How to Login and start trading Crypto at KuCoin

How to Login Account in KuCoin

How to Login to KuCoin

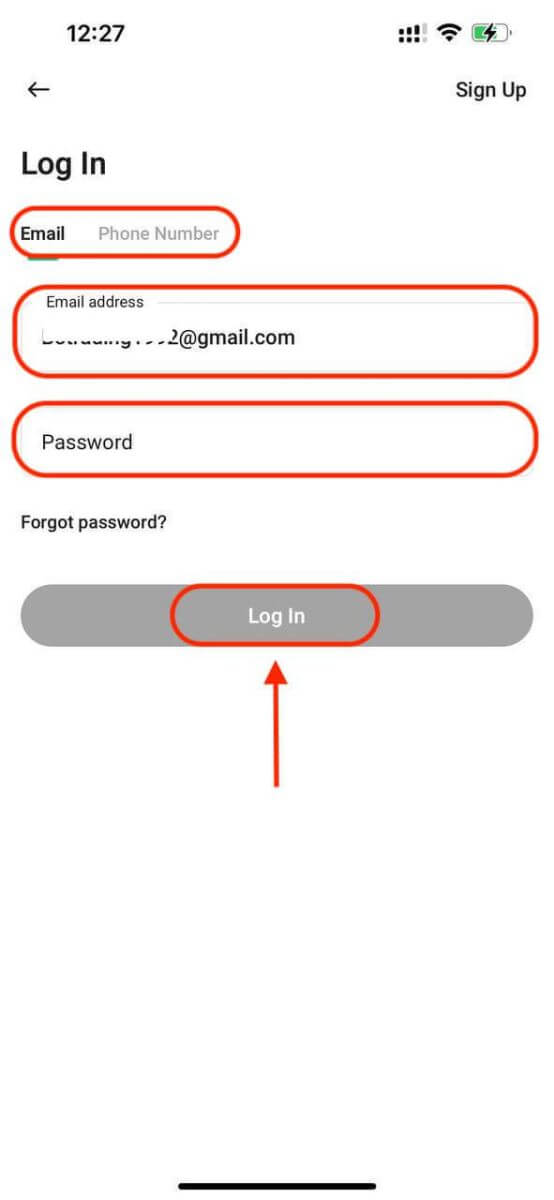

How to Login to KuCoin using Email

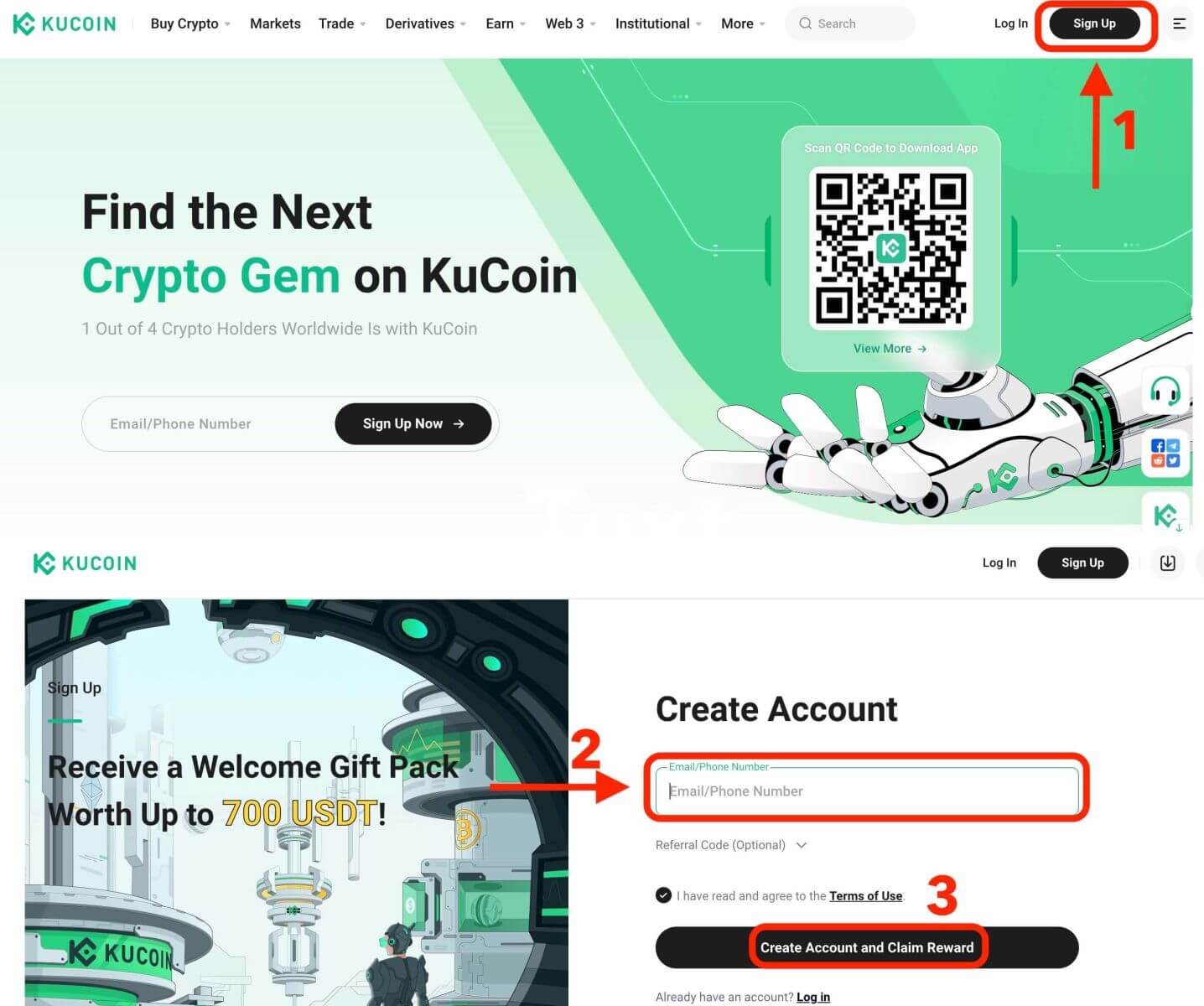

I will show you how to login to KuCoin and start trading in a few simple steps.Step 1: Register for a KuCoin account

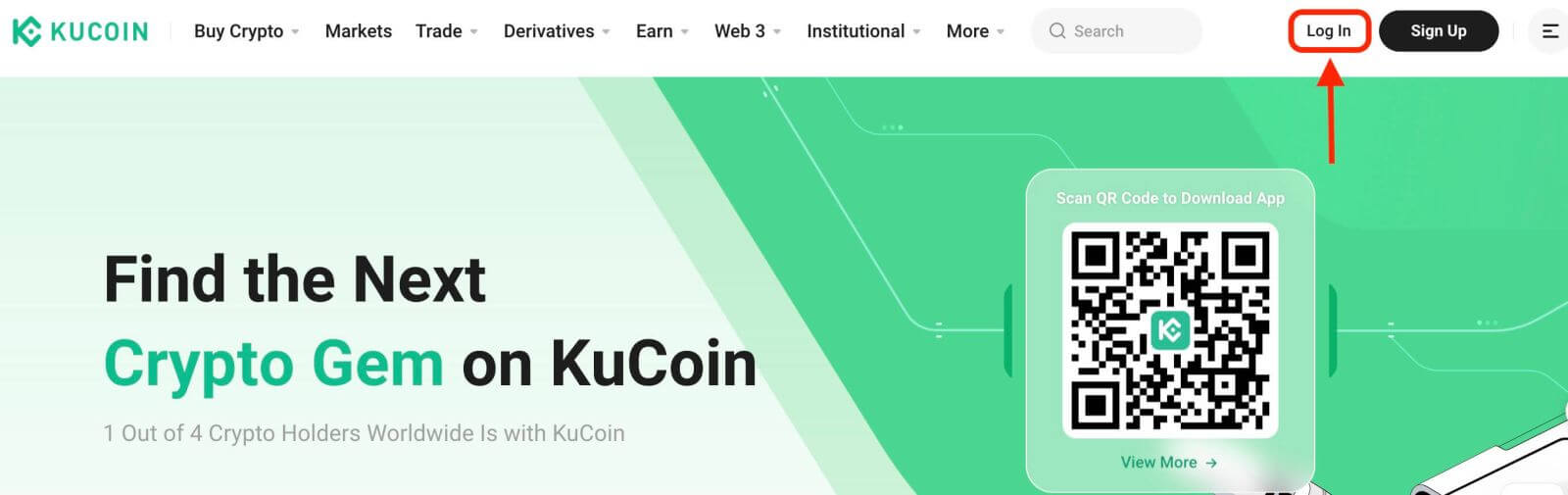

To begin, you can login to KuCoin, you need to register for a free account. You can do this by visiting the website of KuCoin and clicking on "Sign Up".

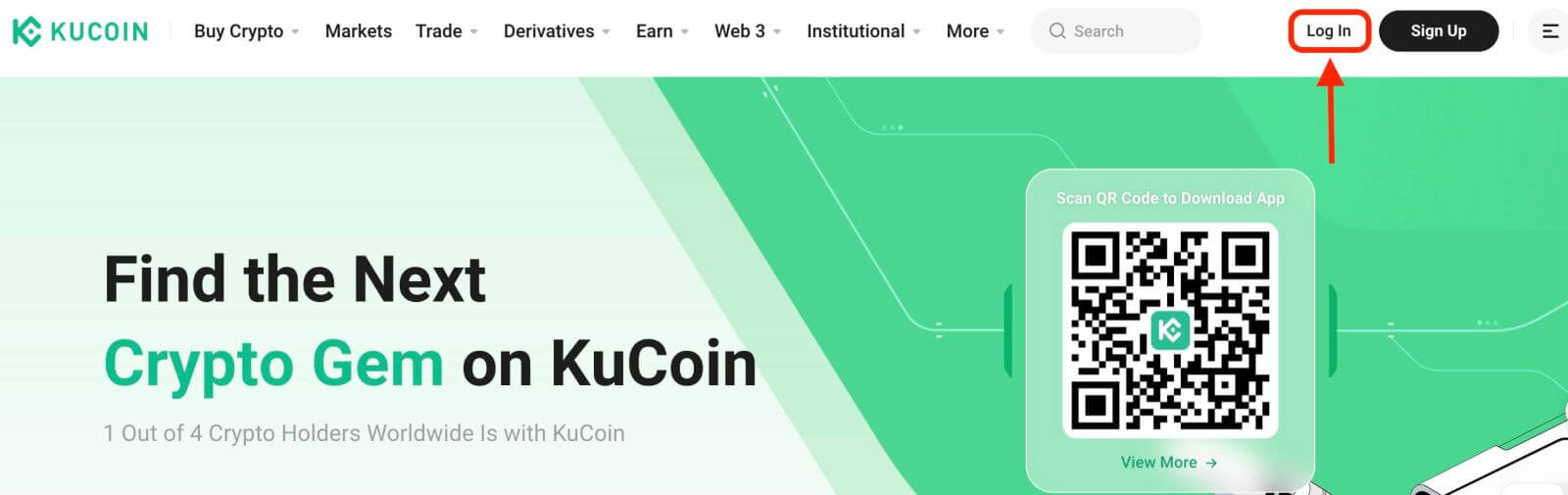

Step 2: Login to your account

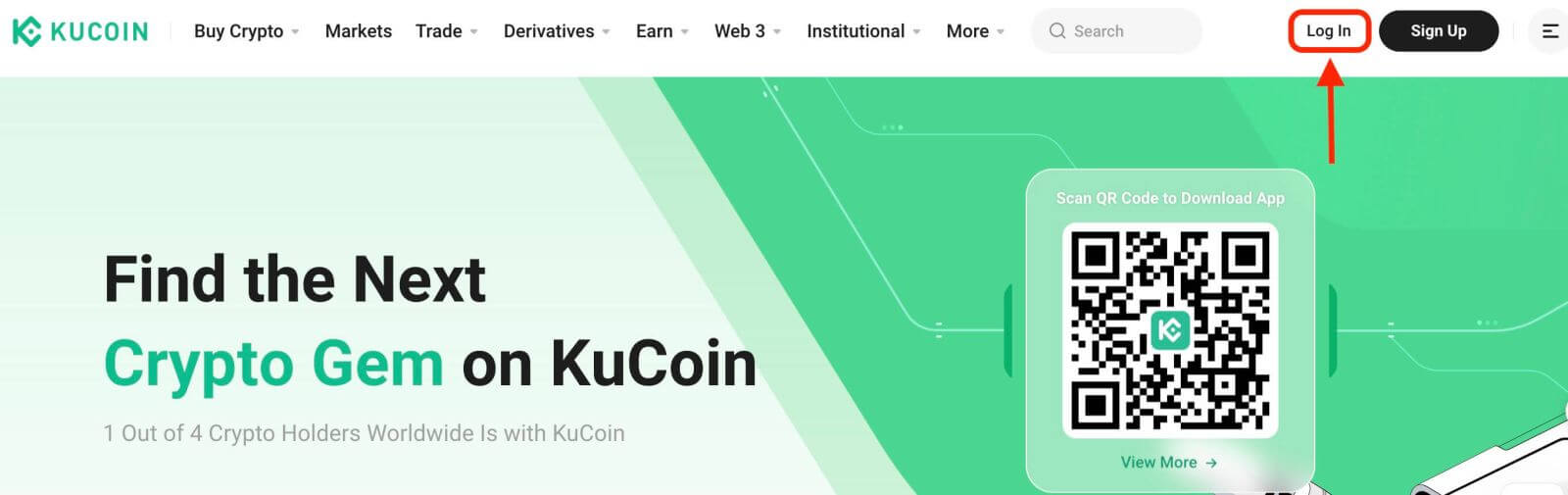

Once you have registered for an account, you can login to KuCoin by clicking on "Log In" button. It is typically located in the upper right-hand corner of the webpage.

