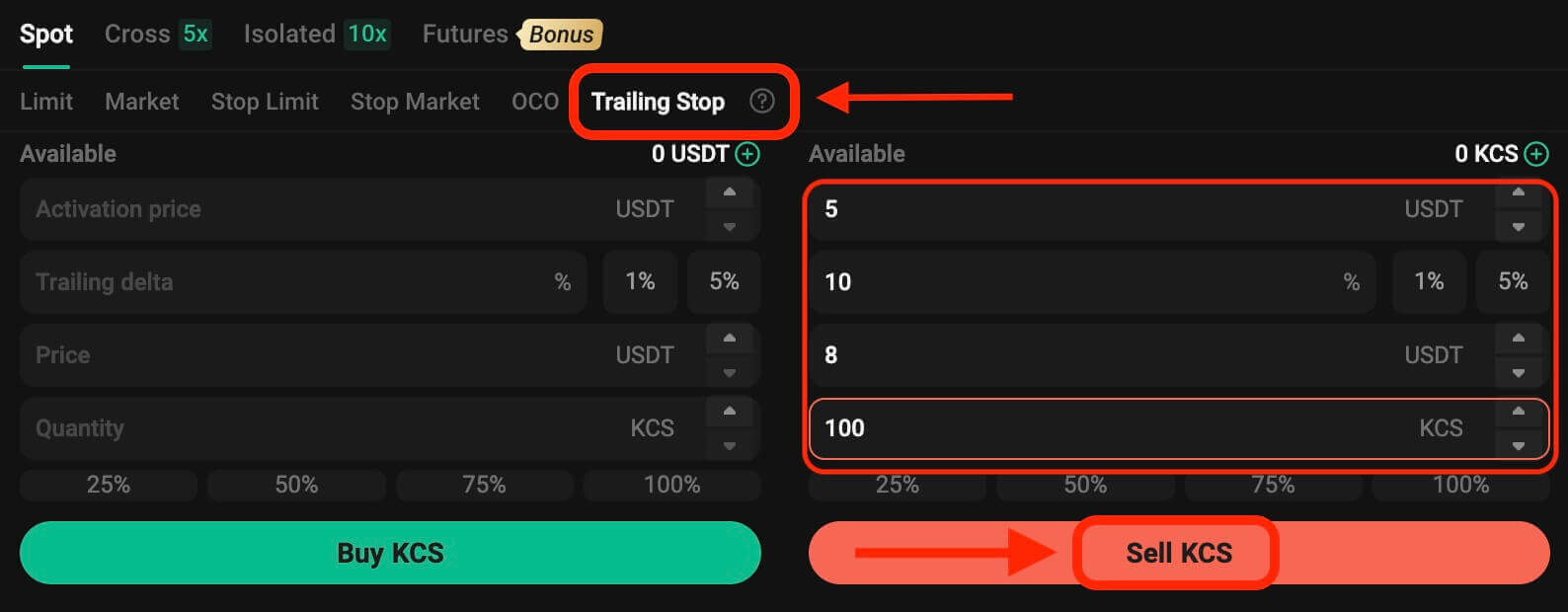

6. Trailing Stop Order

A trailing stop order is a variation of a standard stop order. This type of order allows setting the stop price as a specific percentage away from the current asset price. When both conditions align in the market’s price movement, it activates a limit order.

With a trailing buy order, you can swiftly purchase when the market rises after a decline. Similarly, a trailing sell order enables prompt selling when the market declines after an upward trend. This order type safeguards profits by keeping a trade open and profitable as long as the price moves favorably. It closes the trade if the price shifts by the specified percentage in the opposite direction.

For instance, in the KCS/USDT trading pair with KCS priced at 4 USDT, assuming an anticipated rise in KCS to 5 USDT followed by a subsequent retracement of 10% before considering selling, setting the selling price at 8 USDT becomes the strategy. In this scenario, the plan involves placing a sell order at 8 USDT, but only triggered when the price reaches 5 USDT and then experiences a 10% retracement.

To execute this trailing stop order:

- Select Trailing Stop: Choose the "Trailing Stop" option.

- Set Activation Price: Specify the activation price as 5 USDT.

- Set Trailing Delta: Define the trailing delta as 10%.

- Set Price: Specify the Price as 8 USDT.

- Set Quantity: Define the Quantity as 100.

- Confirm Order: Click on "Sell KCS" to execute the trailing stop order.