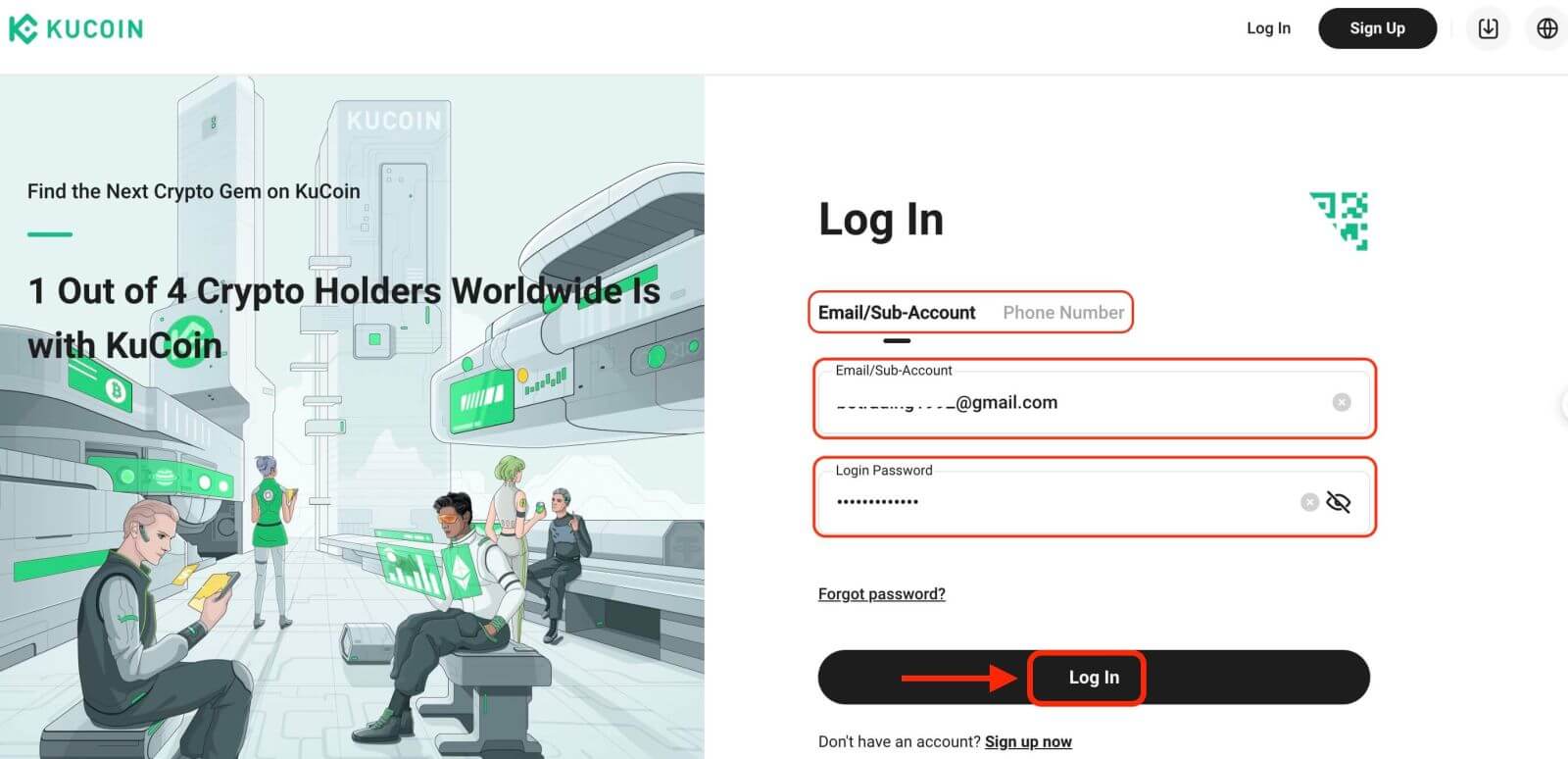

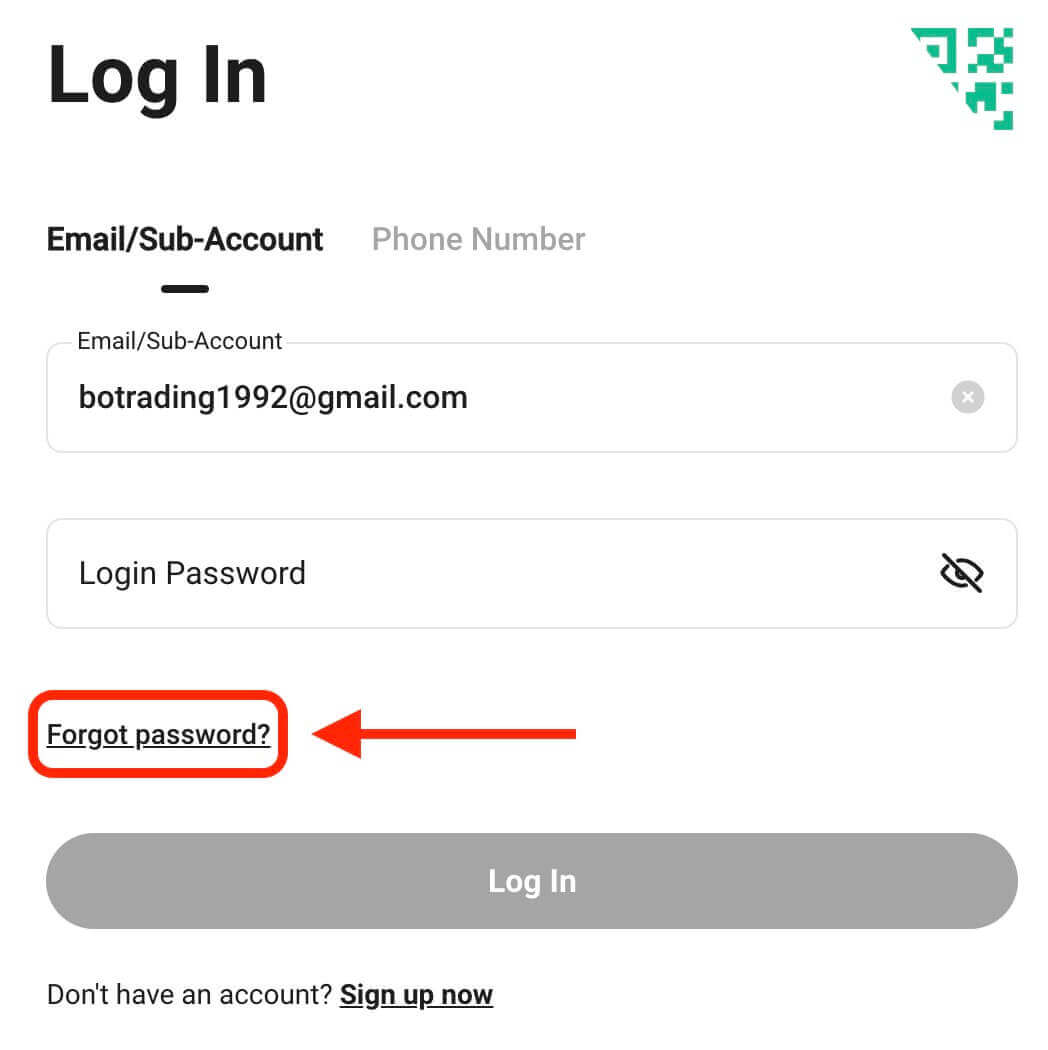

A login form will appear. You will be prompted to enter your login credentials, which include your registered email address and password. Ensure that you enter this information accurately.

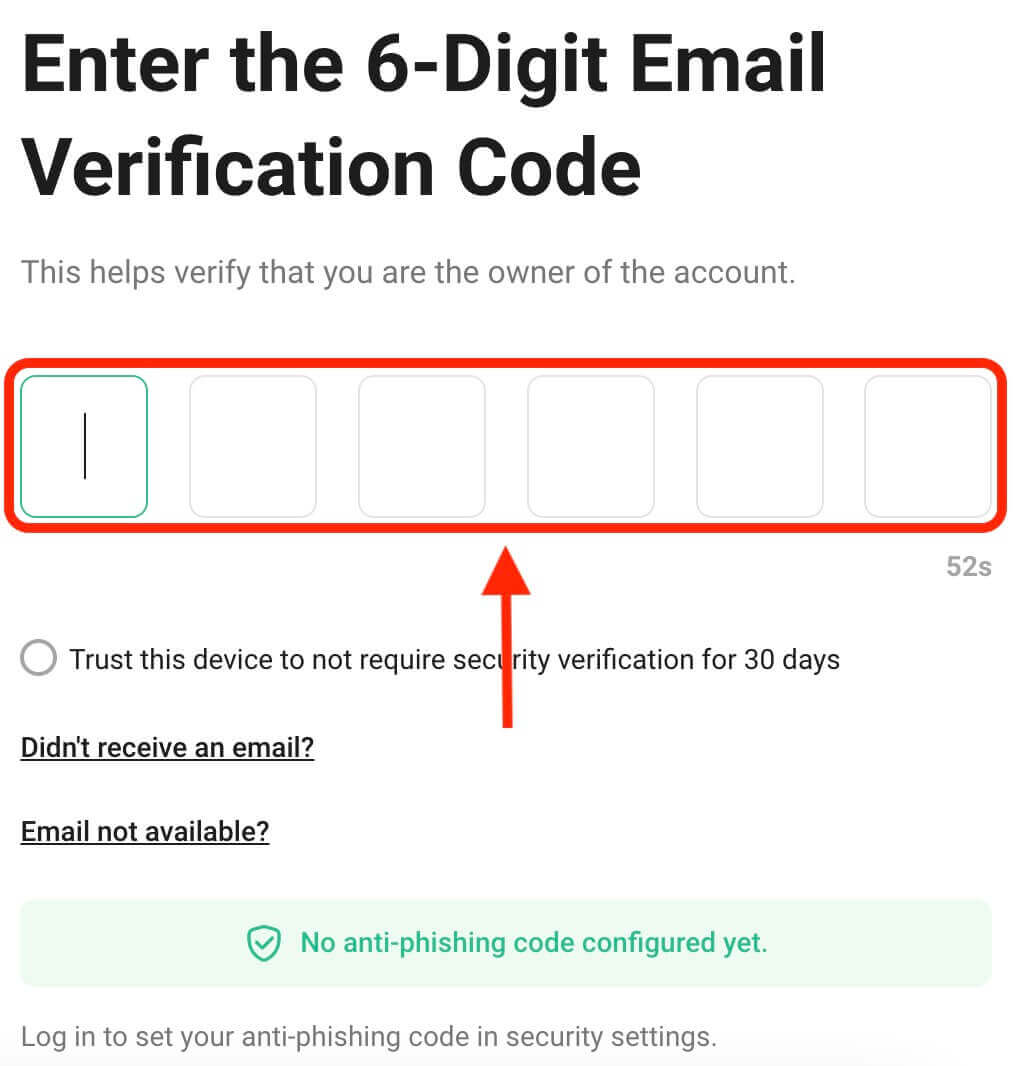

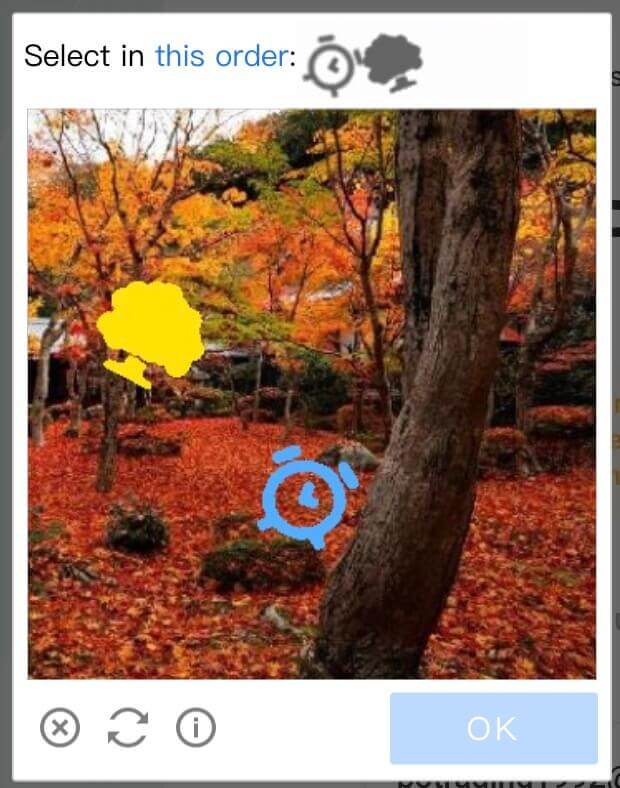

Step 3: Complete the puzzle and enter the digit email verification code

As an additional security measure, you may be required to complete a puzzle challenge. This is to confirm that you are a human user and not a bot. Follow the on-screen instructions to complete the puzzle.

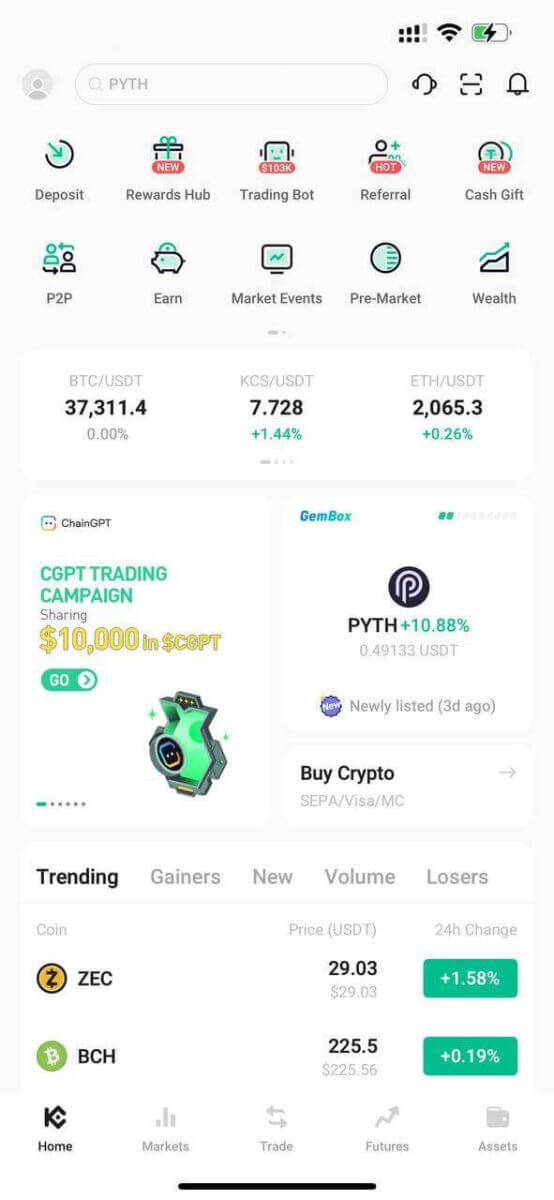

Step 4: Start trading

Congratulations! You have successfully logged in to KuCoin with your KuCoin account and you will see your dashboard with various features and tools.

That’s it! You have successfully logged in to KuCoin using Email and started trading on financial markets.

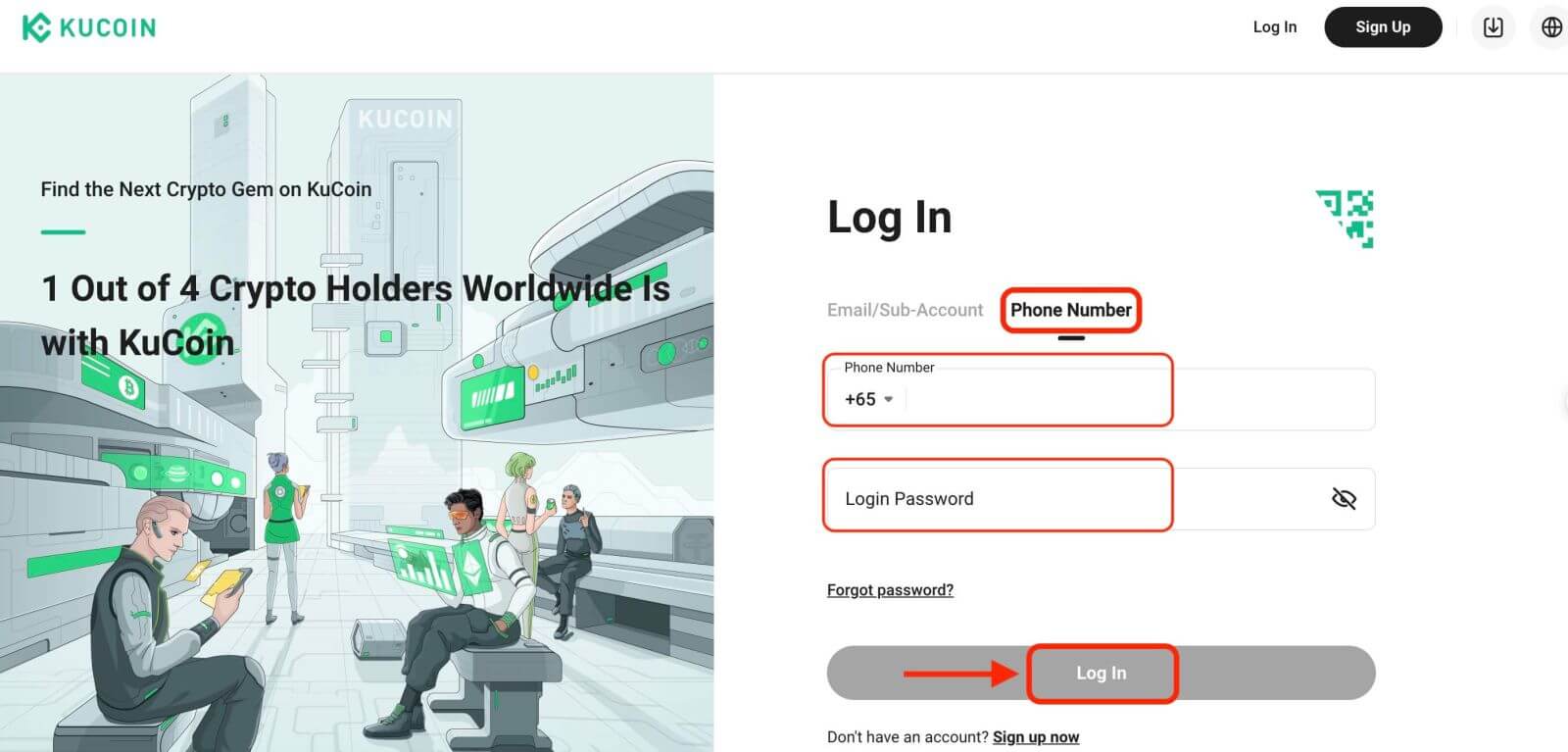

How to Login to KuCoin using Phone Number

1. Click on "Log In" at the top right corner of the website.

2. You will need to enter your phone number and password that you used during registration.

Congratulations! You have successfully logged in to KuCoin and you will see your dashboard with various features and tools.

That’s it! You have successfully logged in to KuCoin using your phone number and started trading on financial markets.

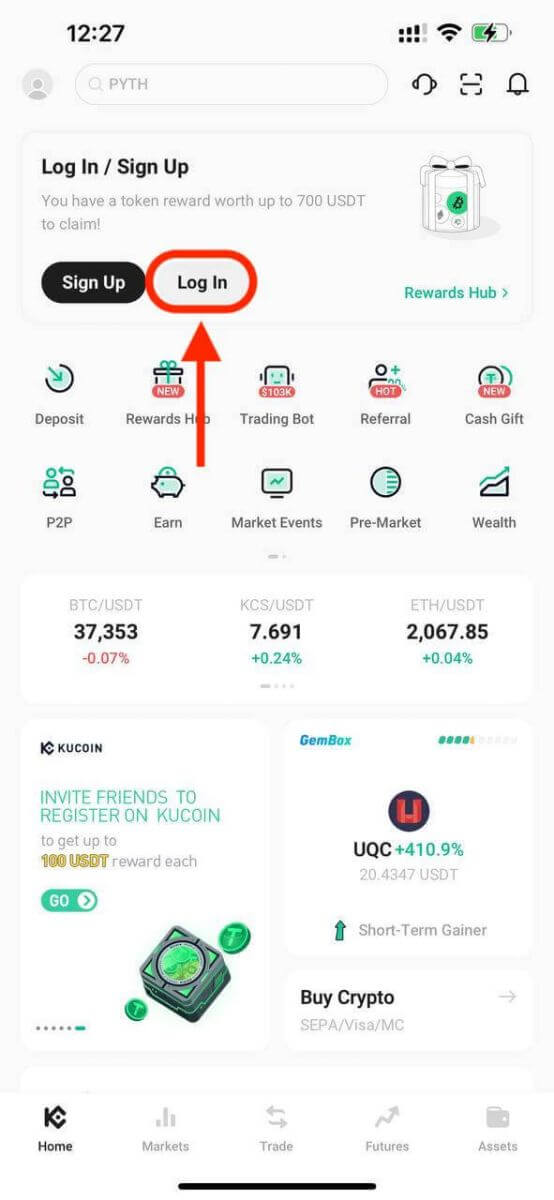

How to Login into the KuCoin app

KuCoin also offers a mobile app that allows you to access your account and trade on the go. The KuCoin app offers several key features that make it popular among traders.1. Download the KuCoin app for free from the Google Play Store or App Store and install it on your device.

2. After downloading the KuCoin App, open the app.

3. Then, tap [Log In].

4. Enter your mobile number or email address based on your selection. Then enter your account password.

5. That’s it! You have successfully logged in to the KuCoin app.

Two-Factor Authentication (2FA) on KuCoin Login

KuCoin prioritizes security as a top focus. Utilizing Google Authenticator, it adds an additional security layer to safeguard your account and prevent potential asset theft. This article provides a guide on binding and unbinding Google 2-Step Verification (2FA), along with addressing common queries.

Why use Google 2FA

When you create a new KuCoin account, setting a password is essential for protection, but relying solely on a password leaves vulnerabilities. It’s highly recommended to enhance your account’s security by binding Google Authenticator. This adds an extra safeguard, deterring unauthorized logins even if your password is compromised.

Google Authenticator, an app by Google, implements two-step verification through time-based one-time passwords. It generates a 6-digit dynamic code that refreshes every 30 seconds, each code usable only once. Once linked, you’ll need this dynamic code for activities like login, withdrawals, API creation, and more.

How to Bind Google 2FA

The Google Authenticator app can be downloaded from the Google Play Store and Apple App Store. Go to the store and search for Google Authenticator to find and download it.

If you already have the app, let’s check out how to bind it to your KuCoin account.

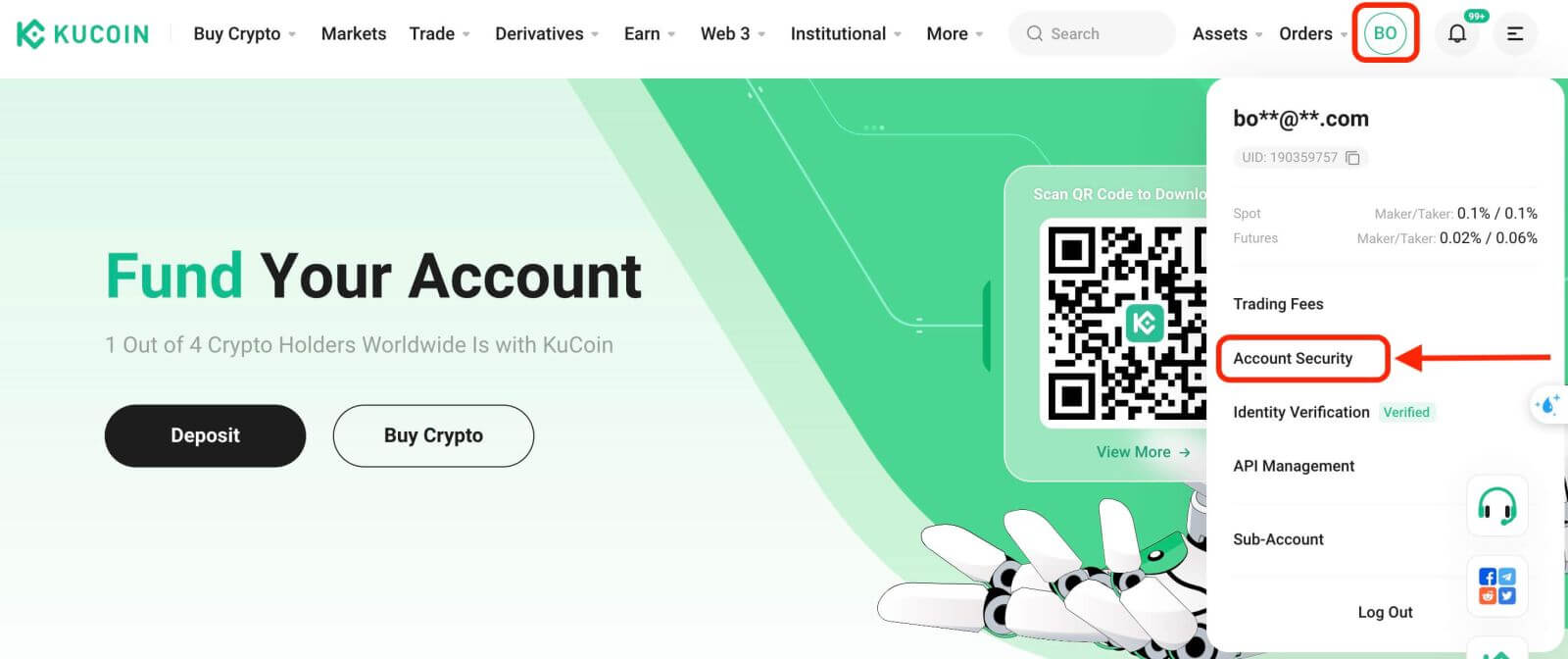

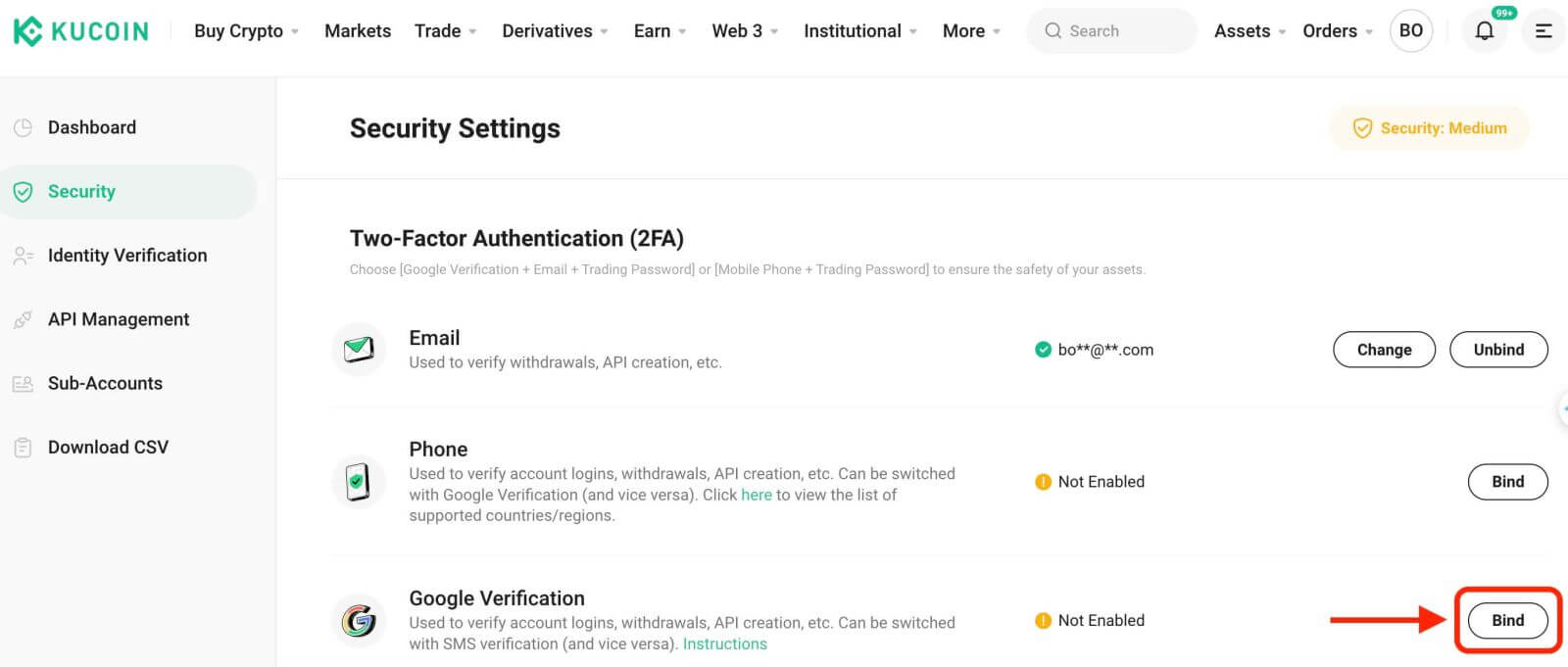

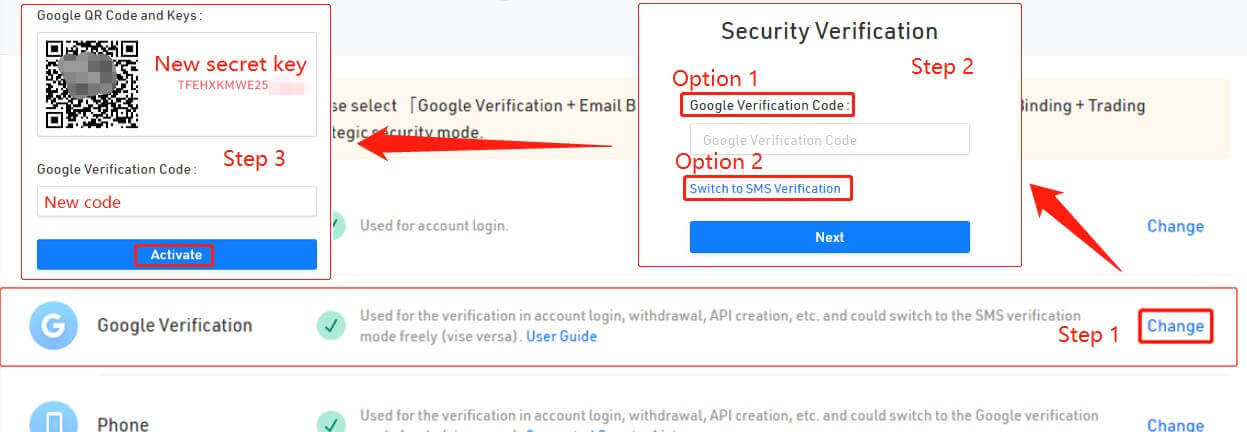

Step 1: Log in to your KuCoin account. Click the avatar on the upper-right corner and select Account Security in the drop-down menu.

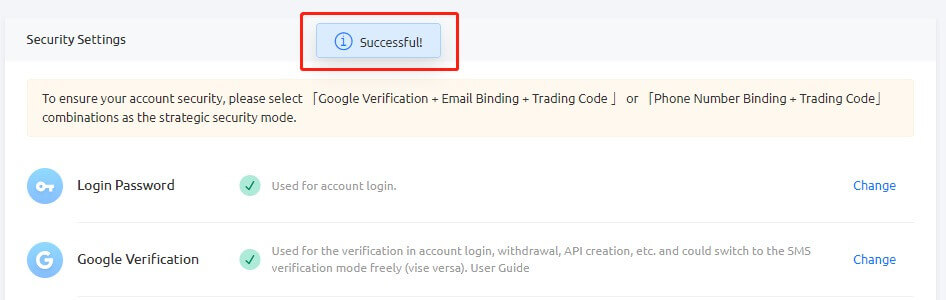

Step 2: Find Security Settings, and click "Bind" of Google Verification.