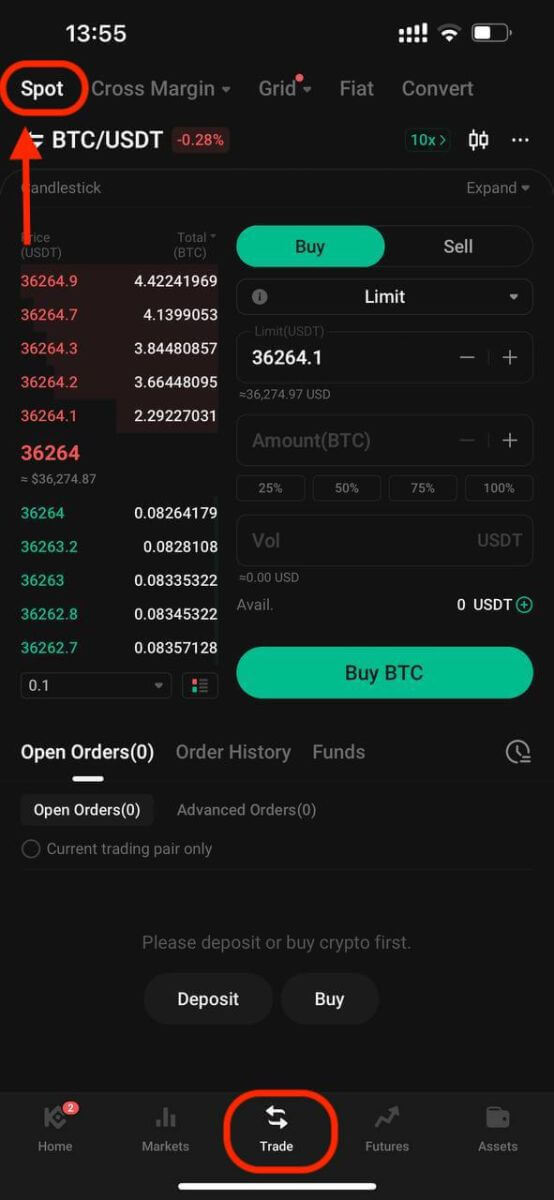

How to Open a Trade on KuCoin【APP】

Step 1: Accessing TradingApp Version: Simply tap on "Trade".

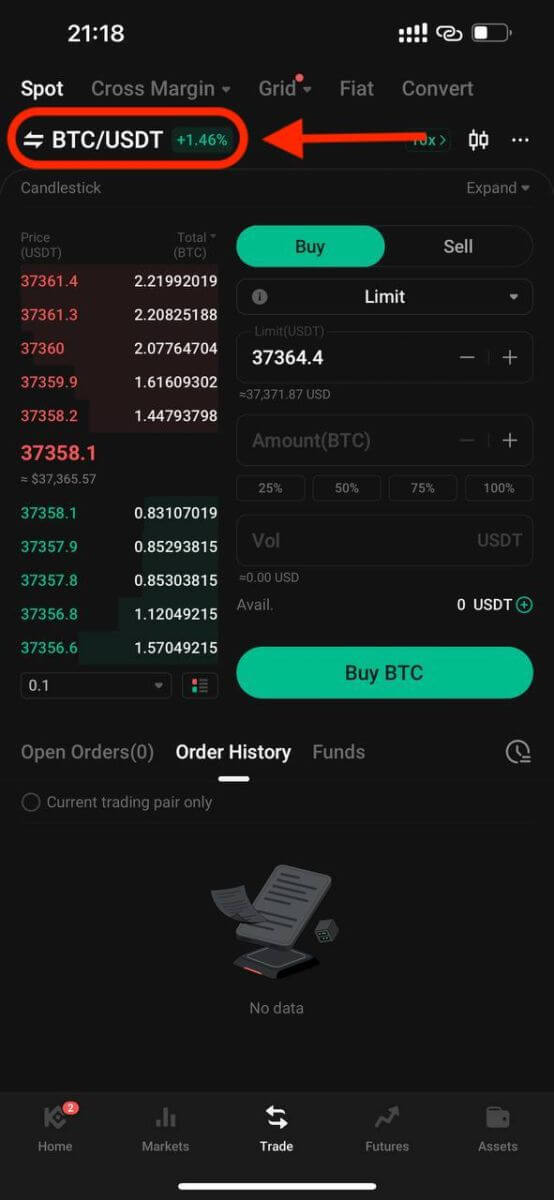

Step 2: Selecting Assets

On the trading page, assuming you wish to buy or sell KCS, you would enter "KCS" into the search bar. Then, you would select your desired trading pair to conduct your trade.