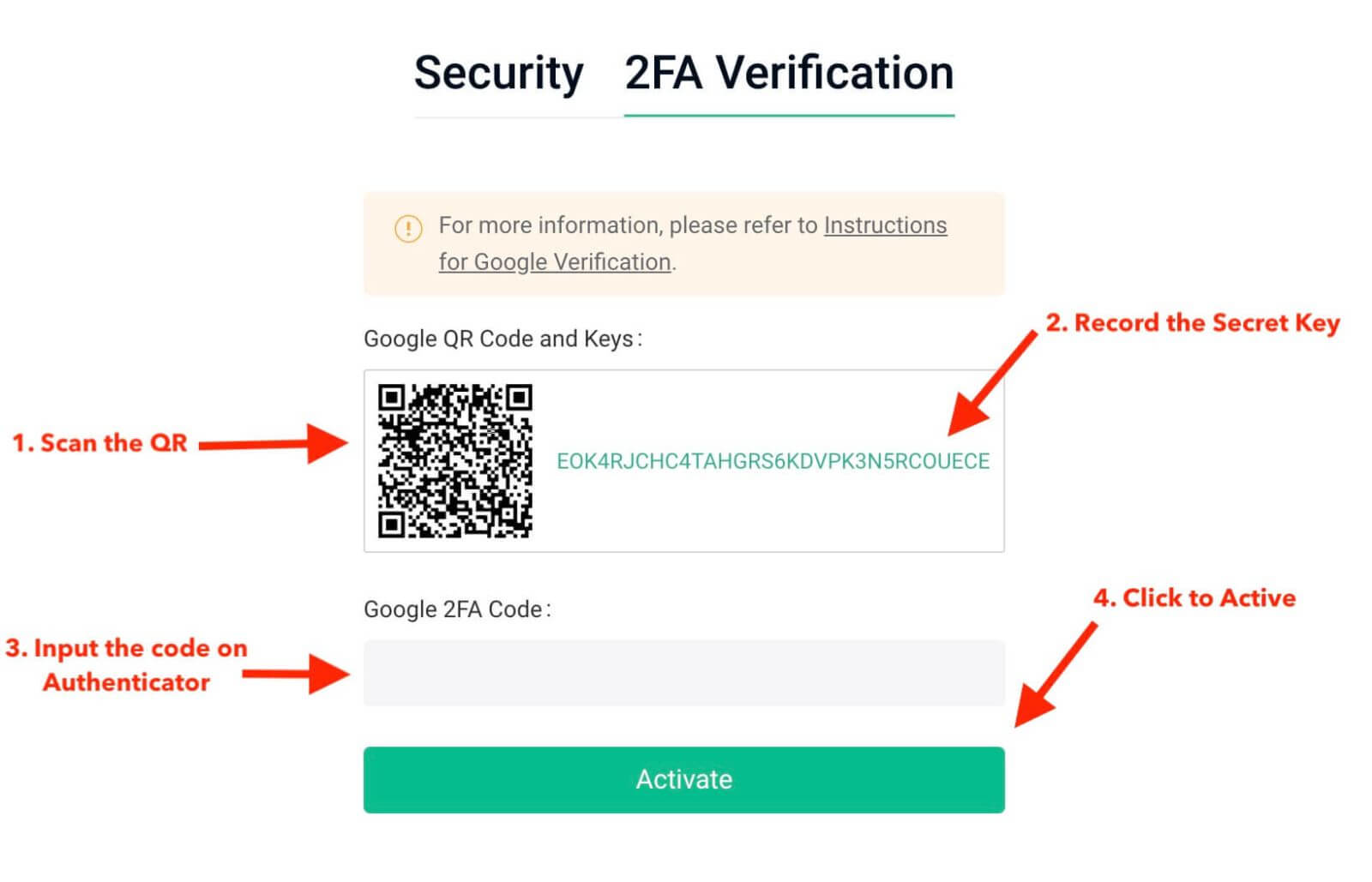

Step 3: Next, you will see a page below. Please record the Google Secret Key and store it in a secure place. You will need it to restore your Google 2FA if you lose your phone or accidentally delete the Google Authenticator app.

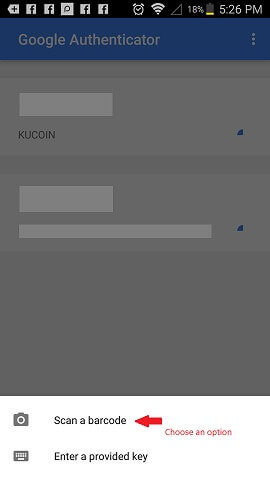

Step 4: Once you have saved the Secret Key, open the Google Authenticator app on your phone, and click the "+" icon to add a new code. Click on Scan barcode to open your camera and scan the code. It will set up the Google Authenticator for KuCoin and start generating the 6-digit code.

******Below is a sample of what you will see on your phone in the Google Authenticator App******

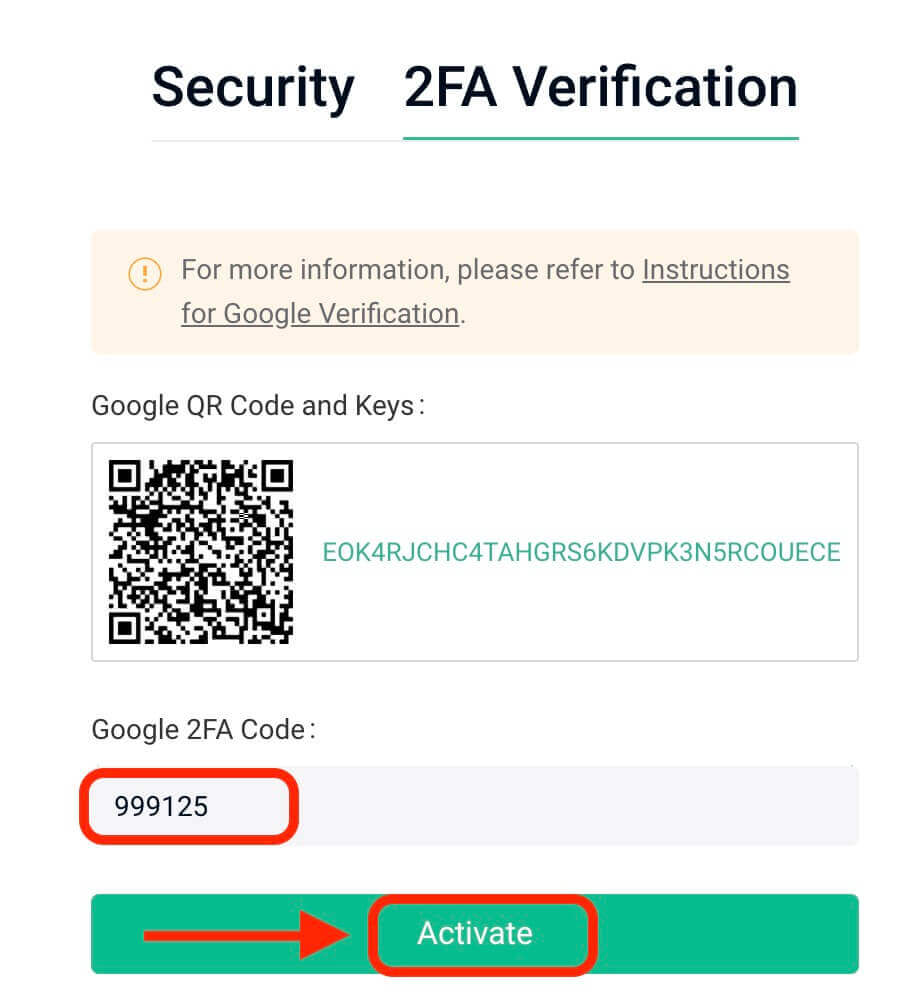

Step 5: Lastly, enter the 6-digit code shown on your phone into the Google Verification Code box, and click on the Activate button to complete.

Tips:

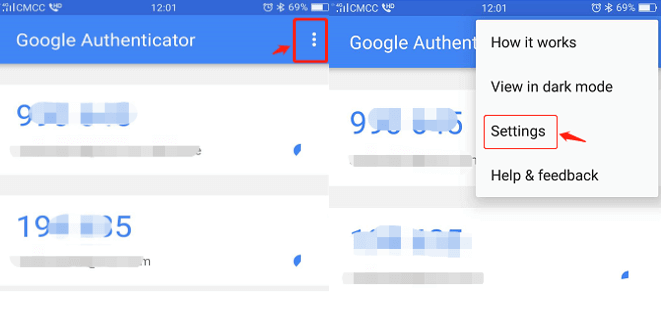

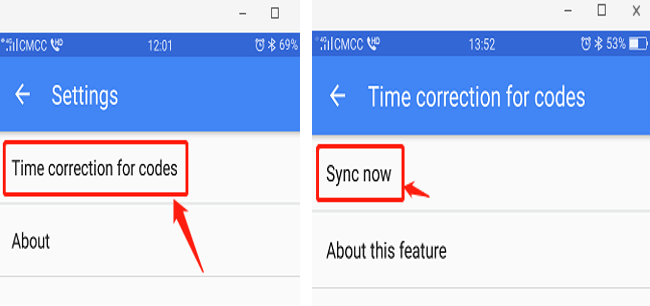

Ensure your Authenticator’s server time is accurate if you’re using an Android device. Navigate to "Settings – Time correction for codes."

For some phones, a restart might be necessary after binding. Additionally, in your device settings under General Date Time, enable both 24-Hour Time and Set Automatically options.

Users must input the verification code for login, trading, and withdrawal processes.

Avoid removing Google Authenticator from your phone.

Ensure the accurate entry of the Google 2-step verification code. After five consecutive incorrect attempts, Google 2-step verification will be locked for 2 hours.

3. Reasons for Invalid Google 2FA Code

If the Google 2FA code is invalid, ensure that you have done the following:

- Ensure the correct account’s 2FA code is entered if multiple accounts’ 2FAs are bound to one phone.

- The Google 2FA code remains valid for only 30 seconds, so input it within this time frame.

- Confirm synchronization between the time displayed on your Google Authenticator App and the Google server time.

How to synchronize the time on your phone (Android Only)

Step 1. Open "Settings"

Step 2. Click "Time Correction for Codes" – "Sync now"

If the previous steps are unsuccessful, consider re-binding Google 2-Step Verification using the 16-digit Secret Key if you’ve saved it.

Step 3: If you haven’t saved the 16-digit Secret Key and are unable to access your Google 2FA code, refer to Part 4 for unbinding Google 2FA.

4. How to Restore/Unbind Google 2FA

If you cannot access the Google Authenticator app for any reason, please follow the guidance below to restore or unbind it.

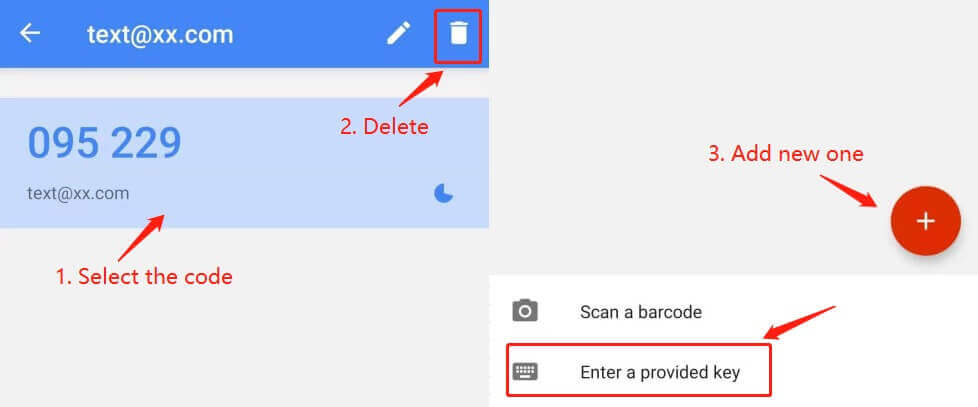

(1). If you saved your Google Secret Key, just rebind it in the Google Authenticator app and it will start generating a new code. For security reasons, please delete the previous code in your Google 2FA app once you have set a new one.

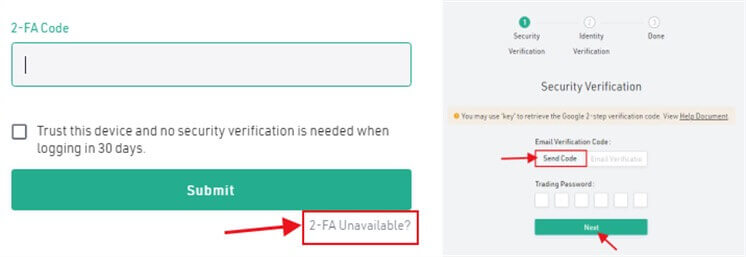

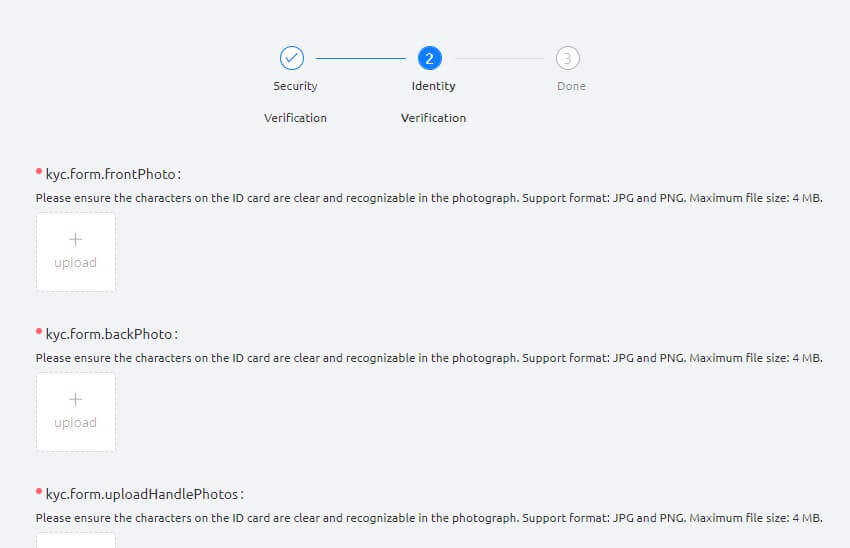

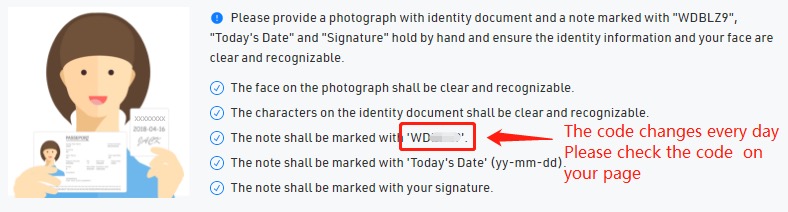

(2) If you haven’t saved the Google Secret Key, click on "2-FA unavailable?" to proceed with the unbinding process. You’ll need to input the Email Verification Code and Trading Password. Following this, upload the requested ID information for identity verification.

While this process might seem inconvenient, it’s crucial to maintain the security of your Google 2FA code. We cannot unbind it without confirming the identity of the requester. Once your information is verified, the unbinding of Google Authenticator will be processed within 1–3 business days.

(3). If you got a new device and want to transfer Google 2FA to it, please log in to your KuCoin account to change 2FA in the account security settings. Please refer to the screenshots below for detailed steps.

Tips:

After making significant security changes, such as unbinding Google 2FA, withdrawal services on KuCoin will be temporarily locked for 24 hours. This measure ensures the security of your account.

We trust this article has been informative. If you have further questions, our 24/7 customer support is available via online chat or by submitting a ticket.

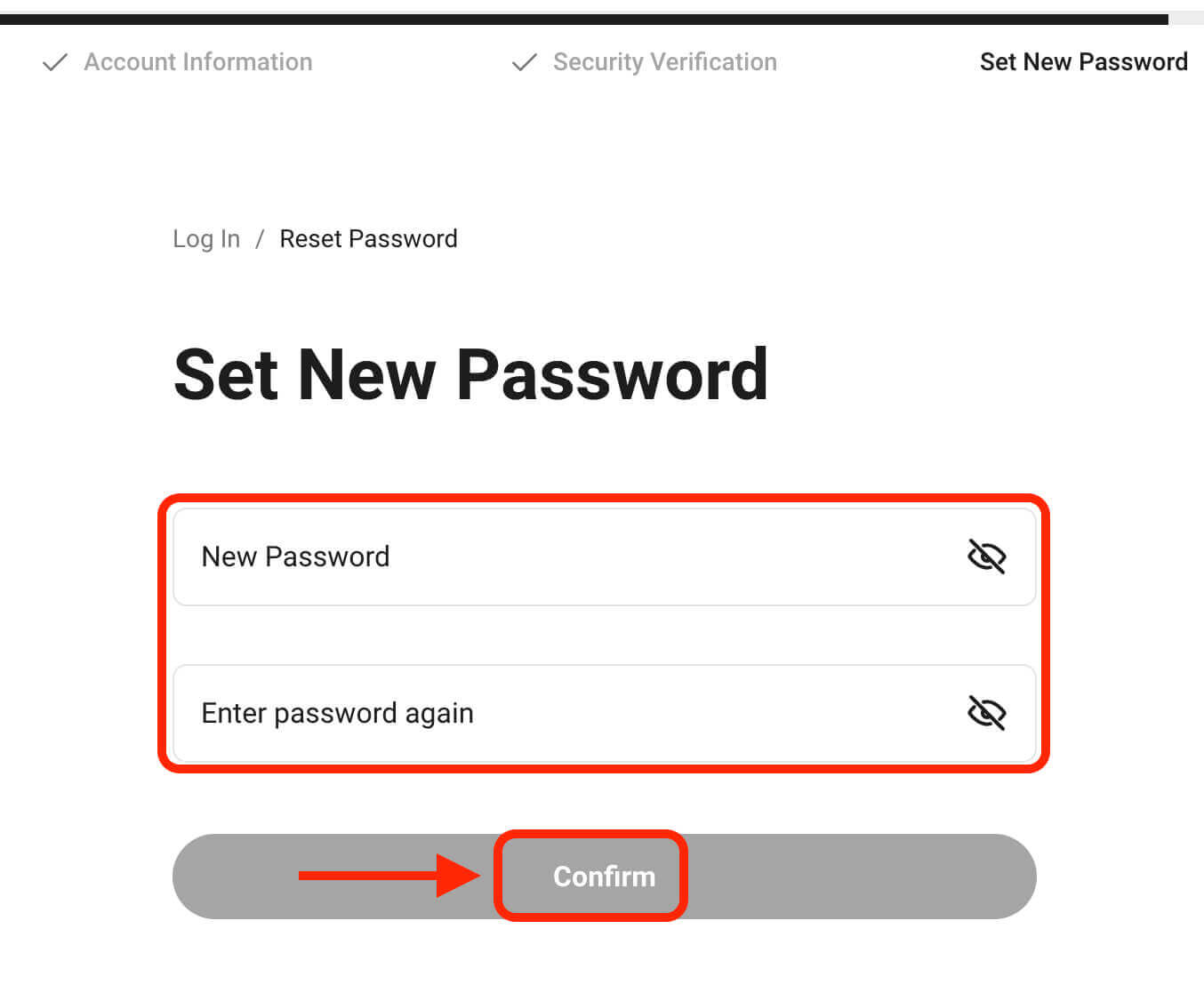

How to Reset KuCoin Password

If you’ve forgotten your KuCoin password or need to reset it for any reason, don’t worry. You can easily reset it by following these simple steps:Step 1. Go to the KuCoin website and click on the "Log In" button, typically found in the upper right-hand corner of the page.

Step 2. On the login page, click on the "Forgot password?" link below the Log In button.

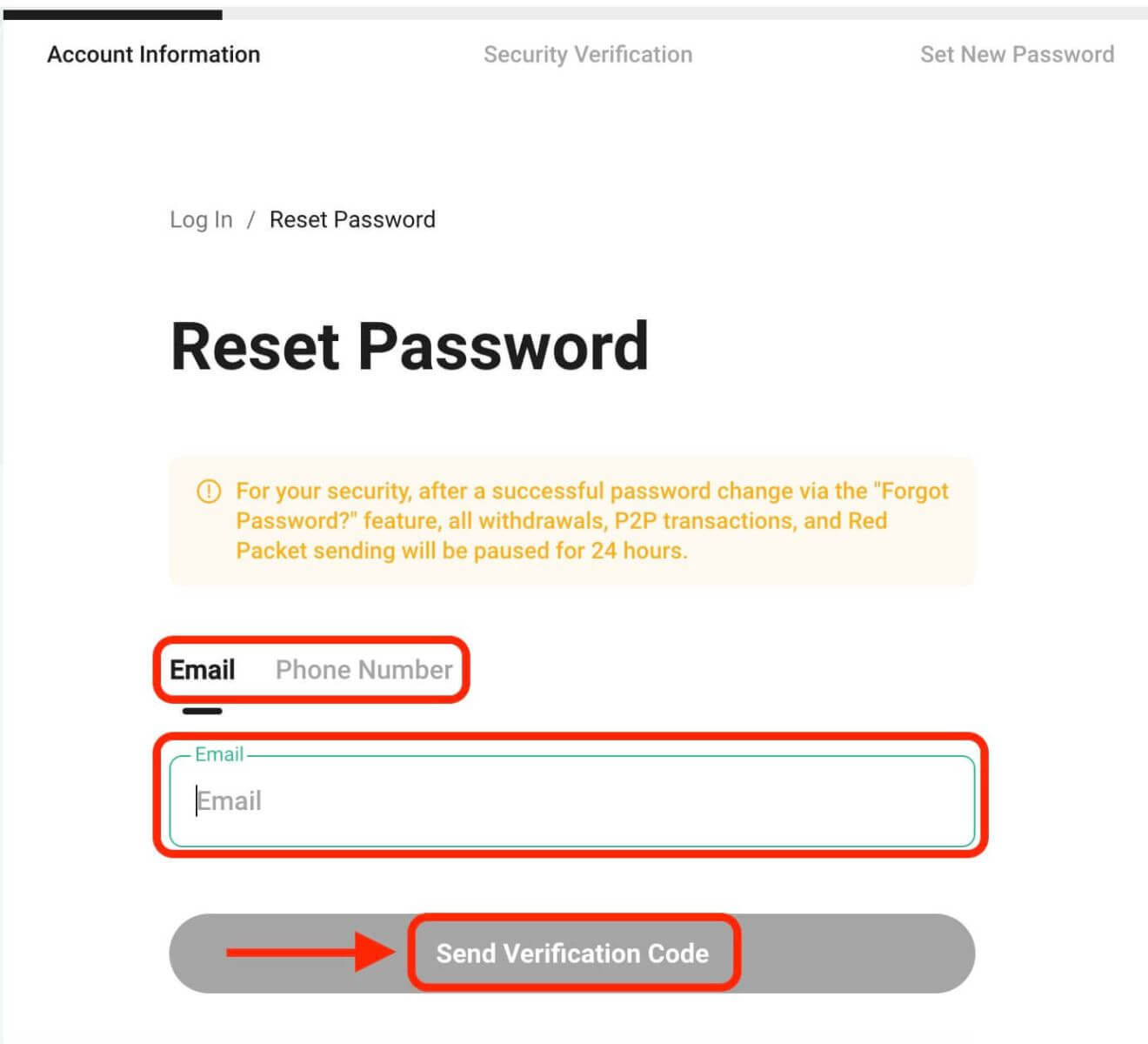

Step 3. Enter the email address or phone number that you used to register your account and click on the "Send Verification Code" button.

Step 4. As a security measure, KuCoin may ask you to complete a puzzle to verify that you are not a bot. Follow the instructions provided to complete this step.

Step 5. Check your email inbox for a message from KuCoin. Enter the verification code and click "Confirm".

Step 6. Enter your new password a second time to confirm it. Double-check to ensure both entries match.

Step 7. You can now log in to your account with your new password and enjoy trading with KuCoin.

How to Buy/Sell Crypto at KuCoin

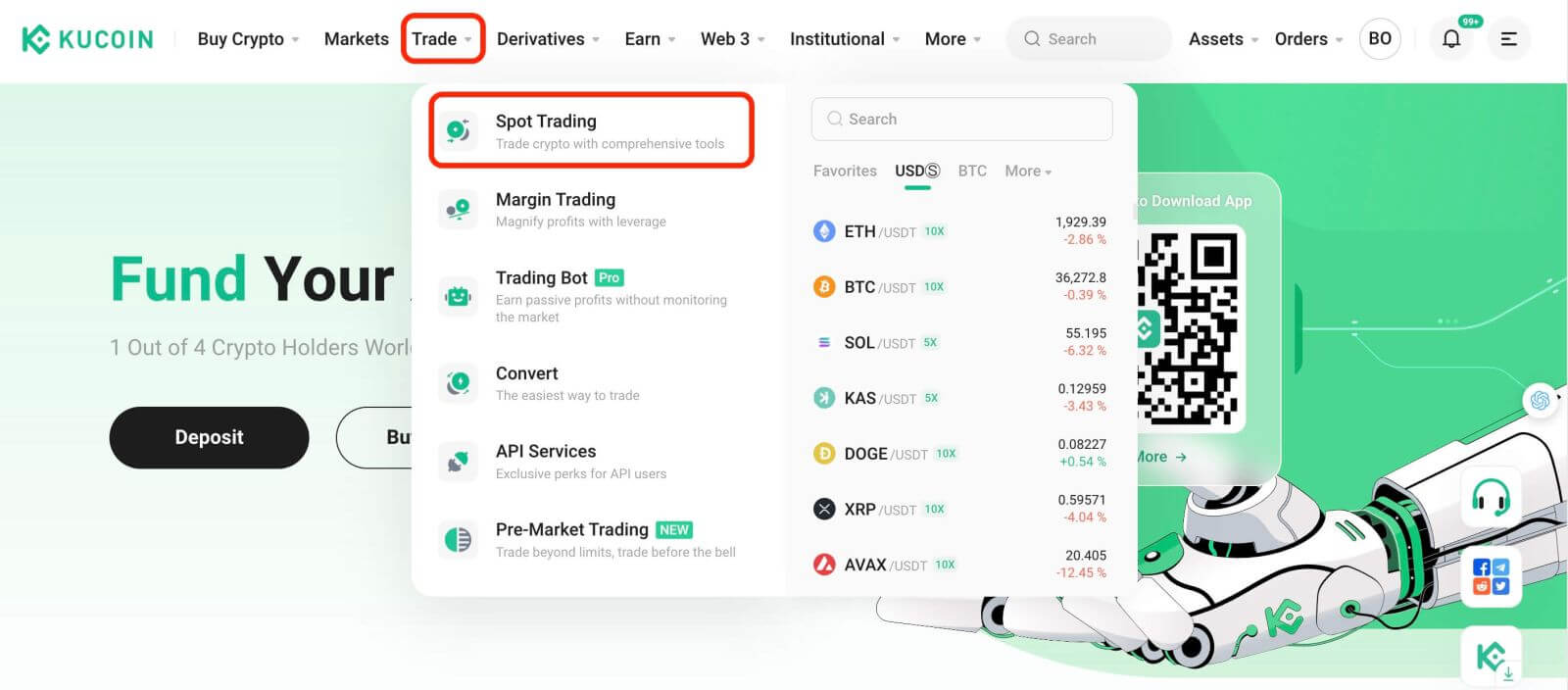

How to Open a Trade on KuCoin via the Web App

Step 1: Accessing TradingWeb Version: Click on "Trade" in the top navigation bar and choose "Spot Trading" to enter the trading interface.

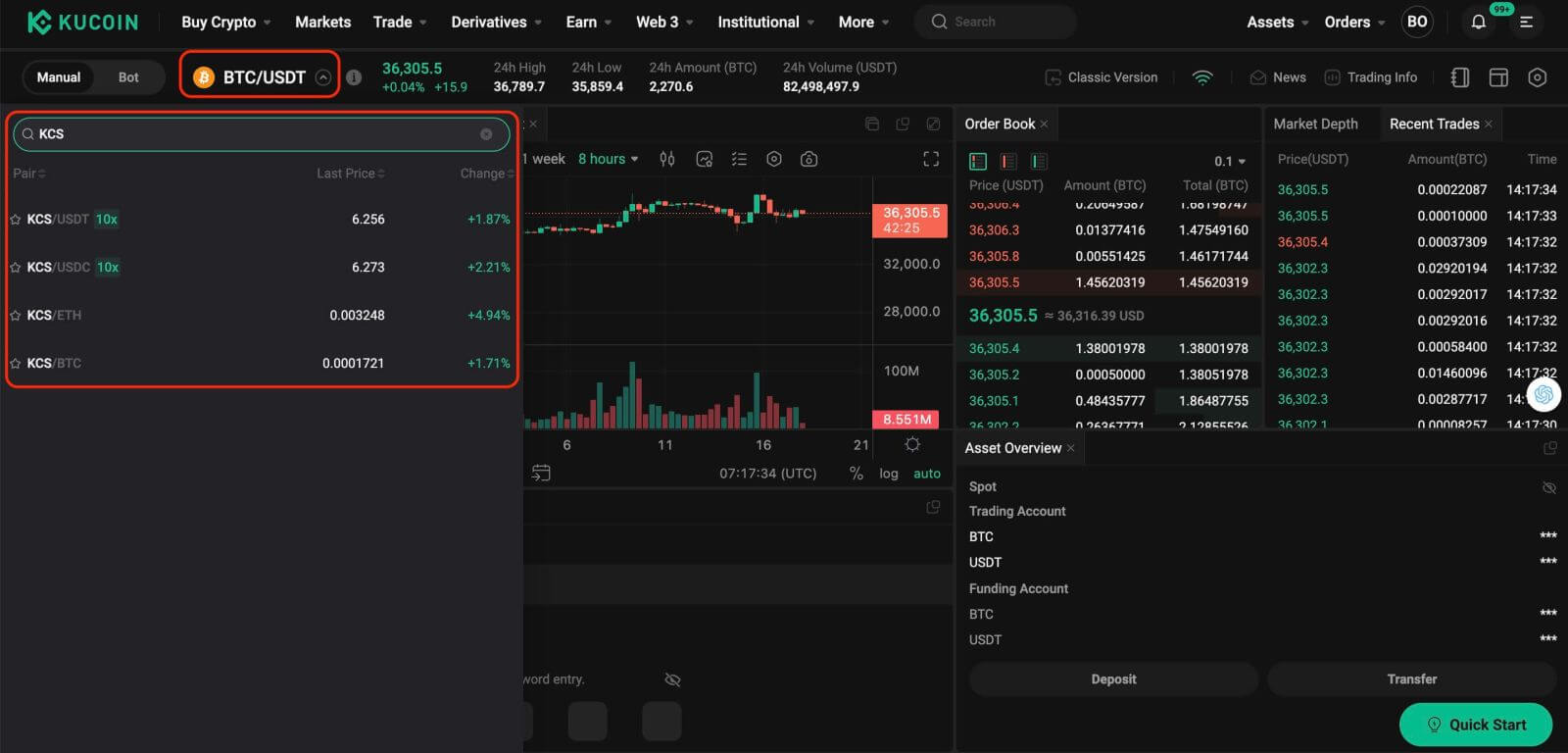

Step 2: Selecting Assets

On the trading page, assuming you wish to buy or sell KCS, you would enter "KCS" into the search bar. Then, you would select your desired trading pair to conduct your trade.