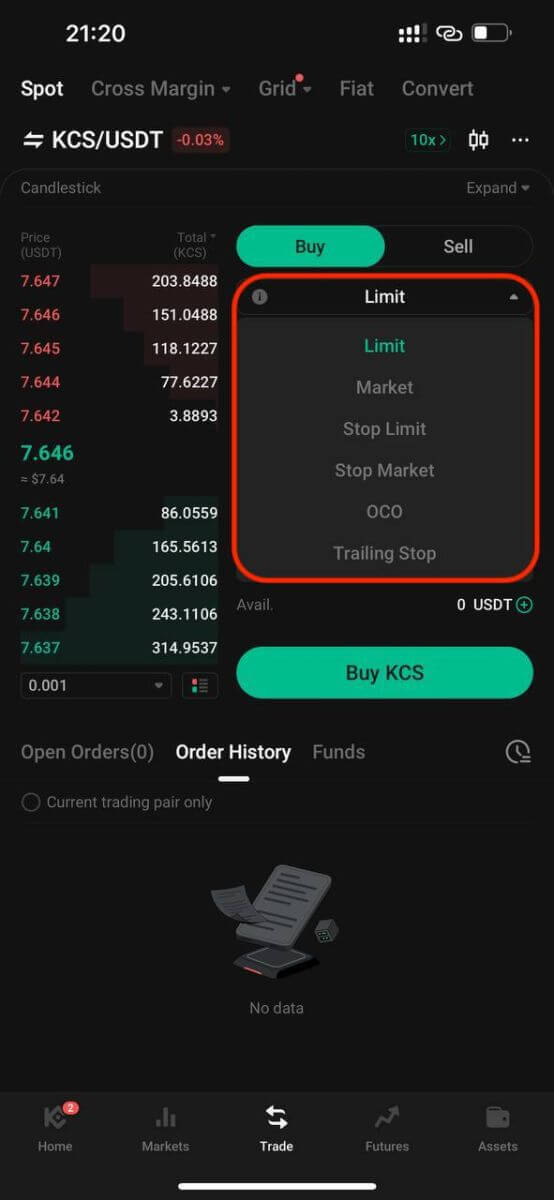

Step 3: Placing Orders

At the trading interface is the panel for buying and selling. There are six order types you can choose from:

- Limit orders.

- Market orders.

- Stop-limit orders.

- Stop-market orders.

- One-cancels-the-other (OCO) orders.

- Trailing stop orders.

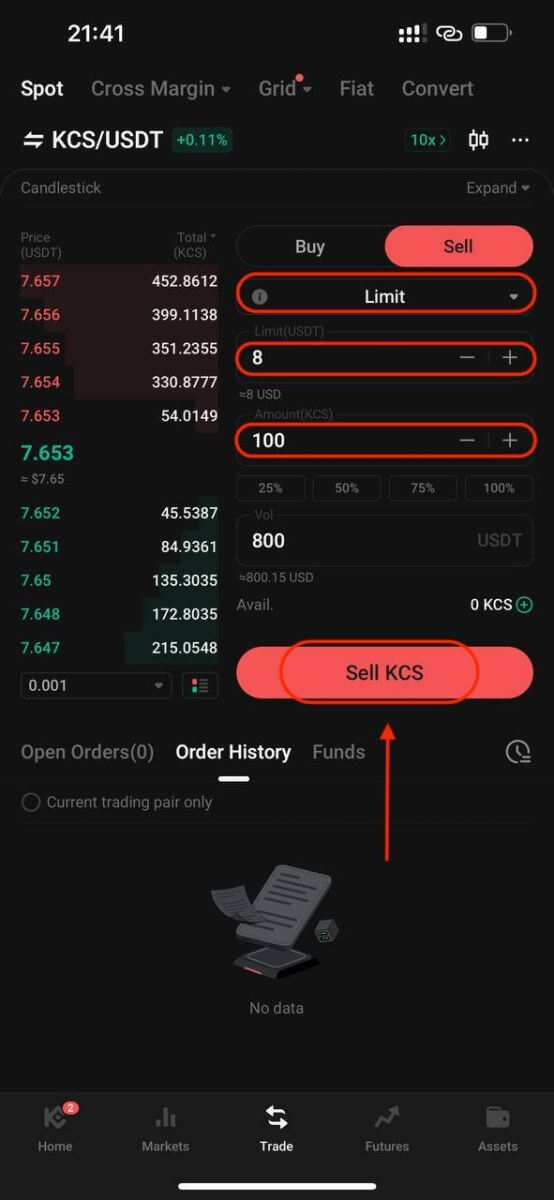

1. Limit Order

A limit order is an order to buy or sell an asset at a specific price or better.