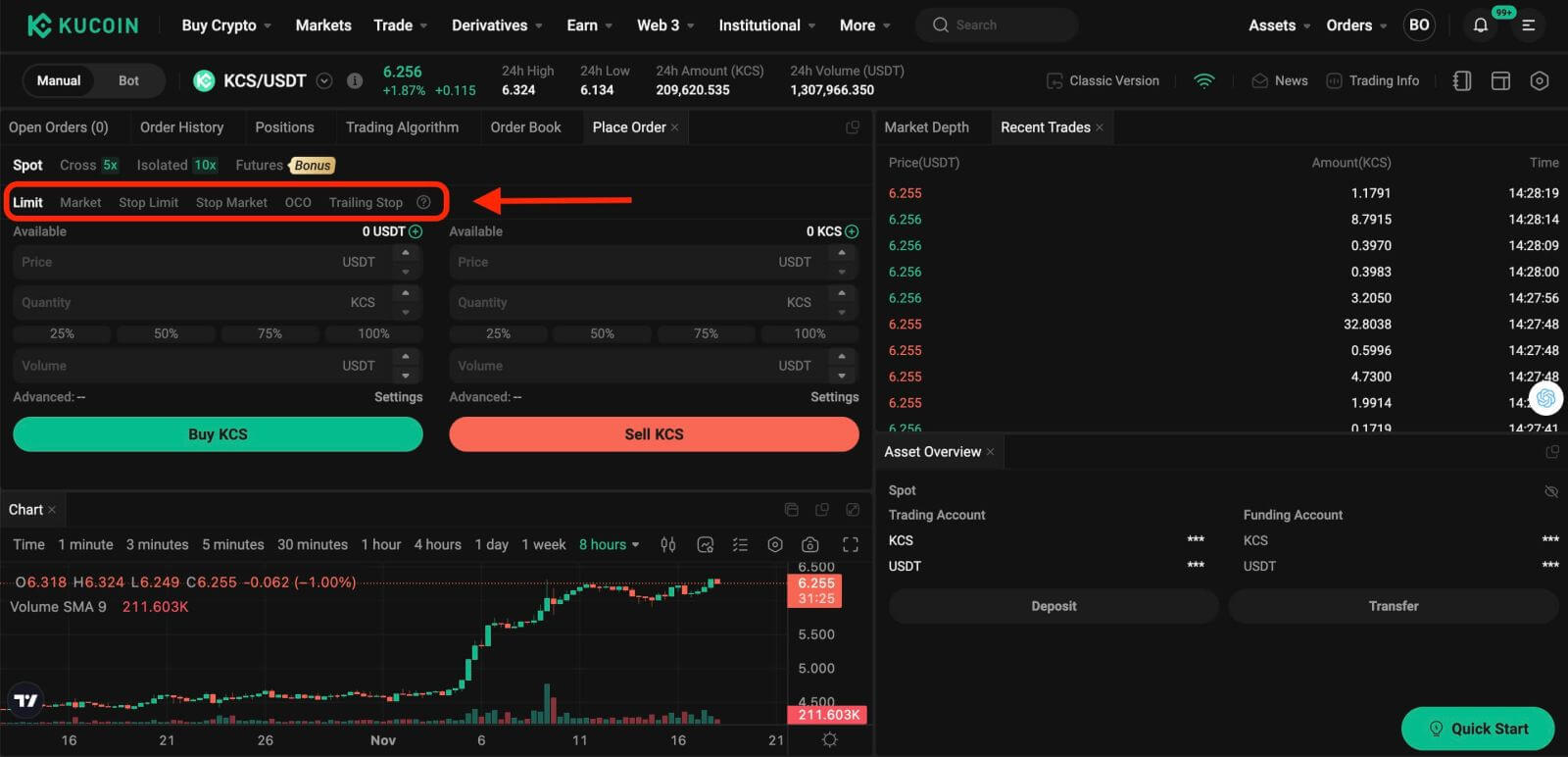

Step 3: Placing Orders

At the bottom of the trading interface is the panel for buying and selling. There are six order types you can choose from:

- Limit orders.

- Market orders.

- Stop-limit orders.

- Stop-market orders.

- One-cancels-the-other (OCO) orders.

- Trailing stop orders.

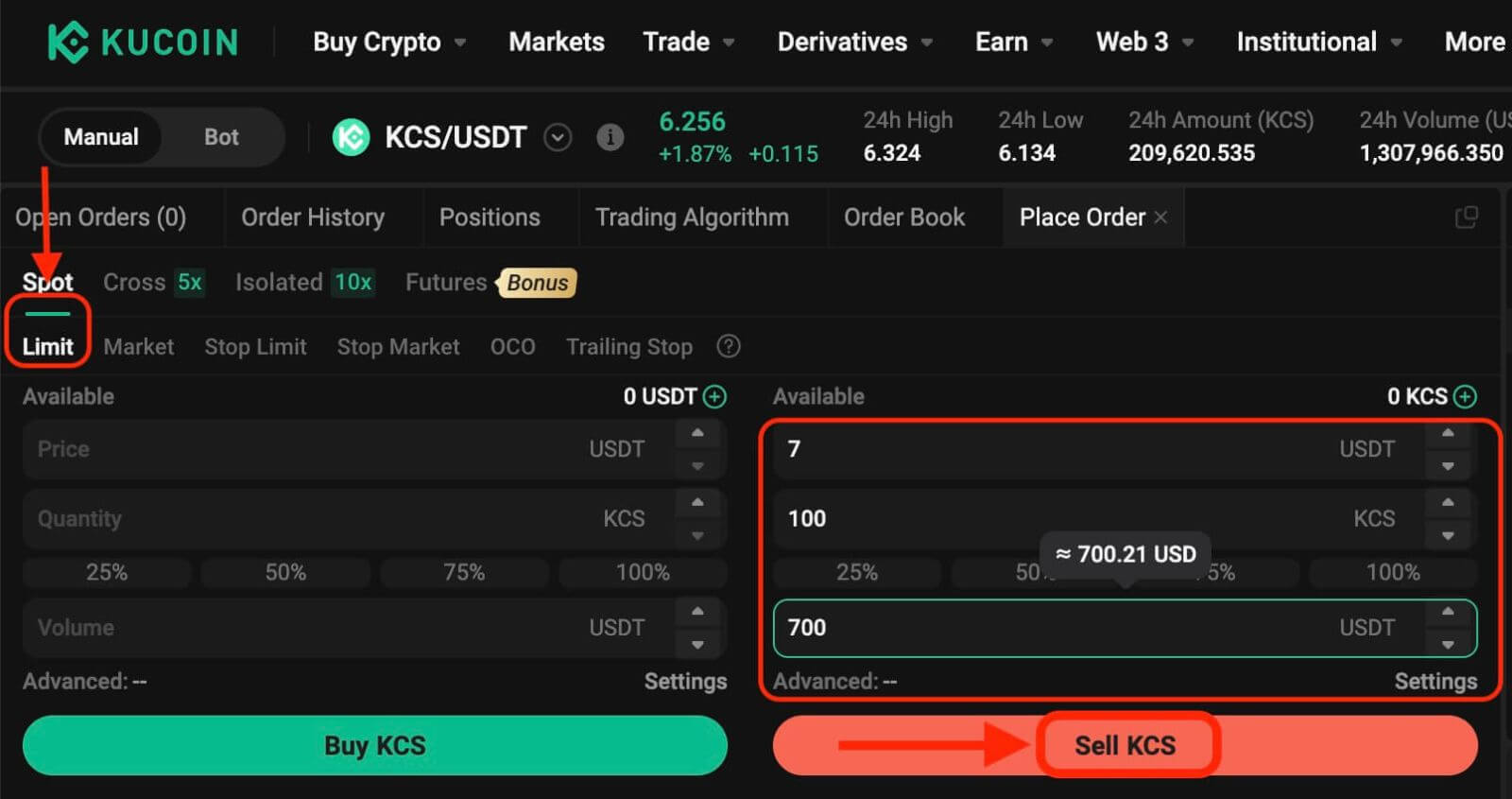

1. Limit Order

A limit order is an order to buy or sell an asset at a specific price or better.

For instance, if the current price of KCS in the KCS/USDT trading pair is 7 USDT, and you wish to sell 100 KCS at a KCS price of 7 USDT, you can place a limit order to do so.

To place such a limit order:

- Select Limit: Choose the "Limit" option.

- Set Price: Enter 7 USDT as the specified price.

- Set Quantity: Define the Quantity as 100 KCS.

- Confirm Order: Click on "Sell KCS" to confirm and finalize the order.

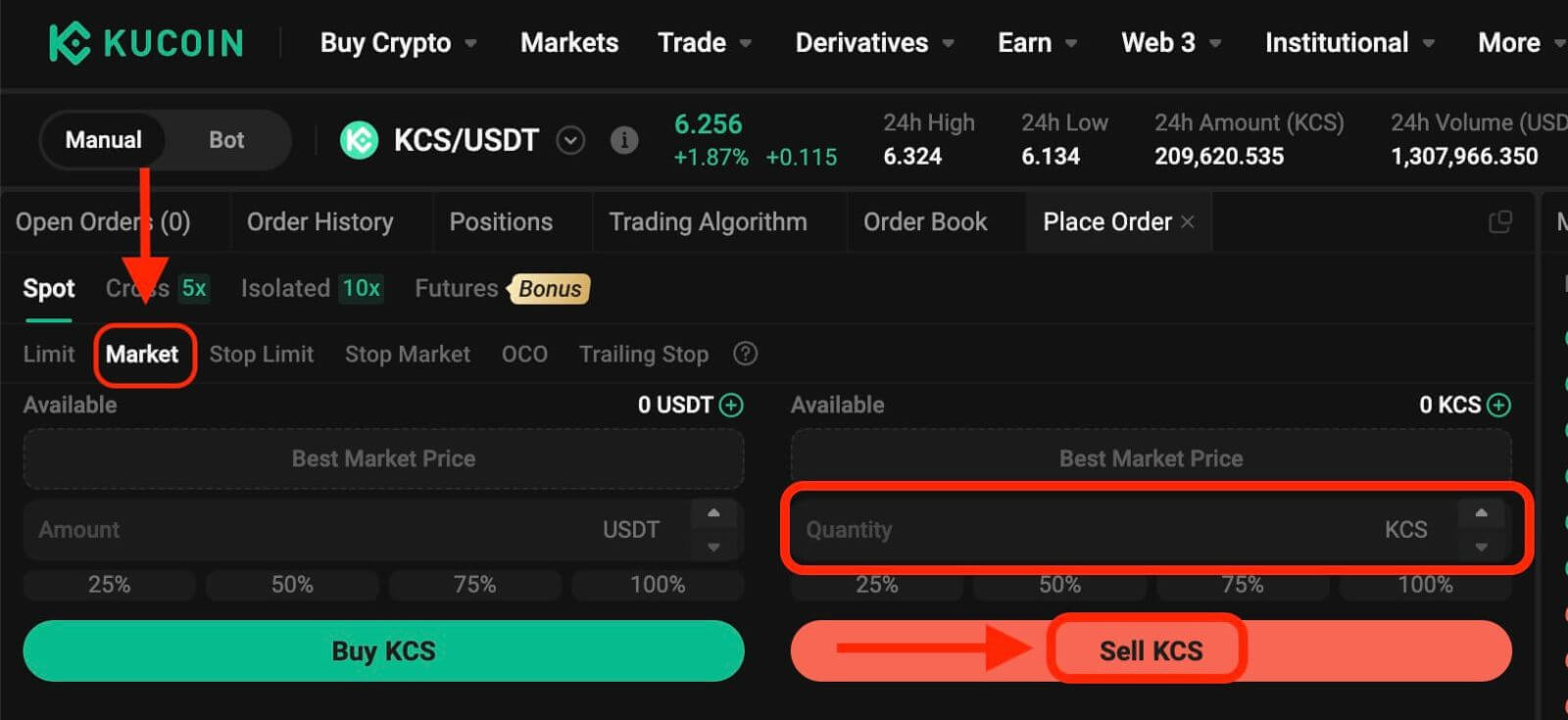

2. Market Order

Execute an order at the current best available market price.

Take the KCS/USDT trading pair for example. Assuming the current price of KCS is 6.2 USDT, and you wish to quickly sell 100 KCS. To do this, you can use a market order. When you issue a market order, the system matches your sell order with the existing buy orders on the market, which ensures a swift execution of your order. This makes market orders the best way to quickly buy or sell assets.

To place such a market order:

- Select Market: Choose the "Market" option.

- Set Quantity: Specify the Quantity as 100 KCS.

- Confirm Order: Click on "Sell KCS" to confirm and execute the order.

Please note: Market orders, once executed, cannot be canceled. You can track order and transaction specifics in your Order History and Trade History. These orders are matched with the prevailing maker order price in the market and can be impacted by market depth. It’s crucial to be mindful of market depth when initiating market orders.

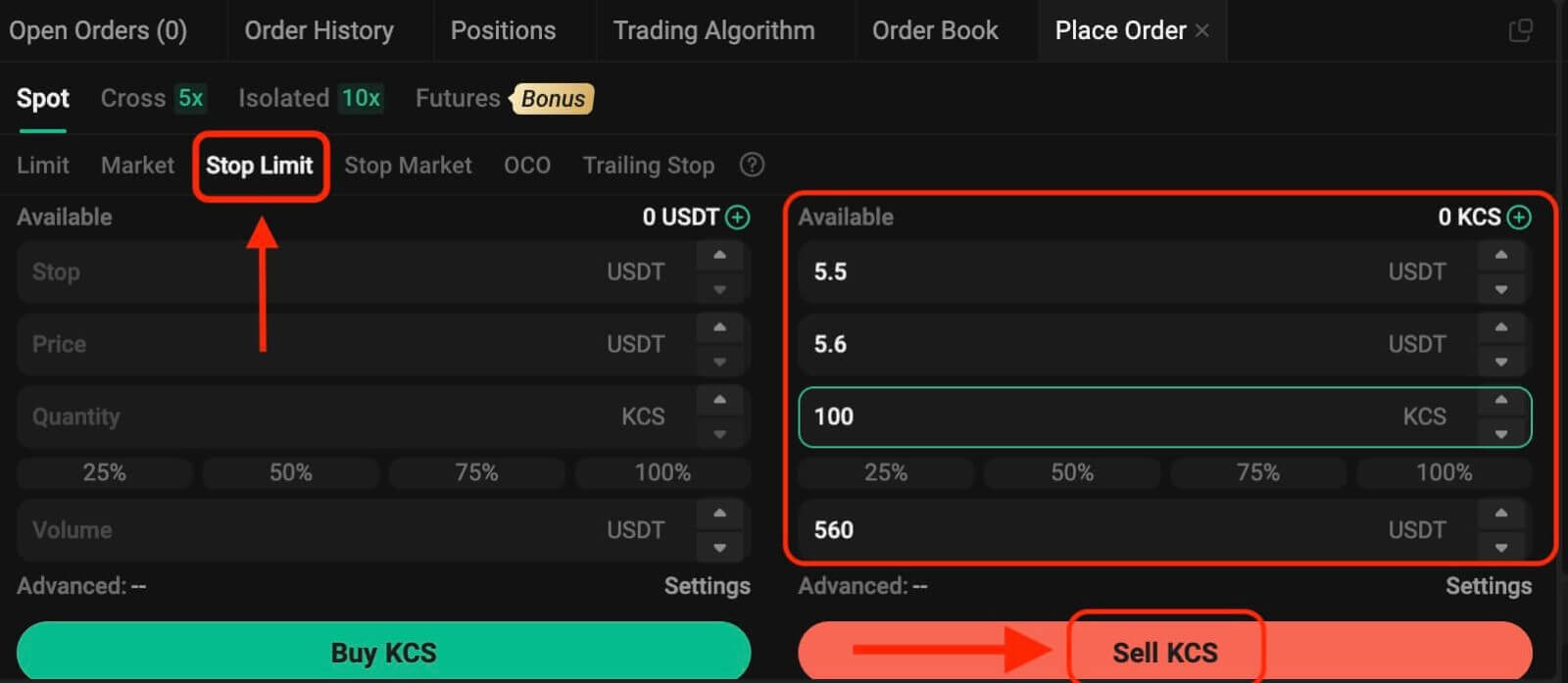

3. Stop-Limit Order

A stop-limit order blends the features of a stop order with a limit order. This type of trade involves setting a "Stop" (stop price), a "Price" (limit price), and a "Quantity." When the market hits the stop price, a limit order is activated based on the specified limit price and quantity.