For instance, if the current price of KCS in the KCS/USDT trading pair is 8 USDT, and you wish to sell 100 KCS at a KCS price of 8 USDT, you can place a limit order to do so.

To place such a limit order:

- Select Limit: Choose the "Limit" option.

- Set Price: Enter 8 USDT as the specified price.

- Set Quantity: Define the Quantity as 100 KCS.

- Confirm Order: Click on "Sell KCS" to confirm and finalize the order.

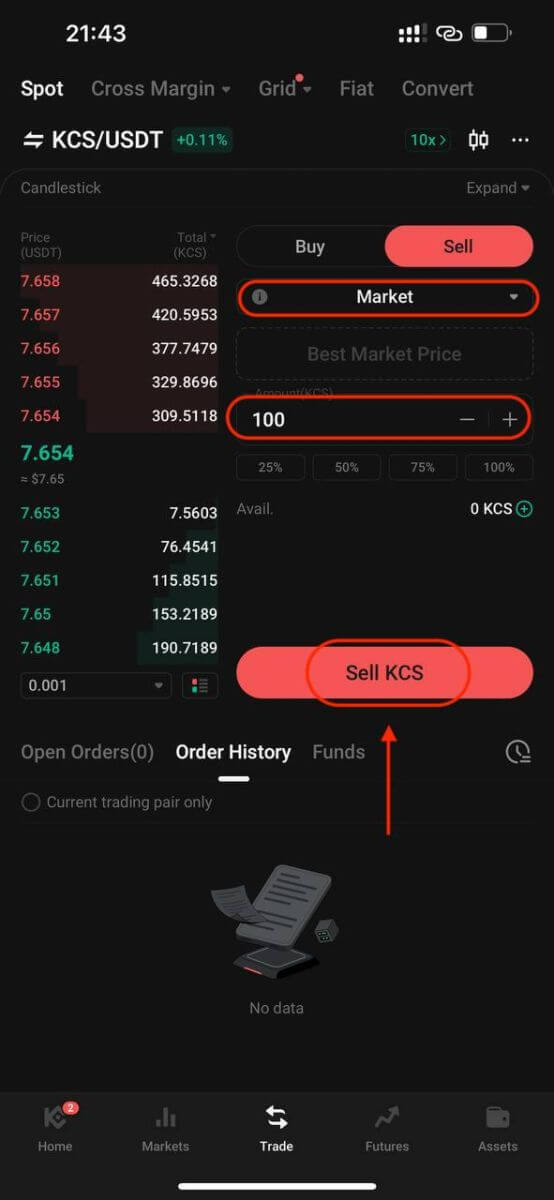

2. Market Order

Execute an order at the current best available market price.

Take the KCS/USDT trading pair for example. Assuming the current price of KCS is 7.8 USDT, and you wish to quickly sell 100 KCS. To do this, you can use a market order. When you issue a market order, the system matches your sell order with the existing buy orders on the market, which ensures a swift execution of your order. This makes market orders the best way to quickly buy or sell assets.

To place such a market order:

- Select Market: Choose the "Market" option.

- Set Quantity: Specify the Quantity as 100 KCS.

- Confirm Order: Click on "Sell KCS" to confirm and execute the order.

Please note: Market orders, once executed, cannot be canceled. You can track order and transaction specifics in your Order History and Trade History. These orders are matched with the prevailing maker order price in the market and can be impacted by market depth. It’s crucial to be mindful of market depth when initiating market orders.

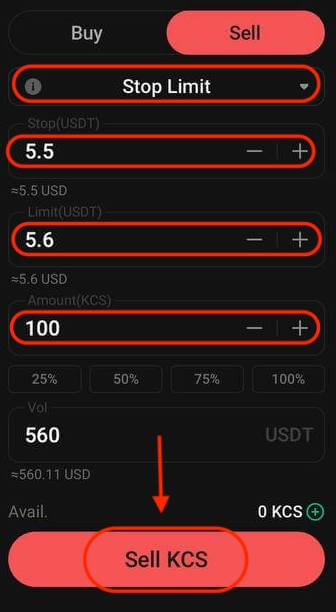

3. Stop-Limit Order

A stop-limit order blends the features of a stop order with a limit order. This type of trade involves setting a "Stop" (stop price), a "Price" (limit price), and a "Quantity." When the market hits the stop price, a limit order is activated based on the specified limit price and quantity.