Take the KCS/USDT trading pair for example. Assuming the current price of KCS is 4 USDT, and you believe that there is resistance around 5.5 USDT, this suggests that once the price of KCS reaches that level, it is unlikely to go any higher in the short term. As such, your ideal selling price would be 5.6 USDT, but you don’t want to have to monitor the market 24/7 just to maximize these profits. In such a scenario, you can opt to place a stop-limit order.

To execute this order:

- Select Stop-Limit: Choose the "Stop-Limit" option.

- Set Stop Price: Enter 5.5 USDT as the stop price.

- Set Limit Price: Specify 5.6 USDT as the limit price.

- Set Quantity: Define the Quantity as 100 KCS.

- Confirm Order: Click on "Sell KCS" to confirm and initiate the order.

Upon reaching or exceeding the stop price of 5.5 USDT, the limit order becomes active. Once the price hits 5.6 USDT, the limit order will be filled as per the set conditions.

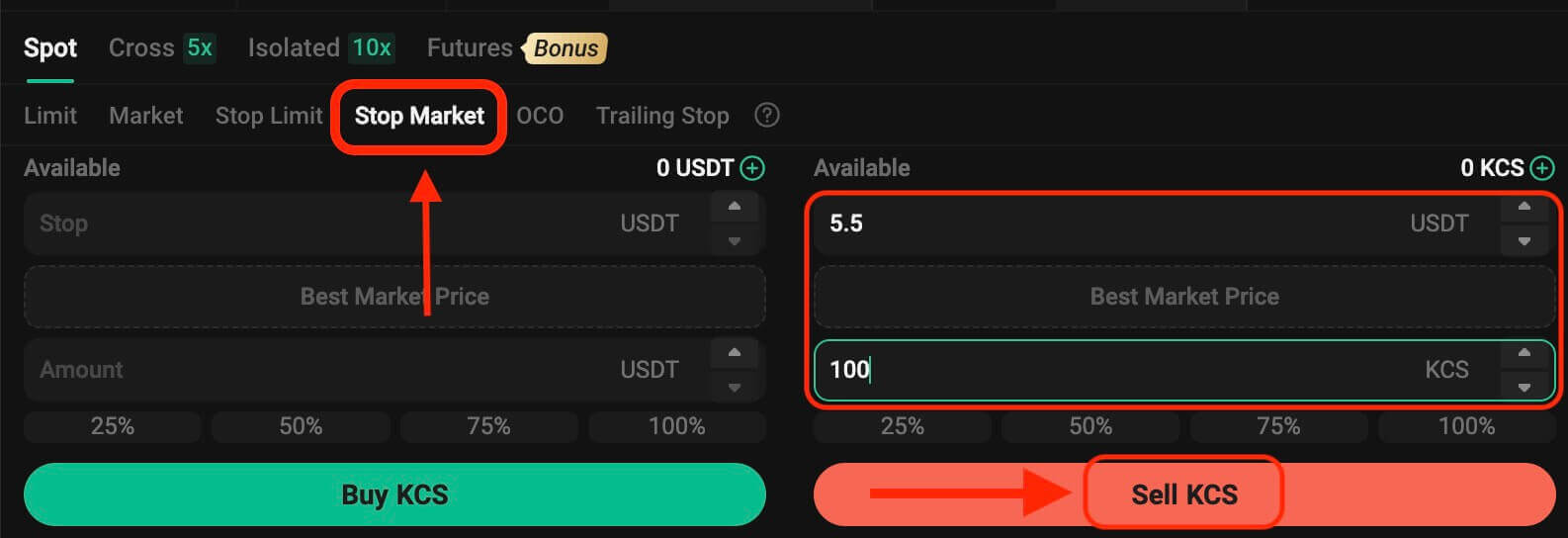

4. Stop Market Order

A stop market order is an order to buy or sell an asset once the price reaches a specific price (the "stop price"). Once the price reaches the stop price, the order becomes a market order and will be filled at the next available market price.

Take the KCS/USDT trading pair for example. Assuming the current price of KCS is 4 USDT, and you believe there is resistance around 5.5 USDT, this suggests that once the price of KCS reaches that level, it is unlikely to go any higher in the short term. However, you don’t want to have to monitor the market 24/7 just to be able to sell at an ideal price. In this situation, you can choose to place a stop-market order.

- Select Stop Market: Choose the "Stop Market" option.

- Set Stop Price: Specify a stop price of 5.5 USDT.

- Set Quantity: Define the Quantity as 100 KCS.

- Confirm Order: Click on "Sell KCS" to place the order.

Once the market price reaches or surpasses 5.5 USDT, the stop market order will be activated and executed at the next available market price.

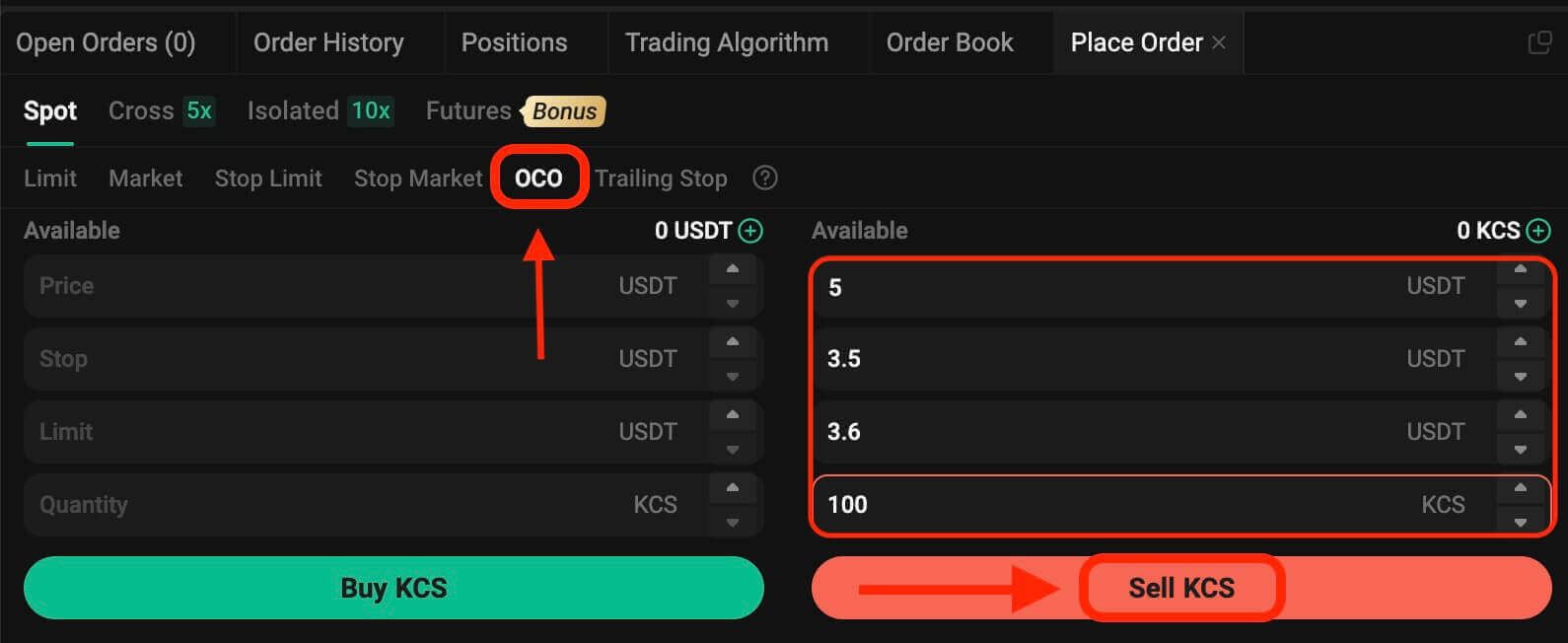

5. One-Cancels-the-Other (OCO) Order

An OCO order executes both a limit order and a stop-limit order concurrently. Depending on market movements, one of these orders will activate, automatically canceling the other.

For instance, consider the KCS/USDT trading pair, assuming the current KCS price is at 4 USDT. If you anticipate a potential decline in the final price—either after rising to 5 USDT and then dropping or directly decreasing—your objective is to sell at 3.6 USDT just before the price falls below the support level of 3.5 USDT.

To place this OCO order:

- Select OCO: Choose the "OCO" option.

- Set Price: Define the Price as 5 USDT.

- Set Stop: Specify the Stop price as 3.5 USDT (this triggers a limit order when the price reaches 3.5 USDT).

- Set Limit: Specify the Limit price as 3.6 USDT.

- Set Quantity: Define the Quantity as 100.

- Confirm Order: Click on "Sell KCS" to execute the OCO order.

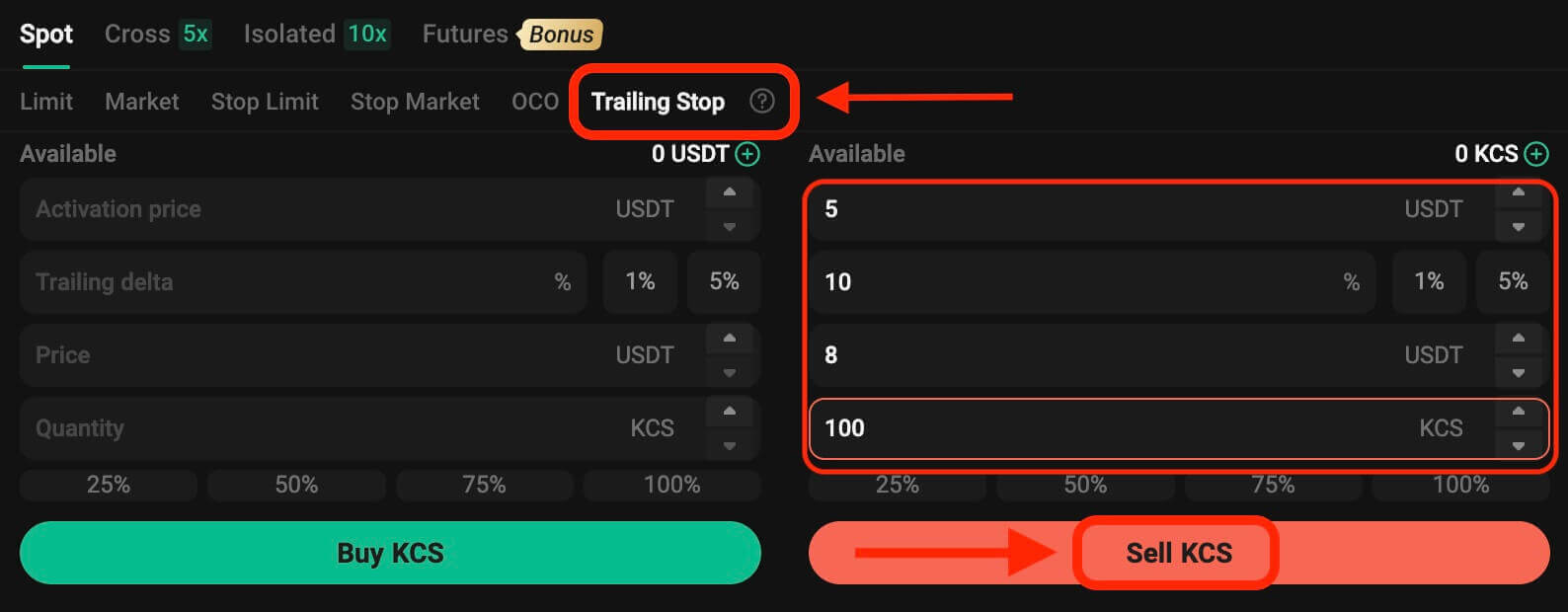

6. Trailing Stop Order

A trailing stop order is a variation of a standard stop order. This type of order allows setting the stop price as a specific percentage away from the current asset price. When both conditions align in the market’s price movement, it activates a limit order.

With a trailing buy order, you can swiftly purchase when the market rises after a decline. Similarly, a trailing sell order enables prompt selling when the market declines after an upward trend. This order type safeguards profits by keeping a trade open and profitable as long as the price moves favorably. It closes the trade if the price shifts by the specified percentage in the opposite direction.

For instance, in the KCS/USDT trading pair with KCS priced at 4 USDT, assuming an anticipated rise in KCS to 5 USDT followed by a subsequent retracement of 10% before considering selling, setting the selling price at 8 USDT becomes the strategy. In this scenario, the plan involves placing a sell order at 8 USDT, but only triggered when the price reaches 5 USDT and then experiences a 10% retracement.

To execute this trailing stop order:

- Select Trailing Stop: Choose the "Trailing Stop" option.

- Set Activation Price: Specify the activation price as 5 USDT.

- Set Trailing Delta: Define the trailing delta as 10%.

- Set Price: Specify the Price as 8 USDT.

- Set Quantity: Define the Quantity as 100.

- Confirm Order: Click on "Sell KCS" to execute the trailing stop order.

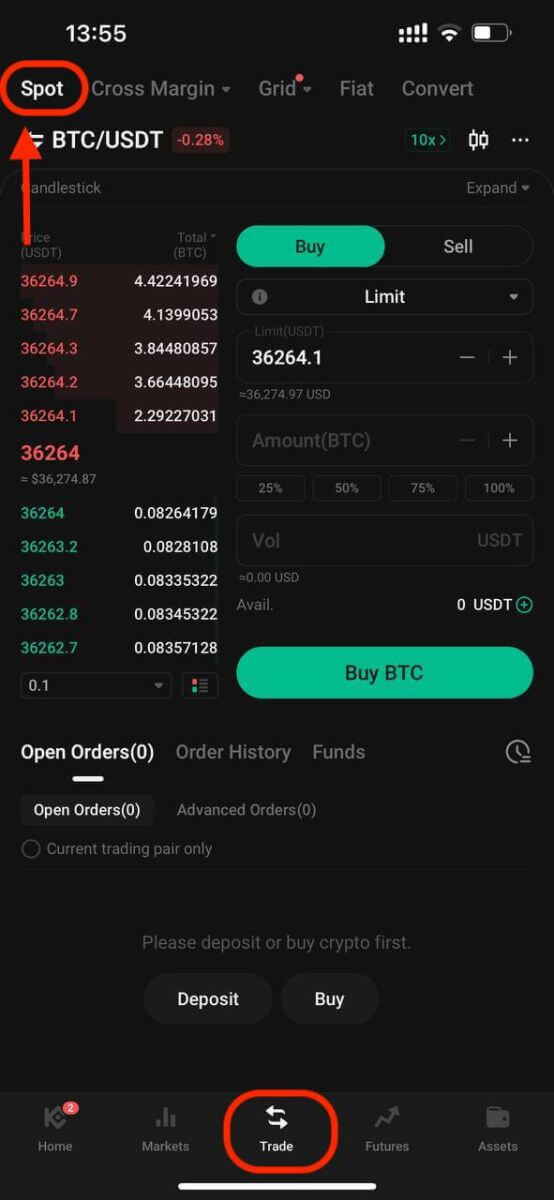

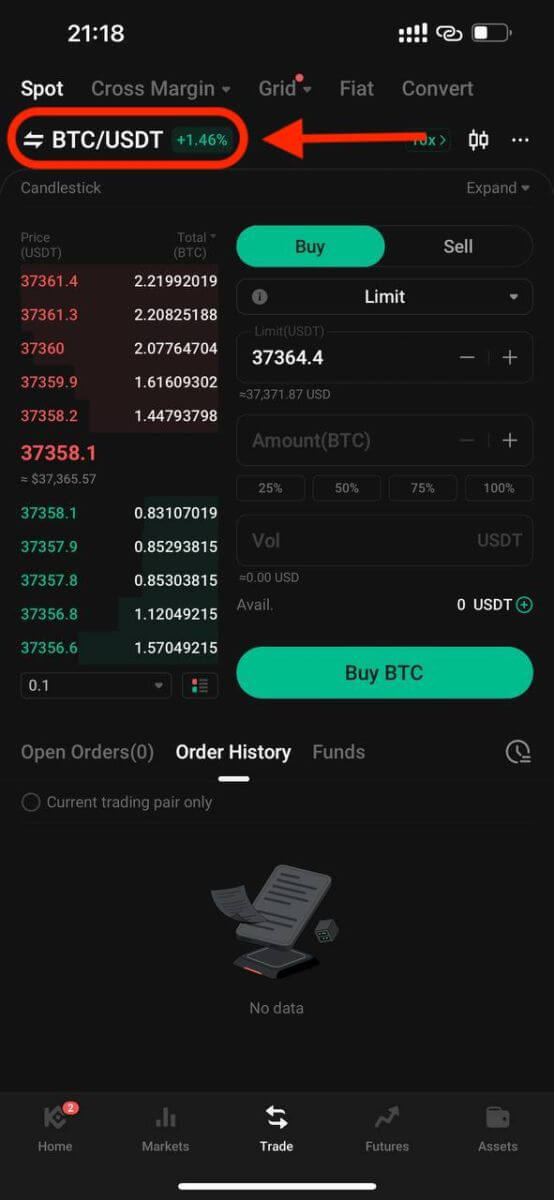

How to Open a Trade on KuCoin via the Mobile App

Step 1: Accessing TradingApp Version: Simply tap on "Trade".

Step 2: Selecting Assets

On the trading page, assuming you wish to buy or sell KCS, you would enter "KCS" into the search bar. Then, you would select your desired trading pair to conduct your trade.

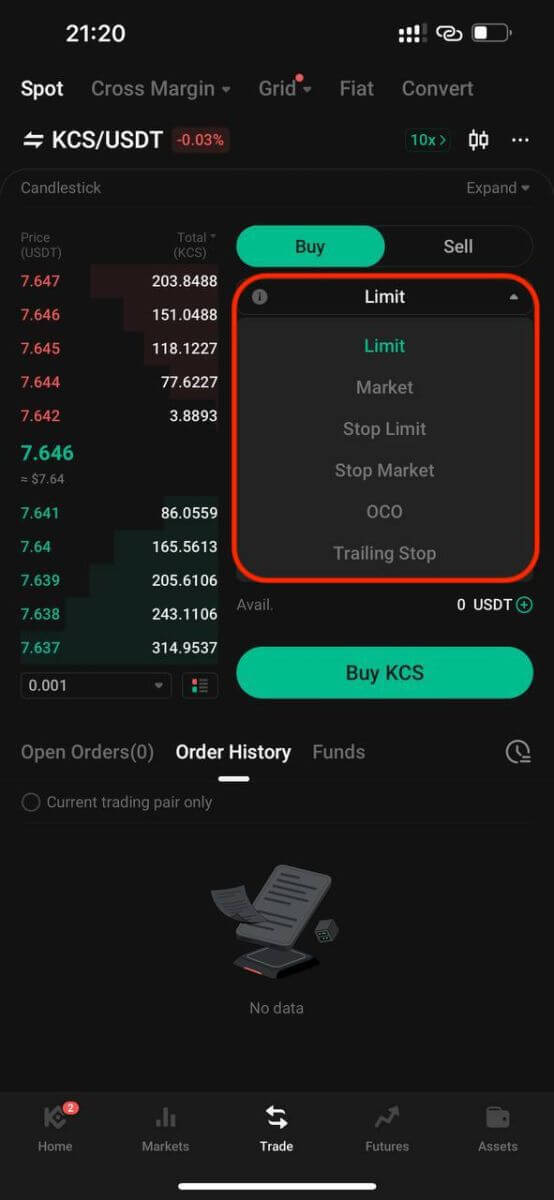

Step 3: Placing Orders

At the trading interface is the panel for buying and selling. There are six order types you can choose from:

- Limit orders.

- Market orders.

- Stop-limit orders.

- Stop-market orders.

- One-cancels-the-other (OCO) orders.

- Trailing stop orders.

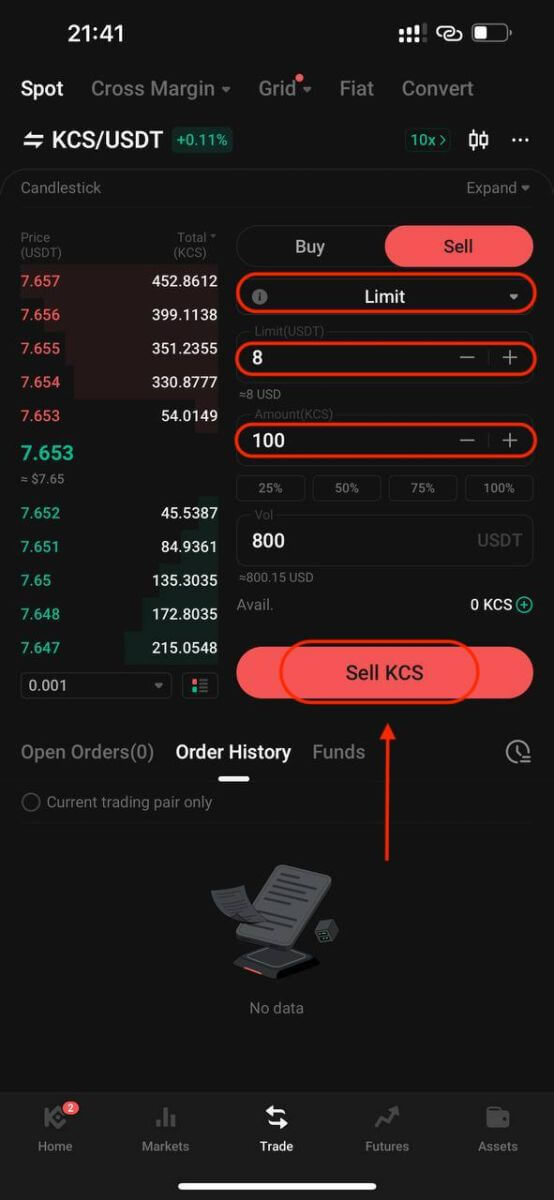

1. Limit Order

A limit order is an order to buy or sell an asset at a specific price or better.

For instance, if the current price of KCS in the KCS/USDT trading pair is 8 USDT, and you wish to sell 100 KCS at a KCS price of 8 USDT, you can place a limit order to do so.

To place such a limit order:

- Select Limit: Choose the "Limit" option.

- Set Price: Enter 8 USDT as the specified price.

- Set Quantity: Define the Quantity as 100 KCS.

- Confirm Order: Click on "Sell KCS" to confirm and finalize the order.

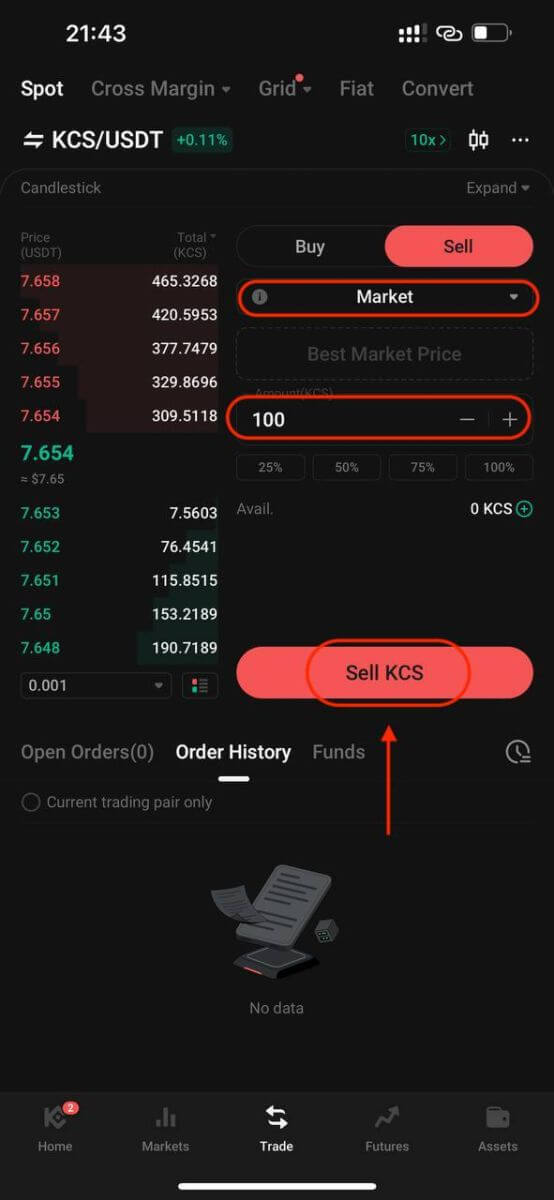

2. Market Order

Execute an order at the current best available market price.

Take the KCS/USDT trading pair for example. Assuming the current price of KCS is 7.8 USDT, and you wish to quickly sell 100 KCS. To do this, you can use a market order. When you issue a market order, the system matches your sell order with the existing buy orders on the market, which ensures a swift execution of your order. This makes market orders the best way to quickly buy or sell assets.

To place such a market order:

- Select Market: Choose the "Market" option.

- Set Quantity: Specify the Quantity as 100 KCS.

- Confirm Order: Click on "Sell KCS" to confirm and execute the order.

Please note: Market orders, once executed, cannot be canceled. You can track order and transaction specifics in your Order History and Trade History. These orders are matched with the prevailing maker order price in the market and can be impacted by market depth. It’s crucial to be mindful of market depth when initiating market orders.

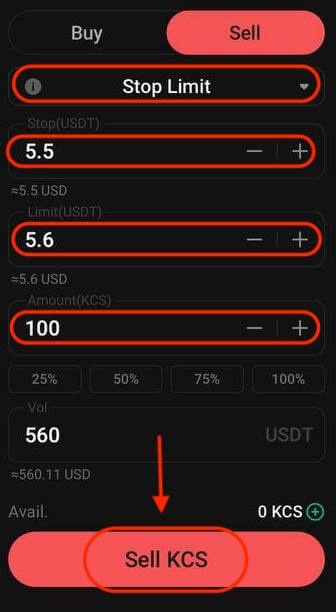

3. Stop-Limit Order

A stop-limit order blends the features of a stop order with a limit order. This type of trade involves setting a "Stop" (stop price), a "Price" (limit price), and a "Quantity." When the market hits the stop price, a limit order is activated based on the specified limit price and quantity.

Take the KCS/USDT trading pair for example. Assuming the current price of KCS is 4 USDT, and you believe that there is resistance around 5.5 USDT, this suggests that once the price of KCS reaches that level, it is unlikely to go any higher in the short term. As such, your ideal selling price would be 5.6 USDT, but you don’t want to have to monitor the market 24/7 just to maximize these profits. In such a scenario, you can opt to place a stop-limit order.

To execute this order:

- Select Stop-Limit: Choose the "Stop-Limit" option.

- Set Stop Price: Enter 5.5 USDT as the stop price.

- Set Limit Price: Specify 5.6 USDT as the limit price.

- Set Quantity: Define the Quantity as 100 KCS.

- Confirm Order: Click on "Sell KCS" to confirm and initiate the order.

Upon reaching or exceeding the stop price of 5.5 USDT, the limit order becomes active. Once the price hits 5.6 USDT, the limit order will be filled as per the set conditions.

4. Stop Market Order

A stop market order is an order to buy or sell an asset once the price reaches a specific price (the "stop price"). Once the price reaches the stop price, the order becomes a market order and will be filled at the next available market price.

Take the KCS/USDT trading pair for example. Assuming the current price of KCS is 4 USDT, and you believe there is resistance around 5.5 USDT, this suggests that once the price of KCS reaches that level, it is unlikely to go any higher in the short term. However, you don’t want to have to monitor the market 24/7 just to be able to sell at an ideal price. In this situation, you can choose to place a stop-market order.

- Select Stop Market: Choose the "Stop Market" option.

- Set Stop Price: Specify a stop price of 5.5 USDT.

- Set Quantity: Define the Quantity as 100 KCS.

- Confirm Order: Click on "Sell KCS" to place the order.

Once the market price reaches or surpasses 5.5 USDT, the stop market order will be activated and executed at the next available market price.

5. One-Cancels-the-Other (OCO) Order

An OCO order executes both a limit order and a stop-limit order concurrently. Depending on market movements, one of these orders will activate, automatically canceling the other.

For instance, consider the KCS/USDT trading pair, assuming the current KCS price is at 4 USDT. If you anticipate a potential decline in the final price—either after rising to 5 USDT and then dropping or directly decreasing—your objective is to sell at 3.6 USDT just before the price falls below the support level of 3.5 USDT.

To place this OCO order:

- Select OCO: Choose the "OCO" option.

- Set Price: Define the Price as 5 USDT.

- Set Stop: Specify the Stop price as 3.5 USDT (this triggers a limit order when the price reaches 3.5 USDT).

- Set Limit: Specify the Limit price as 3.6 USDT.

- Set Quantity: Define the Quantity as 100.

- Confirm Order: Click on "Sell KCS" to execute the OCO order.

6. Trailing Stop Order

A trailing stop order is a variation of a standard stop order. This type of order allows setting the stop price as a specific percentage away from the current asset price. When both conditions align in the market’s price movement, it activates a limit order.

With a trailing buy order, you can swiftly purchase when the market rises after a decline. Similarly, a trailing sell order enables prompt selling when the market declines after an upward trend. This order type safeguards profits by keeping a trade open and profitable as long as the price moves favorably. It closes the trade if the price shifts by the specified percentage in the opposite direction.

For instance, in the KCS/USDT trading pair with KCS priced at 4 USDT, assuming an anticipated rise in KCS to 5 USDT followed by a subsequent retracement of 10% before considering selling, setting the selling price at 8 USDT becomes the strategy. In this scenario, the plan involves placing a sell order at 8 USDT, but only triggered when the price reaches 5 USDT and then experiences a 10% retracement.

To execute this trailing stop order:

- Select Trailing Stop: Choose the "Trailing Stop" option.

- Set Activation Price: Specify the activation price as 5 USDT.

- Set Trailing Delta: Define the trailing delta as 10%.

- Set Price: Specify the Price as 8 USDT.

- Set Quantity: Define the Quantity as 100.

- Confirm Order: Click on "Sell KCS" to execute the trailing stop order.