Take the KCS/USDT trading pair for example. Assuming the current price of KCS is 4 USDT, and you believe that there is resistance around 5.5 USDT, this suggests that once the price of KCS reaches that level, it is unlikely to go any higher in the short term. As such, your ideal selling price would be 5.6 USDT, but you don’t want to have to monitor the market 24/7 just to maximize these profits. In such a scenario, you can opt to place a stop-limit order.

To execute this order:

- Select Stop-Limit: Choose the "Stop-Limit" option.

- Set Stop Price: Enter 5.5 USDT as the stop price.

- Set Limit Price: Specify 5.6 USDT as the limit price.

- Set Quantity: Define the Quantity as 100 KCS.

- Confirm Order: Click on "Sell KCS" to confirm and initiate the order.

Upon reaching or exceeding the stop price of 5.5 USDT, the limit order becomes active. Once the price hits 5.6 USDT, the limit order will be filled as per the set conditions.

4. Stop Market Order

A stop market order is an order to buy or sell an asset once the price reaches a specific price (the "stop price"). Once the price reaches the stop price, the order becomes a market order and will be filled at the next available market price.

Take the KCS/USDT trading pair for example. Assuming the current price of KCS is 4 USDT, and you believe there is resistance around 5.5 USDT, this suggests that once the price of KCS reaches that level, it is unlikely to go any higher in the short term. However, you don’t want to have to monitor the market 24/7 just to be able to sell at an ideal price. In this situation, you can choose to place a stop-market order.

- Select Stop Market: Choose the "Stop Market" option.

- Set Stop Price: Specify a stop price of 5.5 USDT.

- Set Quantity: Define the Quantity as 100 KCS.

- Confirm Order: Click on "Sell KCS" to place the order.

Once the market price reaches or surpasses 5.5 USDT, the stop market order will be activated and executed at the next available market price.

5. One-Cancels-the-Other (OCO) Order

An OCO order executes both a limit order and a stop-limit order concurrently. Depending on market movements, one of these orders will activate, automatically canceling the other.

For instance, consider the KCS/USDT trading pair, assuming the current KCS price is at 4 USDT. If you anticipate a potential decline in the final price—either after rising to 5 USDT and then dropping or directly decreasing—your objective is to sell at 3.6 USDT just before the price falls below the support level of 3.5 USDT.

To place this OCO order:

- Select OCO: Choose the "OCO" option.

- Set Price: Define the Price as 5 USDT.

- Set Stop: Specify the Stop price as 3.5 USDT (this triggers a limit order when the price reaches 3.5 USDT).

- Set Limit: Specify the Limit price as 3.6 USDT.

- Set Quantity: Define the Quantity as 100.

- Confirm Order: Click on "Sell KCS" to execute the OCO order.

6. Trailing Stop Order

A trailing stop order is a variation of a standard stop order. This type of order allows setting the stop price as a specific percentage away from the current asset price. When both conditions align in the market’s price movement, it activates a limit order.

With a trailing buy order, you can swiftly purchase when the market rises after a decline. Similarly, a trailing sell order enables prompt selling when the market declines after an upward trend. This order type safeguards profits by keeping a trade open and profitable as long as the price moves favorably. It closes the trade if the price shifts by the specified percentage in the opposite direction.

For instance, in the KCS/USDT trading pair with KCS priced at 4 USDT, assuming an anticipated rise in KCS to 5 USDT followed by a subsequent retracement of 10% before considering selling, setting the selling price at 8 USDT becomes the strategy. In this scenario, the plan involves placing a sell order at 8 USDT, but only triggered when the price reaches 5 USDT and then experiences a 10% retracement.

To execute this trailing stop order:

- Select Trailing Stop: Choose the "Trailing Stop" option.

- Set Activation Price: Specify the activation price as 5 USDT.

- Set Trailing Delta: Define the trailing delta as 10%.

- Set Price: Specify the Price as 8 USDT.

- Set Quantity: Define the Quantity as 100.

- Confirm Order: Click on "Sell KCS" to execute the trailing stop order.